2016 was a big year for online and mobile payments in Africa. There were quite a few technological and regulatory advancements that are now helping Africans pay for goods and services more efficiently and safer than they could in the past. These innovations are also helping the region take steps towards sustainable economic growth.

Here’s a roundup of the most notable developments from 2016, which will be the foundation for the continued advancements that will be done this year:

Digital currencies were used more

Bitcoin is a cryptocurrency that is ideal for making international transactions and remittance. This is because it is very secure and fast, and suitable for people without a bank account. During 2016, the number of worldwide daily bitcoin transactions nearly doubled. Africans have been using Bitcoin as a convenient cashless alternative to a bank account or credit card, especially for cross-border payments.

Cross-border payments became easier and less costly

Bitcoin isn’t the only thing that has made cross-border payments easier. In the past, there have been many challenges with making cross-border payments, including high fees and currency exchange problems. This has improved with the growth of the East African Community (EAC), which allows consumers in member states to make easier payments across currencies, which has a great impact on the African travel payments ecosystem. Payment providers have also been focusing on cross-border mobile money solutions by including multiple mobile wallets and digital currencies as viable payment methods. These can be used throughout the continent and even worldwide.

Credit card companies made a big push in Africa

Big credit card companies such as Visa and MasterCard invested in making sure their cards are available throughout the continent. Visa targeted retailers to encourage them to implement their card payment technology, while MasterCard collaborated with some of the governments. One example of this is MasterCard’s Huduma smart card. This card was distributed to Kenyans so that they can pay for state services and receive social payments through a secure platform.

Cashlessness is a major key to financial inclusion in Africa and thus to improving the economy overall. With credit cards, Africans can pay for goods and services much easier, without needing to rely on cash and can benefit from low risk financial services.

EMV became more widely used

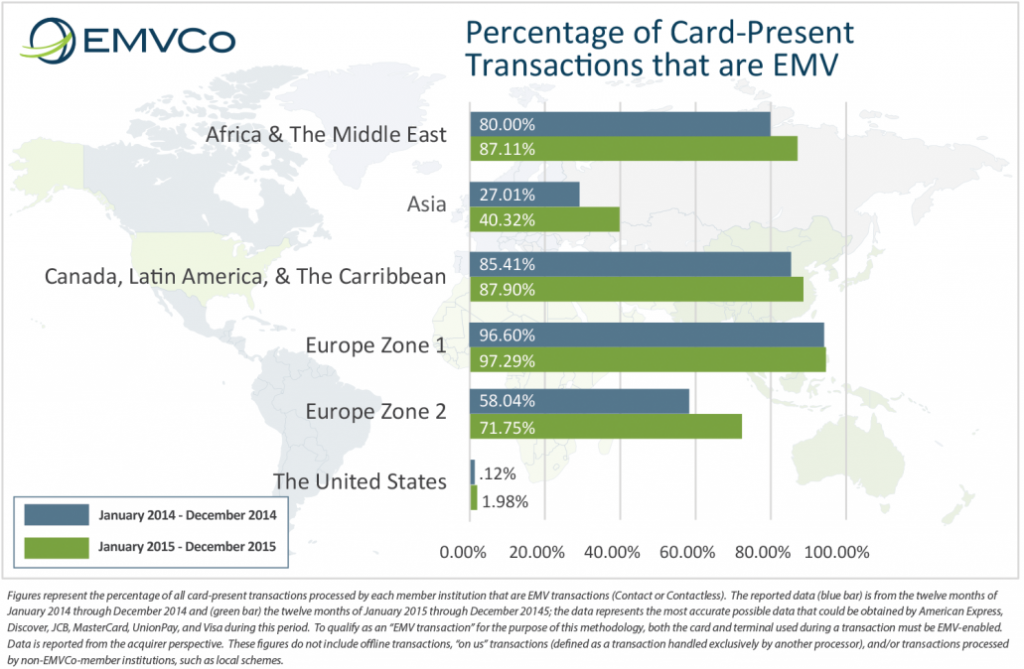

As well as an increase in general credit card use, there was also an increase in the use of EMV cards. EMV stands for Europay, MasterCard and Visa. These credit cards are embedded with a security chip to enhance security and prevent fraud, meeting a high global standard. At the end of 2015, 87.11% of card-present transactions in Africa and the Middle East were EMV, and this number only increased in 2016.

Percentage of card-present payments that are EMV (EMVCo)

Mobile payment regulation improved

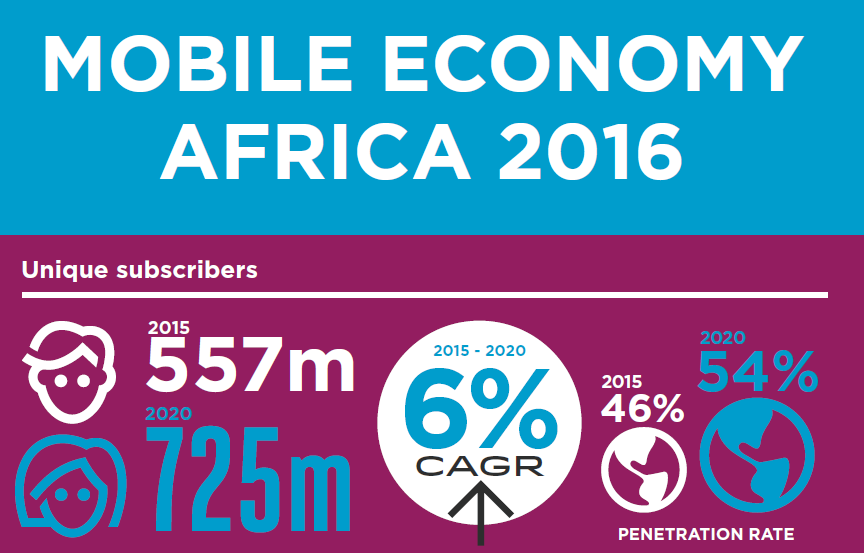

According to GSMA Intelligence, there are now over 550 million unique mobile subscribers in Africa, and this figure is predicted to reach 725 million by 2020.

Unique mobile subscribers (GSMA Intelligence)

With so many people using mobile devices, and with 12% of adults having a mobile money account in the region, there was a need to make big improvements in mobile payment regulations for mobile operators. Governments began to develop frameworks for security. For example, in Lesotho, mobile money systems now have to comply with global anti-money laundering (AML) programs. Also, payment service providers are using more mobile-specific ‘best practices’ and encryption techniques to protect customer data. This is great news for businesses and consumers, as it prevents fraud and increases both security and privacy.

As you can see, 2016 was a promising year of growth for the payment industry in Africa. Payment providers offering a wide range of merchant services are helping Africa move forward in the world of digital payments. Now, more Africans than ever before can benefit from secure, fast, and convenient payments.