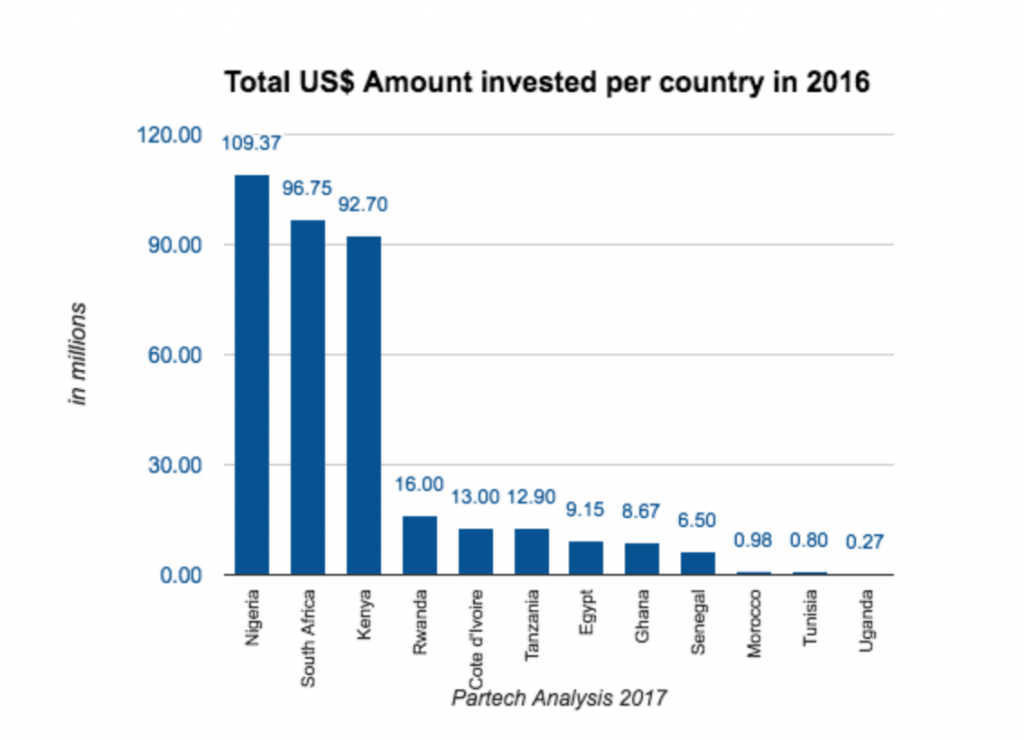

The technological startup landscape in Africa is gaining momentum. According to Partech Ventures, VCs invested $367 million in African startups in 2016, up 33% from 2015. Funding to African startups has grown by an 8.7x factor over the past four years. The countries whose companies garnered the highest funding are Nigeria, South Africa and Kenya.

Leading sectors receiving investment include fintech, followed by e-commerce, e-health, and agri-tech, according to Disrupt Africa. Recruitment, transport and marketing startup companies are also of interest to investors.

Here are a few tips on how to find investors in Africa and secure investment:

Sources of Funding to African Startups

African startups should research local startup forums, industry-specific conventions and trade shows, venture capital conferences and relevant networking events, such as:

- The Africa Startup Forum

- African SME Expo

- My Business Expo

- Afrobytes Tech Conference

- SuperReturn Africa

It is imperative to be active within the startup ecosystem, and it will greatly help in understanding the various players and their specific focus.

Funding can be direct money invested in a company or a host of services provided by the over 300 incubators and aggregators in Africa. These startup-focused companies, as well as co-workspace providers and startup hubs, such as iHub in Nairobi, Kenya, offer professional services to startups, such as administration and business planning.

They assist their portfolio companies in identifying and approaching financial investors. Via these players, startups will also have access to the African startup ecosystem and opportunities to participate in networking events.

More examples of aggregators and incubators can be found here.

International players also invest in African startups, such as the 6 recent grants provided by Microsoft to entrepreneurs working to increase access to internet services across the continent, as well as the affordability of these services. Additional international players who fund African initiatives include Samsung, via its NEXT Venture Capital fund and Orange Digital Ventures, to name a few.

Another significant source of funding is from venture capital funds (VCs). These funds raise capital from private investors and corporations, and invest these funds in a portfolio of companies. Capital Eye, for example, a South African private equity and venture investor, recently partnered with Multiply Group, a Durban-based investment firm, to create Crossfin Technology Holdings, which will invest in fintech startups. The following is a partial list of VCs and angel groups (private investors) active in Africa:

- Savannah Fund

- Fanisi Venture Capital

- Angel Hub Ventures

- TLcom Capital

- Novastar Ventures

- EchoVC

- Invenfin

- 4 Di Capital

- Knife Capital

Additional VCs in Africa, or that invest in African companies can be found via a search in Google.

Approaching Venture Capital Firms

Africa has become a hotbed of entrepreneurial activity. This has attracted both African and international VC firms. VCs generally present their investment focus clearly, on their websites. This could be certain technological areas, such as fintech, agri-tech, medical devices, and many other options, or their stage of investment preference, such as

- Seed

- Early stage investment

- Late stage investment.

As such, the first step in approaching a VC firm, is to ascertain that the startup meets the VC’s investment focus.

Another important point to research is the current fund stage. VCs raise capital towards a specific fund, and then invest monies from their active fund in portfolio companies. If the VC does not have an active fund, there is little point in approaching them until they raise their next fund.

While conducting the above research, African startups should prepare their “investment pitch deck”. A pitch deck is a presentation based on an in-depth business plan, and includes:

- The business plan, itself

- A one-pager summarizing the main points of the business plan

- An investment presentation presenting these points

As the competition is fierce, it is imperative to create a pitch deck that stands out from the crowd. The deck should comprehensively and beautifully present:

- The business opportunity and model

- The technology

- The market and its potential

- A strong team who will realize this potential

When possible, the pitch deck should present a compelling story, and convince the investor that there is a significant advantage to investing in the company.

Appealing to VCs

The goal for any VC is to successfully realize significant profits on the funds they have invested, in the shortest amount of time. The following factors appeal to VCs during the pitch and due diligence stages:

- A strong team that can lead the development process, the market penetration process and growth stages.

- A solution which meets the needs of the target market.

- The commercial value of the product or service presented, including a viable business model, profit margins, and target market size.

- Competitive landscape as a factor of the chances for successful market penetration and market share capture.

- Sustainable competitive advantage which ensures long term profits and value generation.

An attractive offering, combined with in-depth research of relevant potential investors and a compelling investment deck, are all critical steps towards receiving investor funding in Africa.