Airlines and Fraud

Airlines have long ago digitized their booking business, allowing travelers to search and secure seats on flights directly, or through third party booking agencies. But it’s not only ticketing that has gone digital – services such as airline check-in, inflight activities, and loyalty programs are all now offered through kiosks and customer devices.

For all of the benefits of digitizing business, it also creates some vulnerabilities and opens up new potential for fraud. Encouragement to book directly and the availability of search and booking features on mobile devices are resulting in a rise in incidence of fraud. Fraudulent bookings are a pain point for airlines, as they lead to revenue loss for the global industry.

Participants

To examine the state of fraud in the airline industry, CyberSource has commissioned the 2018 Global Airline Online Fraud Report. The report was conducted by CyberSource in partnership with IATA, ARC, and AI and provides valuable insights on performance, metrics, trends, challenges, opportunities, and more. The study benchmarks global metrics and trends in fraud management and protection in the airline industry. It also serves as to profile airline awareness of andapproaches toward fraud management.

Global Airline Online Fraud Report. The report was conducted by CyberSource in partnership with IATA, ARC, and AI and provides valuable insights on performance, metrics, trends, challenges, opportunities, and more. The study benchmarks global metrics and trends in fraud management and protection in the airline industry. It also serves as to profile airline awareness of andapproaches toward fraud management.

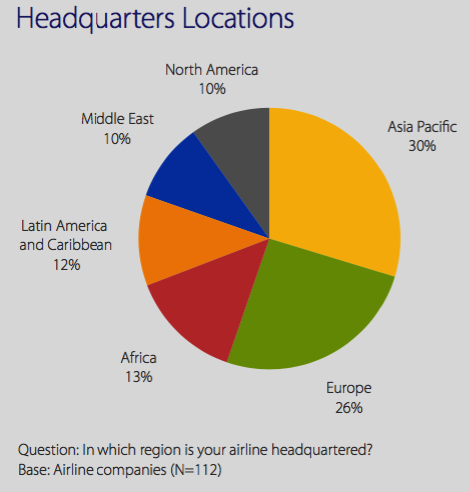

The survey was conducted online between June and September 2017, and included 112 carriers (Full Fare and Low Cost) across all continents, including Africa.

Booking Channel Distribution (airline website, OTAs….)

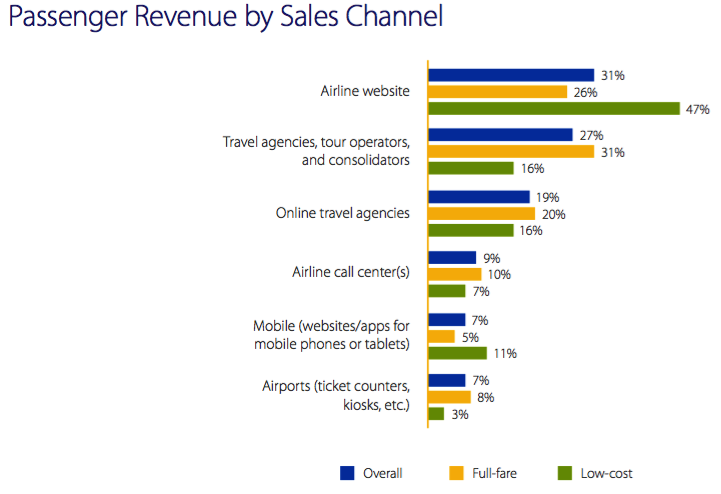

A variety of sales channels were represented, and respondents were asked to estimate the percentage of passenger revenues brought in by each. Websites, perhaps unsurprisingly, came out on top with 31% overall. At 27% the second-largest channel was a grouping for Travel Agencies, Tour Operators, and Consolidators.

Accepted payment methods distribution

Payment methods were also represented, with a broad range of options reported. Respondent airlines were asked to list all payment options they accept for passenger bookings.

Again unsurprisingly, Worldwide Credit and Debit Cards were the most popular method with 99% of airlines accepting cards. PayPal and eWallets came in second at 62%. UATP (54%), Bank Transfers (50%), and Localized Cards (38%) were also well represented amongst others.

Fraud incidence by payment method (Figure 4 in the study)

Compared to the previous (2014) study, payments made via PayPal or other eWallets were up 30%, showing that the is a tremendous growth in prominence of these modern pay methods, which include Apple Pay and Google Wallet.

Mobile payments are on the rise for airlines and are more common for LCCs (42% vs 18% in 2014) than FFCs (33% vs 16% in 2014), and these growth rates show just how important mobile channels are to the airline industry as a whole.

Revenue Loss Rate

There are times when bookings are terminated due to fraudulent transactions, leading to revenue loss. This is a direct hit to a carrier’s top and bottom lines. In the study, airlines reported that across both web and mobile channels, revenue loss equates to about 1.2% of overall channel transactions, and the total cost of managing fraud representing about 0.5% of airline revenues on average.

