There are two commonly used business models used by online travel agencies (OTAs) when working with hotels:

- Merchant Model

Through this model, OTAs leverage their relationship with their merchants (hotels, in this case) and purchase a bulk of rooms at a discounted price. They they resell these rooms at a profit and facilitate the booking through their own site/systems. In this model, the guests pay the OTA, who in turn pays the merchants.

- Agency Model

In the agency model, OTAs act as agents on behalf of their merchants. They list the hotels, services, and prices on their own booking sites. The OTAs receive a commission (typically between 10-30%) on all bookings made through their efforts, and the hotels pay the OTAs once the booking has been paid in full by the guests.

Both of these models have their advantages and disadvantages, of course. The merchant model is considered to be the more profitable option as OTAs set the prices and collect the funds themselves. The agency model increases OTA booking rates, and drives higher volumes.

Many OTAs offer both of these options: either to pay upon booking (merchant model) at a reduced rate, or to pay at check-in (agency model) at a higher rate. Often, OTAs also have a refundable option within specific guidelines.

There is an added layer of complication, in the difference amongst businesses in the industry and their model and revenue mixes. This leads to complex payment processes and agreements between merchants and OTAs, related to timing, PCI regulations (how credit card information is saved and stored) and more.

See below for some real-world examples of how OTAs settle payments with merchants.

The Expedia Group

Expedia Inc., whose revenue in 2018 topped $11bln, has in its portfolio some of the most popular OTAs out there: Orbitz, Hotels.com, Trivago, Travelocity, and many more. It also operates the Expedia platform independently.

In their business model, Expedia is considered to be the merchant of record for all bookings made through them. This means they are held financially liable to customers, and online payments are made through them.

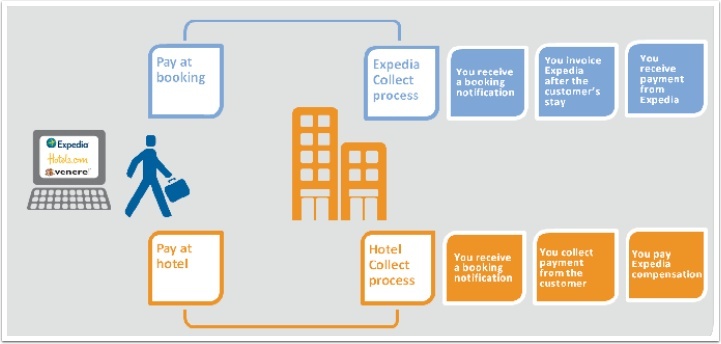

Expedia Traveler Preference combines both agency and merchant revenue models. When the merchant model is used, the charge is made up front: when a guest elects to pay upon booking, funds are collected via the Expedia Collect merchant model. Expedia charges the customer’s credit card and then pays the merchant the agreed upon amount once the stay has been completed at the hotel. Profits can reach up to 30%, depending upon the travel market, inventory/availability, and seasonal fluctuations.

Should a customer opt to pay at in-person at the hotel, Expedia’s Hotel Collect agency model is used, with or without a deposit requirement. Commissions – typically between 20-25% – are paid to Expedia by the hotel following payment receipt from the customer.

Source: Myallocator by Cloudbeds

In Q1 of 2019, the agency model generated nearly 47% of all Expedia revenues. The merchant model represented nearly 40%. Additionally, Expedia offers advertising space on its site, and various marketing plans for its partners, such as flash sales. Expedia’s flash sales – referred to as A Sudden Amazing Price (ASAP) – offer two hotel deals per day, running for 12 hours, and offer up to a 50% discount on bookings.

Expedia also offers Members Only deals, giving 10% off to its members via its loyalty program. Portfolio companies such as Hotels.com and Orbitz have very successful loyalty program offerings. Hotels.com gives a free night for every ten booked, and Orbitz has cash incentives for future reservations made through the site.

The Priceline Group

Booking Holdings – formerly the Priceline Group – is the largest online travel agency in the world, and has a portfolio of popular OTAs, including Booking.com, Priceline.com, Agoda.com, and Kayak. In 2018, the company’s gross profits reached more than $14.5bln. In the third quarter of 2018, it was announced that the company had seen a dramatic increase in revenues from the merchant model – 53.4%, to $1bln – while agency revenue grew less than 1% to $3.54bln. Part of this increase was due to the Agoda brand (purchased in 2005), which has always functioned under the merchant model, and the (much larger) Booking.com, which uses the agency model.

Booking.com has a loyalty reward system called Genius (and, naturally, members referred to as “Geniuses”). This loyalty program is free for life upon making two bookings, and provides members with discounts and rewards which increase as the member books more through the site. Priceline.com offers unique ways to book through their site, such as the Opaque model, allowing customers to “name their price” and place bids on rooms within certain parameters. If the bid is accepted, the customer can choose to proceed with the booking, but the hotel name will not be revealed until the reservation is completed. They also offer an Express Deals option which equally keeps the hotel name hidden until confirmed, but doesn’t involve placing bids. These models enable hotels to decrease losses from their inventory surplus while encouraging customers to grab last-minute deals.

Virtual Credit Cards are a leading method for transactions between hotels and OTAs

In the case of the merchant model, Virtual Cards are a common payment method across the board. These virtual cards are single-use and act like credit cards to enable secure payment transfer from one party to another. The booking customer enters their CVV number, which due to PCI regulations cannot be stored, making virtual credit cards a useful choice. OTAs charge the customer through their standard online payment methods, typically receiving payment via credit or debit card when the reservation is completed on their site. When the booking details are passed from the OTA to the hotel, a virtual card is provided in lieu of the customer’s private and specific personal data, allowing the hotel to charge the OTA the agreed upon rate and tax once the check-in/check-out is completed.

A method shared amongst Expedia Group and Booking Holdings alike, virtual cards are used to transfer payments securely to their merchants. Expedia Collect is a model in which payments are made by the customer directly to the hotel at the time of the booking, and hotels later charge Expedia Virtual Card (EVC), just as they would a credit card. This payment option offers a PCI compliant payment method (carrying a high security standard) to merchants. Similarly, Booking Holdings provides merchants with its own virtual credit card. Merchants charge the cards for the agreed upon amount following the guests’ stay.

Transactions using Expedia Virtual Card are made possible through an authorized payment terminal. Merchants who utilize DPO’s online payment processing solutions can smoothly settle their accounts with Expedia Group’s range of OTAs. Merchants can elect to transfer funds from Expedia directly to their DPO accounts, enabling them to streamline the payment process and have these funds available via a secure and simple method.