As of August 2017, African fintech startups have raised over $100 million in investment. And, we don’t see them slowing down anytime soon.

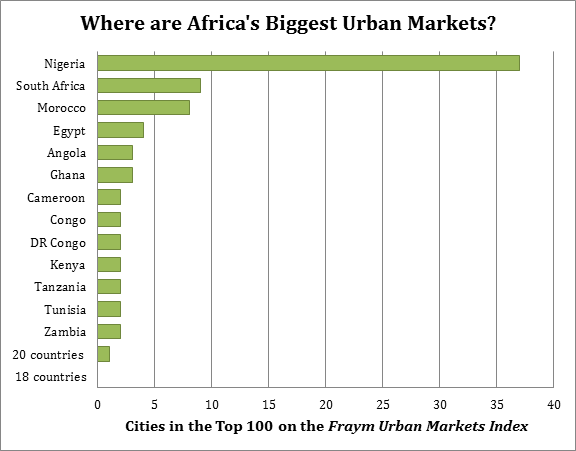

There are over 300 fintech startups active in Africa, with over 31% in South Africa, followed by Nigeria and Kenya. Emerging countries with increased fintech startup activity include Ghana and Cameroon.

Startups focusing on payments and remittances dominate this sector, accounting for 41.5% of all startups. African blockchain startups have also been very successful in securing funding with close to 39% of these startups raising external investment since the beginning of 2015.

As “necessity is the mother of invention”, it is not surprising to see this multitude of fintech startups in Africa where a high percentage of the population is still unbanked.

In Sub-Saharan Africa, for instance, only 34% of the adults hold either a formal or mobile money account.

Financial innovations, combined with the high penetration rate of mobile devices, are enabling many of these currently unbanked adults to have access to a financial service platform for the first time ever. It is this necessity, together with the influx of technologies and penetration rates of mobile devices, that has put Sub-Saharan Africa at the forefront of mobile banking worldwide.

From Payment to Security in Africa’s Fintech Landscape

Fintech is a general term which relates to different types of innovations for financial activity. Here are a few of the major sub-sectors, along with exciting African companies active in these fields:

1. Blockchain and Cryptocurrency

Cryptocurrency is a digital or virtual currency which is difficult to counterfeit because it uses cryptography for security. This currency is not issued by any government, and is therefore immune to inflation.

Blockchain is a highly secure, peer to peer, network of transactions which acts like a virtual ledger of transactions performed. Cryptocurrencies are typically associated with a blockchain, and all transactions performed with the currencies are recorded on a distributed network of thousands of computers, creating a “block”, or real-time record of the transaction. Transactions are done between two parties, with no middle men, in real-time. As at any given moment all records must balance, it is virtually impossible to breach this effective security measure.

One example of a leading African startup in this field is BitPesa. BitPesa leverages Bitcoin and the blockchain technology to facilitate secure and low cost transfers between businesses. The company supports B2B payments to and from Kenya, Nigeria, Uganda and Tanzania. BitPesa recently closed a $2.5 million investment which will fund expansion into Western markets.

2. Innovative Banking

The African economy suffers from a reality of high fraud rates and unbanked citizens, who have no paper trail. Therefore, they cannot receive credit scores necessary to take out loans or even credit cards.

These situations have created a need for innovative banking technologies which assure the authenticity of a user’s identity to combat fraud and alternative methods to establish the trustworthiness of unbanked citizens. By doing so, they are given the opportunity to be included in Africa’s economy.

Multi-factor and biometric authentication startups offer a high level of security during transactions, lowering the chances of successful fraud attempts. Big data generation and analysis enables identifying breaches of security, as well as the creation of a financial history for unbanked users, to be used in place of a credit history for establishing a user’s trustworthiness.

Other innovative banking companies focus on methods to include Africa’s unbanked in the economy, such as via micro-loans and payments, or micro-savings, which also enable creating a payment history for participants.

The Circle Group, for instance, offers Imaginarium, a group-based savings app. Using this app, Africans are encouraged to contribute, together with a circle of contacts they have created, to a joint savings and investment plan. Contributions are made via M-Pesa, and account holders receive bonuses on every deposit made. Circle Group Savings and Investment was one of 20 finalists in the Ecobank Fintech Challenge in 2017.

3. InvestTech

Bringing innovation into the investment market, InvestTech companies offer alternative platforms and marketplaces for investment. From innovative investment management tools, to social investments, InvestTech offers next generation investment tools to private investors and alternative investment opportunities such as in real estate, livestock or micro-investments in businesses.

