In the not-so-distant past, cash-on-delivery was the only viable payment option for e-commerce companies in Africa. But this payment method is far from ideal, and poses quite a few problems, hindering the growth and profitability of online businesses. The solution is to use online payment methods, so your customers can pay online for products in order for them to be delivered to their homes.

Let’s explore the problems associated with cash-on-delivery, and how using an online payment platform can help avoid these issues.

The problems with cash-on-delivery

It’s expensive

When you work with cash-on-delivery, there are multiple fees to be paid. First of all, you need to pay courier fees so that the courier will deliver the goods and collect the cash. Only a handful of couriers work with cash-on-delivery. This means that prices are often high, because the courier companies know your options are limited. There are often both fixed costs and variable costs that depend on the value of the item, which means that for some items, you lose a lot of your profit.

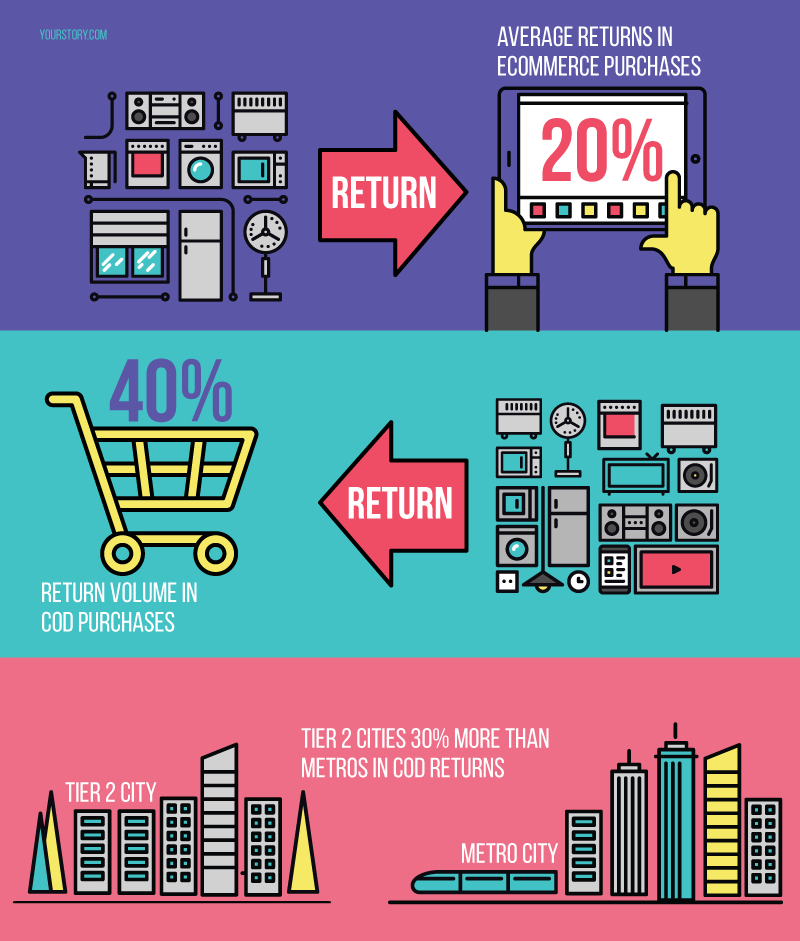

As no payment has been made in advance, customers are also more likely to refuse delivery, and you’ll be left paying for the return, as well. A study by YourStory found that cash-on delivery orders had a 40% return rate.

There are multiple reasons why a customer may refuse delivery:

- The customer may have found the product locally in the meantime

- The customer may be unhappy with how long the delivery took

- The customer may simply have changed their mind about making a purchase

It’s slow

Cash-on-delivery is a slow and inefficient process. There could be multiple delivery attempts if the customer isn’t available, or doesn’t have the cash on them at delivery time. This leads to delays, during which you’ve already sent off your goods but have yet to receive any payment. It may take a week or two for you to receive the cash in your account. This means that your working capital is reduced. The actual payment process can also be very slow if the customer doesn’t have the exact amount of cash on them.

Managing cash is a slow and complicated process as well. Invoices, receipts, and records need to be created and organized manually. You also have to rely on the courier to bring the cash to you in a timely manner, which doesn’t always happen.

It’s risky

Driving around with cash and merchandise can be unsafe. The risk of theft is very real and can cause great monetary losses to both you and the courier. Sometimes, the courier will impose order limits for cash-on-delivery to reduce these risks. In these cases, customers will need to pay through bank deposits or make a number of sub-orders instead of one big order – processes that take time and incur more fees, too.

One solution may be to equip couriers with mPOS devices so that customers can pay by card on delivery. While this makes the payment process a lot more streamlined – it doesn’t prevent customers from refusing deliveries, and it often raises courier prices. The ideal solution is one where customers pay before receiving their goods – and that’s where online payments come in.

How online payments can help

Reduced fees

When customers have already paid for their goods online, the only thing left to do is deliver the product. There are no special courier fees required, as any standard delivery service can be used.

After making a payment online, customers will feel as if they already own the product, and are therefore less likely to return it. Even if a customer does perform a return, they will usually pay for shipping it themselves (unless you offer to pay for returns).

Streamlined, convenient payment process

The online payment process is quick and easy. You can offer your customer multiple payment options, such as credit card, mobile wallet, SMS or email payments. One of the benefits of paying with ewallets is that you can accept online payments from customers who do not have a bank account.

There’s no waiting time between delivery and payment. The payment is processed in real-time, with no waiting required.

Secure payments

When working with a PCI DSS level 1 certified payment service provider, like Direct Pay Online, you can be sure that the payment process is highly secure. The PSP will use risk management technology and fraud detection algorithms to reduce fraud and avoid chargebacks. Not only does this remove monetary losses associated with fraud, but it makes your customers feel more confident about the purchase, too.

Customers may like the familiarity of cash-on-delivery – it’s what they are used to. This is why it’s important for e-commerce businesses to educate their customers about online payments, and guide those who may be unfamiliar with the online payment process. To encourage customers, you can even provide incentives such as free delivery or exclusive discounts when making a payment online. The returns policy should be fair, as well, so as not to discourage customers from paying upfront.

As you can see, there are numerous reasons why ecommerce companies need to adopt digital payments. These payments are clearly safer, quicker, and easier than cash-on-delivery. As for your customers – with a little bit of guidance, you can be sure that they too will soon prefer online payments.