Until now, you’ve probably been paying for goods and services using cash or mobile money transfers. However, there’s another simple, easy and secure way to make payments with your mobile phone:

eWallets!

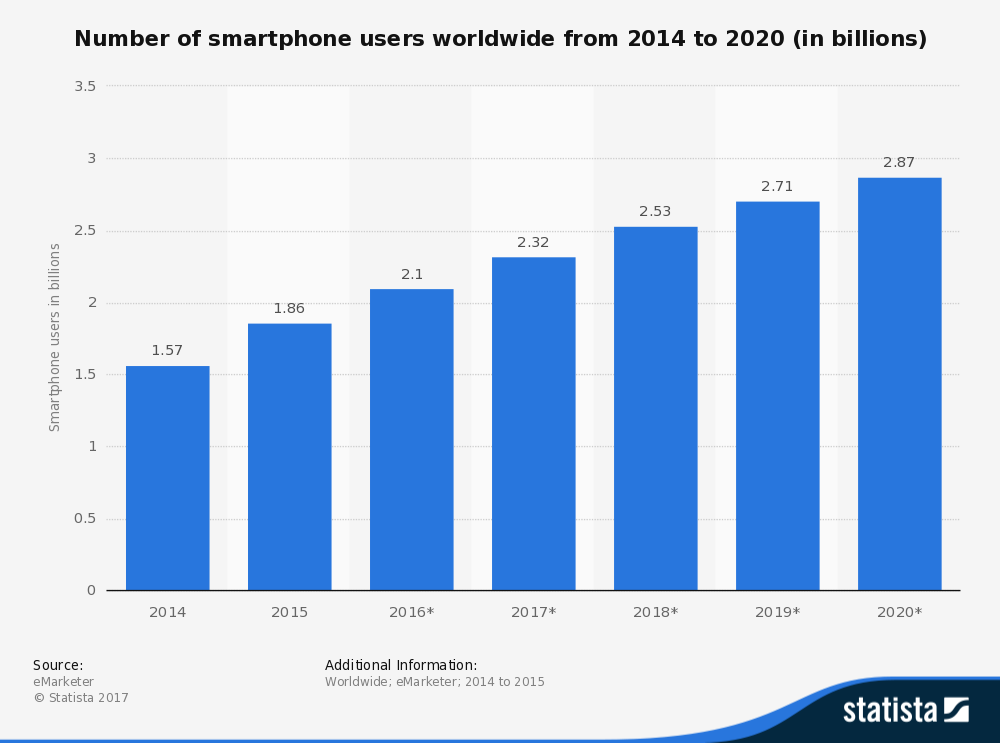

It’s estimated that there are over 2 billion smartphone users worldwide! Many of these people keep their smartphones with them wherever they go, making ewallets a really convenient way to pay.

Number of smartphone users worldwide from 2014 to 2020 (Statista)

So, what exactly is an ewallet?

Also known as digital wallets, ewallets are mobile payment apps that store your payment information on your smartphone. This information can include your credit, debit and prepaid card details.

If you’re in a store that accepts ewallets, you can pay using a technology known as Near Field Communication (NFC). NFC allows the payment information to pass from your phone onto a retailer’s compatible payment terminal, just by holding the phone a few centimeters away. Besides NFC you can also scan a QR code with your ewallet app and make the payment, seamlessly. Many apps also allow you to make quick online payments at various online stores.

Here are the main benefits of paying via ewallet:

Easy to use

It only takes a few minutes to set up an ewallet. Simply download the app and follow onscreen instructions to set up your account and add your payment details.

More and more retailers are using a mobile payment solution that allows them to accept ewallets. When you’re ready to make your first payment at one of these retailers, you just have to hold your phone near the payment reader or scan the QR code, and the payment will be made. Simple as that!

Safe and secure

Your money and personal details are safe when you use an ewallet. All of your account information is encrypted – this means that actual account numbers aren’t stored on your phone. You will need to enter a password, or other verification details, any time you wish to view or change account information. This is far safer than walking around with cash and credit cards in your pocket.

When you make a payment, the retailer doesn’t receive your credit card details. Instead, a random transaction number is used. This means your data is safe from fraud. In addition, if you ever lose your phone, you don’t need to worry about a thing, since ewallets are password locked.

Fast

Like other mobile payment methods, an ewallet payment is almost instantaneous, requiring just a simple wave of your phone. Once a payment has been made, the transaction is automatically recorded for later viewing.

You can also make online payments in just a few clicks with an ewallet. As all of your cards are already stored in the ewallet, you won’t have to fill in lengthy payment detail forms every time you want to make a payment on an ecommerce website.

Easy to connect to other accounts

Using an ewallet is ideal for someone who wants the flexibility to make payments from different accounts. You can add all of your existing credit cards or mobile money accounts to an ewallet. Then, when you come to make a payment, you can simply choose which card or mobile money account you want to use. This will save space in your actual wallet, as you won’t need to carry all of your cards around with you!