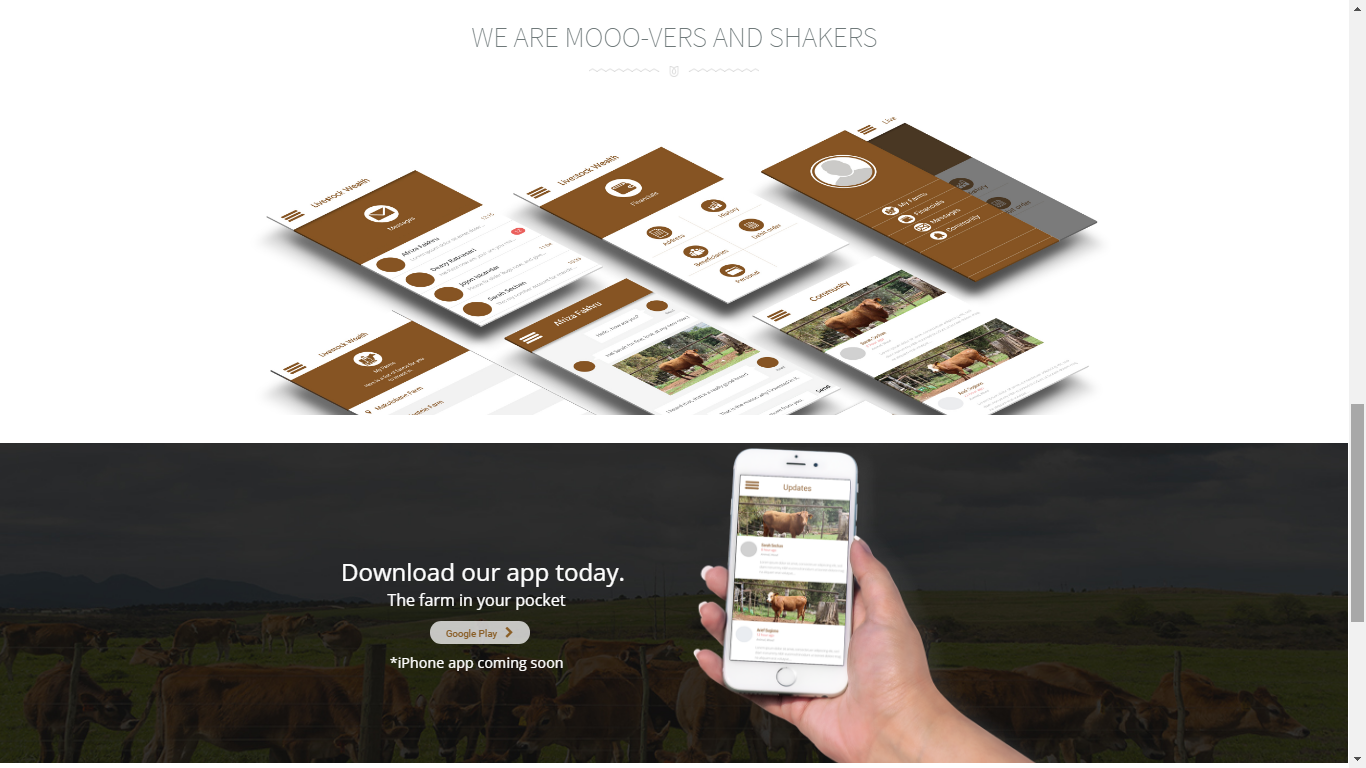

One of the interesting African players in this field is Livestock Wealth.

Livestock Wealth is a crowd-farming initiative, which allows private investors to purchase livestock and become part owners of the farm.

Cows are bought and calves are raised, with the intent of being sold for beef. Any cow sold is replaced by the farm. The annual profits are shared with the livestock holders. The mobile app and quarterly financial reports offer complete transparency. Investors can expect a return on their investment within two to three years, enabling them to purchase additional “stock”. Investors can borrow against their stock, and all livestock are insured, decreasing risk.

4. Payment and Remittances

Accounting for over 40% of all African fintech startups, payment and remittance startups clearly dominate this field. However, this isn’t much of a surprise because remittances are the largest source of foreign investment into Africa.

Additionally, mobile payment and banking technologies are helping to bridge the gap between the banked and unbanked in Africa. Novel technologies enable receiving payment via mobile device, and paying for goods and services with a simple push or swipe. In an economy where the majority of the population rely on cash payments, this is revolutionary—saving time and the expense of traveling to make payments.

Direct Pay Online is a leading payments service provider (PSP) in Africa, providing payment services to merchants in Kenya, Uganda, Rwanda, Zanzibar, Tanzania, Ethiopia, Zambia, South Africa, Namibia, Botswana, and Mauritius.

Direct Pay Online provides a real-time, cloud-based processing platform, with state of the art technology that supports multiple transaction types, including cross-border remittances for all currencies. Its technology supports all modes of payments, accepting all major credit cards as well as local cards, mobile money and ewallets.

Their platform can be implemented on ecommerce sites for online payment receipt or can be used in conjunction with mPOS devices and QR payment technologies. They also have PCI DSS Level 1 certification, the highest level of security in the industry, ensuring safety, security and data privacy. Direct Pay Online also recently acquired VCS SA and PayThru making it the largest PSP in Africa, serving over 20,000 merchants.

2018 Projections and Trends

Global investment in fintech ventures is projected to double between 2016 and 2018, reaching $6 billion in 2018. With the high level of digital penetration and acceptance of alternative platforms for payment and banking, it is safe to assume that Africa will continue to be a significant player in this market.

Ecobank Research Group’s FICC Guidebook has cited increased fintech innovation as one of the three key trends for 2018 in Africa. This uptake will be fueled by the growing generation of digital natives in Africa and the proliferation of tech hubs across the continent, which will assist fintech startups in raising capital.

Fintech platform and application availability will put Africa at the forefront of this industry, essentially enabling Africans to leapfrog over traditional, and soon-to-be outdated business models and technologies, such as physical credit cards.

What’s more,the new generation of fintech technologies will increase the inclusion levels of previously unbanked Africans, through building alternative credit histories. By doing so, a host of citizens will be able to improve their financial standing using the numerous financial tools finally at their disposal. Novel payment methods will save them time and money, while alternative savings options will enable them to grow their net worth.