You might think the key to increasing hotel booking rates is through marketing techniques. However, there’s little use to an effective marketing campaign if customers can’t complete their bookings easily. It is true that marketing techniques draw in potential customers, but it’s the booking and payment process where these customers are converted into paying guests.

Research performed by SaleCycle found that 21% of online booking abandonment occur at the payment stage. This means that the real solution for increasing your hotel’s booking rates is through optimizing the booking and payment process.

Where do people abandon their bookings? (SaleCycle)

Here are three important steps to take to ensure your payment process is optimal:

1. Offer a wider variety of payment methods

Every potential customer will have a preferred method of payment. You should appeal to as many people as possible by using a payment service provider that supports many payment options. Not only does accepting a variety of payment methods help you expand your customer base, it also helps to improve the customer experience, resulting in stronger loyalty to your brand (and repeat bookings!)

Many customers will want to use their credit or debit cards to make payments, both offline and online. Bank transfers are a widespread payment method, too. However, there are other payment types that are increasing in popularity.

With the recent rise in the number of smartphone users, mobile payment methods such as mobile wallets and mobile money are being used more and more. Analysis by the ADI (Adobe Digital Index) found that 23% of mobile payments are done via digital wallet payment methods. Digital currencies such as Bitcoin are also rising in popularity and should be considered as a valid payment option.

The ease and convenience of making mobile payments has the added benefit of encouraging spontaneous purchases. People who are traveling and are on-the-go might not have the luxury of making bookings and reservations from a laptop or desktop. Offering mobile payment options will increase the number of last-minute bookings guests make, which helps your bottom line.

You might also get guests who prefer to make payments offline while booking online. Offering email payments, where you send your customer a link that enables them to make their payment online at their own convenience, is the ideal solution to keep these customers happy and to ensure they do not abandon the booking during the payment process.

For payments when guests are onsite, you can use a mobile point-of-sale (mPOS) device with a mobile payment system to charge customers anywhere and at any time. Guests are ready to check out after their stay in your hotel? Let them close their bill in their rooms before they leave via a payment-enabled tablet, instead of having to go to the concierge. This is merely one example of how you can improve payment convenience for your guests and help them have a more enjoyable experience at your hotel, which will increase the chances of repeat bookings in the future.

2. Ensure the payment process is trustworthy and secure

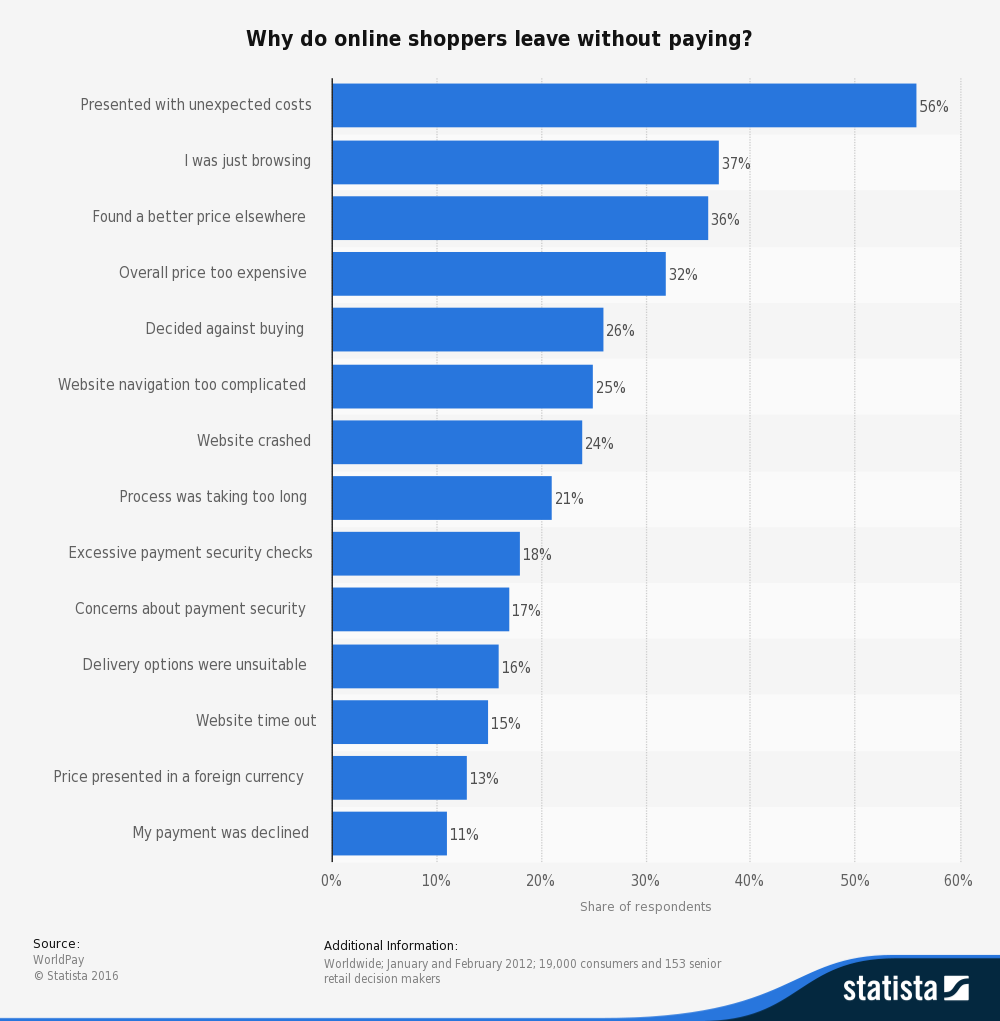

According to Statista, 17% of online shoppers abandon their purchases due to concerns about payment security. When customers come to your payment page, they need to feel that it is both trustworthy and secure in order to proceed.

Why do online shoppers leave without paying? (Statista)

You can convey security on your payment page in a number of ways:

- Make sure your payment page has the same look, feel and branding as your website, as consumers need that continuity to be sure that your payment page is not a scam

- If using a hosted payment page, make sure the payment service provider is a well-known platform that already has the trust of consumers

- Display trust and SSL seals and show the logos of recognized companies such as Visa, MasterCard and PayPal.

However, one of the most effective ways to gain the trust of consumers is by working with a payment service provider that is PCI DSS Level 1 compliant and putting their logo on your payment page. This will give customers an extra boost of confidence. PCI DSS Level 1 certification shows that you comply with the highest standards of security when handling credit card information.

Together, these steps will give customers the confidence to complete their bookings, knowing that their payment details are safe and secure.

3. Make the payment process fast

There’s nothing more off-putting for a customer than a payment page that has multiple, complicated steps. You should ensure that customers can make payments in a maximum of two or three simple steps. These steps should be clearly numbered and labelled so customers can see their progress within the payment process. If your payment service provider can enable you to offer one-click payments, this will also further improve the customer experience and therefore increase conversion rates.

This is especially true when it comes to mobile transactions. According to mporium, 30% of online consumers will abandon a purchase if the checkout process is not optimized for mobile use. To prevent these abandonments, each step of the payment process should simple, easy to navigate and easy to complete using a small touchscreen. Mobile users will appreciate a process that minimizes the amount of information they have to enter. Anything you can do to make payments easier and faster will encourage customers to complete their bookings.

Increasing your hotel’s booking rates may feel like a very challenging endeavor, but it doesn’t need to be as difficult as it seems. Follow these steps to provide a convenient, fast and secure payment process for your customers, and be sure to prepare your staff for the influx of guests.