With a population of 182 million, of which half are under the age of 30, according to Bloomberg, Nigeria has become a prime market for ecommerce.

Nigeria’s population is the fastest growing out of the 10 most populous countries globally, and is projected to become the third largest country in terms of population by 2050. With the current under-14 age group making up 40% of the total population, Nigeria could enjoy a large, productive workforce and economic growth in the coming years.

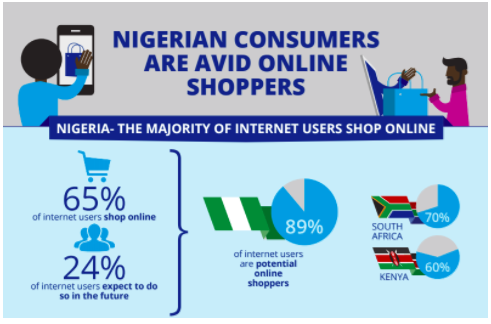

KPMG projects that the annual growth rate of ecommerce in Sub-Saharan countries will be 40% through 2025, while Nigeria’s middle class is projected to increase three-fold through 2030, according to PWC. This growth, combined with Nigeria’s high proportion of potential online shoppers, at 89% of all internet users, according to a study commissioned by PayPal, contribute to why Nigeria is widely accepted as the biggest ecommerce hub in Africa.

Source: Techcabal

Overcoming Technical Obstacles towards a Growing eCommerce Market

While today Nigeria is considered a leading ecommerce market, up until a few years ago, this was not the case. In fact, in the first years of this decade, online payment failure rates were as high as 60-70% of attempted transactions in Nigeria. Mobile money had only recently begun to gain acceptance, and many Nigerians were wary of cyber fraud, limiting ecommerce acceptance.

However, necessity is the mother of invention, and with only 8 major malls, serving Nigeria’s enormous population, and rent levels at these malls acting as a deterrent to retailers, Nigeria overcame the obstacles limiting ecommerce penetration and success, becoming one of the leading ecommerce markets in Africa.

The following are some of the changes which influenced the growth and adoption currently associated with the booming Nigerian ecommerce market:

1. Growth in internet and smartphone penetration

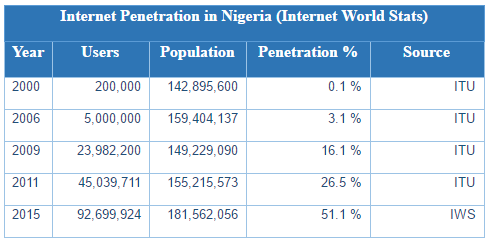

Internet penetration in Nigeria has reached over 50% of the population, up from 26.5% in 2011, according to Internet World Stats. Smartphone penetration is 30%, with smartphone users spending over 190 minutes per day on their devices.

With the uptake of internet and smartphone usage, Nigeria has seen acceptance of online and mobile shopping. 71% of online shoppers in Nigeria are on major ecommerce platforms over mobile devices, and 51% of online shoppers with smartphones complete a purchase at least once a month. Leading retailers such as Jumia and Konga have integrated advanced, and secure online payment platforms to answer this growing need.

2. Technological and banking sector evolvement

Recent years have seen improvements in the infrastructure of mobile banking systems leading to an increase in acceptance. Mobile money service agents have been added to enable easier money deposits to mobile accounts across the country, bringing this crucial technology to the masses. Market leader, Paga, for instance has a base of 10,000 agents throughout Nigeria. Registered mobile money accounts in Nigeria grew 200% from 3.4 million in 2012 to 10.7 million in 2015, according to the Institute of International Finance, and the market will continue to expand as awareness grows.

With the adoption of mobile banking, electronic payment methods in Nigeria are increasing in popularity, as well. Mobile money and e-wallets are a commonly recognized form of payment, and mPOS terminals for accepting mobile payments are gaining traction. This past year has seen the introduction of QR code payments, led by Visa and MasterCard, and there are apps such as DumaPay that can be used for this cashless payment method. These seamless payment methods have significantly improved online payments, fostering ecommerce acceptance in Nigeria.

3. Fintech entrepreneur emergence, powered by increased investments

According to a KPMG report, investments in Nigerian fintech companies during 2015-2016 surpassed $200 million. Investments in Nigerian fintech startups, accounted for $49 million in 2015 alone. Incubators, accelerators and hubs supporting innovation have sprouted, offering ecommerce entrepreneurs assistance in their early stages. Banking institutions and additional market players are teaming up with these enterprises, working together to offer advanced financial solutions to the large Nigerian market.

Financial services within Nigeria’s digital economy has been quoted to have the potential to add $88 billion to the economy and create over 3 million new jobs through 2027.

The convergence of Nigeria’s demographic makeup, with the high rates of internet and mobile phone penetration, and increasing advances in financial technologies, have led ecommerce evolution in this large and promising market, creating a continually expanding ecommerce hub.