When customers pay by credit or debit card, there’s always a risk of fraud. However, card providers such as MasterCard implement a wide range of features to ensure the highest level of security possible– preventing fraudulent transactions and ensuring that you, the merchant, can recognize a fraudulent card.

If you’re accepting a MasterCard card payment, you’ll be happy to know that the following Mastercard security features are being used to keep your business, and your customers’ card information, safe:

Physical card security features

MasterCard was the first card provider to bring a card with numerous security features to market. And, the company has remained a leader in data protection and preventing payment card fraud.

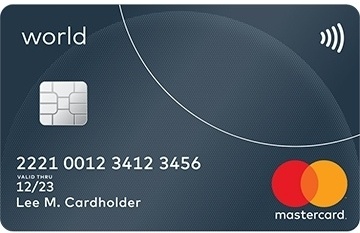

The following features are present on all MasterCard debit and credit cards:

- A full color MasterCard Brand Mark should appear on the front of the card

- The account number must begin with ‘5’

- The first four digits of the account number should be printed below the account number – this is called the pre-printed BIN (Bank Identification Number)

- The 16-digit account number should be uniformly spaced, with equally sized lettering

- The customer’s name should appear beneath the account number – this must be the person carrying out the transactions

- A valid expiration date should be on the front of the card

- Many cards have chip technology – using EMV, for protection above and beyond that which is provided by a regular magnetic strip

- A MasterCard hologram must appear on the front or rear of the card, or there must be a holographic magnetic tape on the rear of the card (HoloMagTM)

- Either traditional magnetic tape or the HoloMagTM appears on the rear of the card

- There is a CVC2 number printed in reverse italics to the right of the magnetic strip on the rear of the card, next to the last four digits of the account number

- There should be no signs of tampering or excessive wear, the card must feel smooth and straight, not bumpy or bent.

A MasterCard Credit Card (Source: MasterCard)

Watch out for suspicious behaviors

While being able to identify fake credit cards is a must, sometimes it’s possible to identify a suspicious customer solely based on their behavior. Here are some behaviors that should raise suspicion:

- Unusually big ticket purchases from a first-time customer

- Customers using anonymous email addresses to buy online

- Lots of expensive goods bought at one time

- The customer seems to not want to share information or talk to you, or acts in a distracting or brash manner

- Purchases made right at the end of the day

If you think a MasterCard debit or credit card may be fraudulent, either because it’s missing some features, or the customer appears suspicious, contact your Voice Authorization Center and request a Code 10. This will alert the card issuer without the customer knowing. Remember not to put yourself in physical danger at any time – never confront the customer and remain calm, answering any questions asked over the phone in a normal tone of voice.

Follow the card processing rules

When accepting MasterCard payments, follow the MasterCard Transaction Processing Rules, which can be downloaded here. These rules detail a merchant’s requirements for credit card processing – including:

- For Card Present transactions:

- If the card has a chip, the chip should be read. If the POS cannot read the chip, the magnetic stripe should be swiped. In the event that this does not work, the card information can be entered carefully by electronic key entry.

- The cardholder must present the physical card, unless the payment is recurring, in that case the card only needs to be present for the first transaction.

- The merchant must check the expiration date, check that the card is signed, and check for the above security features.

- The merchant should retain the card while the authorization process takes place.

- The merchant must request either PIN entry or a signature to verify the cardholder’s identity.

- For Card Not Present transactions, the merchant should request the CVC2 three-digit code on the rear of the card. This information must not be stored anywhere.

Use MasterCard fraud mitigation tools

In addition the features above, MasterCard also offers a solution for fraud prevention and risk management called ‘GateKeeper’. GateKeeper uses a multilayer approach of security strategies for maximum protection. Here are some of the key features:

- Fast, real-time transaction screening

- Instant acceptance or rejection decisions, or flagging of medium- to high-risk transactions for review

- Web-based system for analysis and review of transactions

- 24/7 support from fraud and risk specialists to help you in understanding fraudulent transactions and knowing what to do in cases where you suspect fraud

Thankfully, MasterCard has dedicated much of their experience and expertise to the prevention of fraud, leading to the production of secure cards with robust security features and a thorough transaction processing procedure. If you want to significantly reduce your risk of fraud, learn how to identify a fraudulent card or a suspicious customer, by following these processes outlined by MasterCard.