Attention all employers: There is a new trend emerging on the employee salary payment scene:

Payroll cards.

Payroll cards emerged as an alternative method for employers to pay their employees, seeking to replace cash and paper checks. Payroll cards are a safe, secure option for receiving salary payments. With 1.7bln people in the world that remain unbanked, payroll cards allow them a greater opportunity at financial viability.

Similarly following global trends, there has been an increase in the use of digital payments in Africa, and many employers and employees are now choosing these alternative payment methods. Could payroll cards could be the next big solution for salary payments in Africa?

What are payroll cards?

A payroll card is a prepaid card, similar to a gift card. An employer pays an employee by loading the employee’s payroll card with their salary. The card can then be used like a credit or debit card, and does not require a bank account to support it. Payroll cards can only be loaded by the employer – though this can be done again and again, without needing to be replaced – and can be used just as a debit card would: in an ATM, in shops, or online.

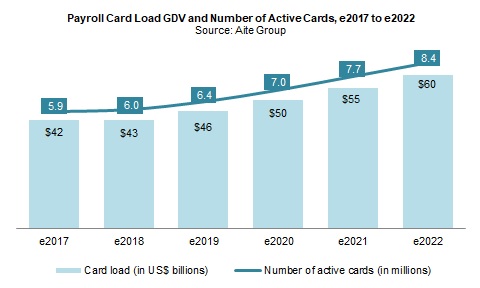

In 2017, the Aite Group released a report about the US State of Play for Payroll Cards. They forecasted a steady increase in cards loaded by employers and this trend continues despite some challenges (more detail below).

The pros of payroll cards

Cost effective and simple for employers

Using payroll cards eliminates the printing costs, administration costs, and check handling fees associated with paying employees by paper check. The employer simply loads the payroll card with the employee’s salary and a receipt is issued automatically. The cards can be reloaded each month and do not need to be replaced unless damaged or lost.

Instant, convenient use

The employee can use the payroll card immediately and no bank account is required. They are also saved the hassle of coming into the office to pick up a paycheck and take it to the bank to cash or deposit. In some cases, employees without bank accounts can enjoy a bank-like experience using a payroll card. Cards are issued by major credit card companies, such as Visa, or payment processors, and can be used anywhere that a credit or debit card is accepted. Therefore, employees can withdraw cash from ATMs, get cash back on purchases (where offered), make purchases, and use the card to make online payments through an online payment solution.

Good for money management

Employees can manage their money more effectively with payroll cards. There is no allowed overdraft, so it’s impossible to go into debt. Employees can add their own money to the payroll card if they wish, as well.

Payments are more secure

Payroll cards have security measures such as PIN codes and EMV chips that make transactions safer and prevent fraudulent use. In the event that a payroll card is lost or stolen, the employee simply reports this loss and can receive a new card loaded with the existing balance. This is an obvious improvement over cash, which cannot be replaced if lost. Having a card also saves the risk of carrying cash – either receiving a cash salary, or cashing a paycheck. Cardholders can keep their balance on the card itself and only carry as much cash as they need at the time.

The cons of payroll cards

Fees

There are more fees associated with using payroll cards than other payment types, such as checks. Using the card at an ATM can often incur a transaction fee, especially if the employee wishes to withdraw a large amount of cash at one time. ATMs may also charge a balance enquiry fee. Other fees can include monthly card maintenance fees, out-of-network ATM fees, and replacement fees if the card is lost or stolen. These fees are variable and dependent upon which bank owns the machine.

For employers, the fees are typically low or nil. Most fees are incurred by the recipient.

Legal issues

Many places have laws that dictate how an employee can be paid. Some laws insist that employees are given a choice of how they receive their salary, making it harder for employers to go completely cashless by using payroll cards. Other laws insist that employees must be able to withdraw their entire salary once a month without any associated fees. It’s important that employers find out if payrolls cards are suitable for use in their locale.

Difficult to recover lost funds

If a payroll card is stolen and used fraudulently, there is a long process required in order to recover the lost funds. It’s imperative that employees report a stolen payroll card or unauthorized charge immediately. It becomes increasingly difficult to get the money back as time passes (however, it is still much better than stolen cash).

Payroll cards in Africa

The embrace of a cashless society is seen across Africa as alternative payments have become very popular in recent years. Payroll cards are a promising digital alternative to using paper checks or cash, especially in Africa, where there is a large unbanked population. Payroll cards are a great option for employers and employees. As a leading payment processor in Africa, DPO has merchants and business owners covered for implementing cards in their payroll system.