With these figures in mind, it is apparent that risk management is crucial for an airline’s business.

Airlines working with DPO’s payment processing solution experience revenue loss of only 0.2%

Use of Validation Services

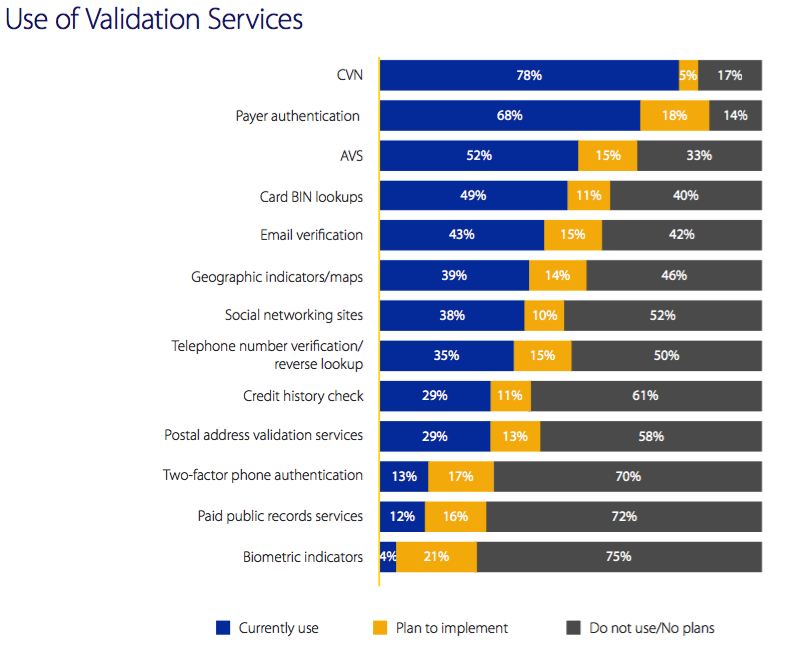

Validation services help a merchant to detect and deter fraud before it occurs, and airlines use a variety of validation methods. The most popular validation service is Card Verification Number (CVN), used by 78% of airlines, with 29% reporting this method as “very effective”. Also reported were payer authentication (such as Verified by Visa or MasterCard SecureCode), and Address Verification Services.

Two-factor phone authentication can be very effective, though could lead to a drop in conversion rates as many customers can be put off by this added layer complexity. Only 13% of airlines report using this method.

Airlines were asked about the fraud detection methods and services they are currently using, or plan to implement.

Fraud Management Challenges

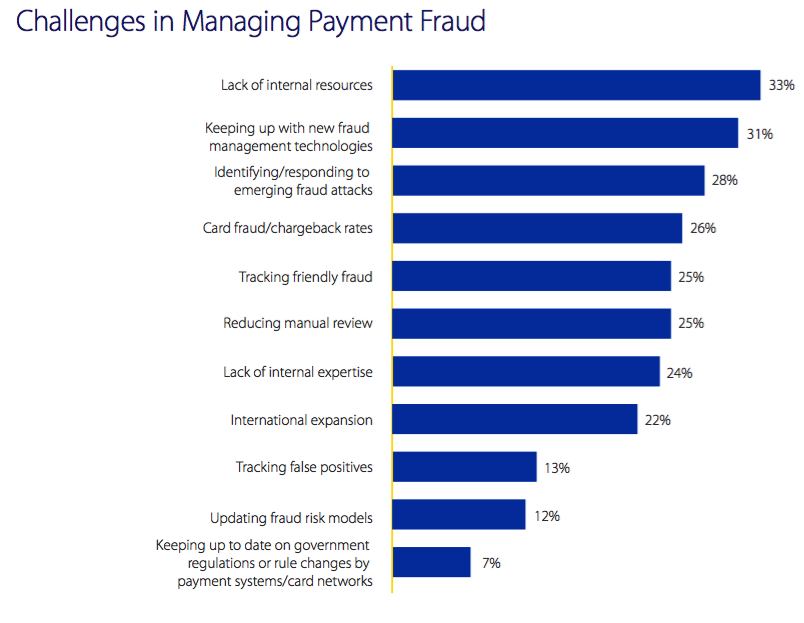

Respondents were asked about the challenges they face in combating fraud, and the top answers were lack of resources and ability to keep up with new fraud management technologies, at 33% and 31% respectively.

Priorities in Managing Payment Fraud

When asked about their priorities in managing payment fraud, airlines followed up their above challenges with goals to improve automated detection (59%) and fraud analytics (50%), as well as streamlining manual review workflow.

DPO’s payment solution for airlines to concentrate their resources on other business operations, while providing them with secure payment processing and 24/7 transaction monitoring. DPO’s solution applies 2-layer fraud prevention system which screens transactions in real-time. DPO’s risk assessment team constantly works to identify fraudulent patterns and intercept fraud attempts before they even occur