It looks like 2017 is going to be a strong year for digital payments. Technology is improving at an exponential rate, and there will be even more solutions for secure, fast, and convenient payments than there were in 2016. Plus, many existing technologies will become more prevalent and widely adopted.

Here are six important payment predictions for 2017 that you should be aware of:

1. Increased adoption of mobile payments

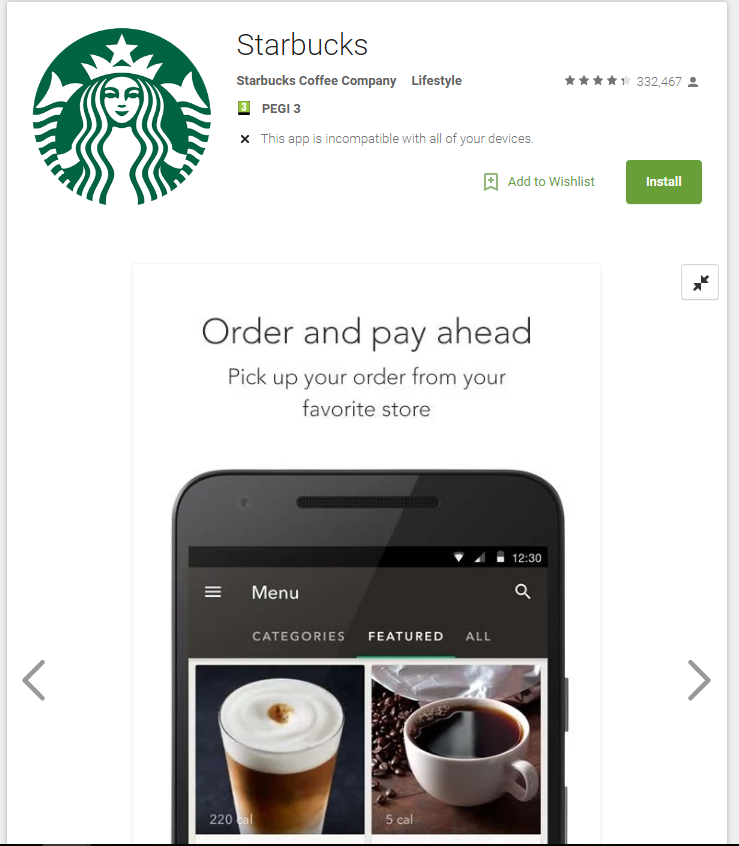

Mobile payment revenue is expected to surpass 780 billion US dollars in 2017, showing a huge increase in the adoption of mobile payments. In particular, we will see an increase in the use of mobile wallets.

Global mobile payment revenue 2015-2019 (Statista)

Also, more businesses, restaurants and travel companies will use mobile devices such as mPOS systems to provide payment services to customers through a mobile app. This is less expensive, highly secure, and allows for more payment options than a traditional cash register.

Another mobile payment trend for this year is the increased use of near field communication (NFC) technology. It allows two devices that are located close to each other (such as a POS device and a mobile phone) to exchange data. This means that payments can be made simple by placing a person’s NFC-enabled device close to an NFC-enabled reader. This technology exists already, but more business will update their technology to provide NFC capabilities this year.

These three trends will drive businesses to increase the variety of mobile payment methods they offer to their customers.

2. Mobile ordering will become more popular

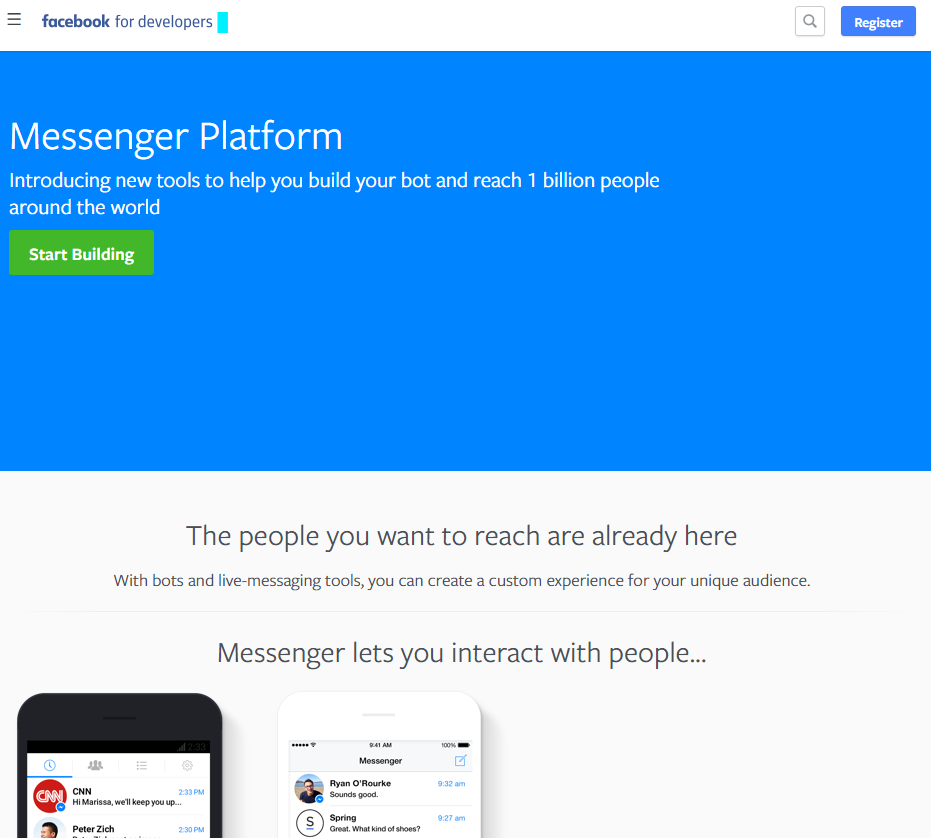

Consumers are increasingly less willing to wait for their purchases or services to arrive. It’s this on-demand economy that will cause more restaurants, coffee shops, and stores to implement mobile ordering. International coffee shop chain Starbucks has been a main player driving this trend with their mobile app. The app allows customers to order and pay ahead of time, so that when they arrive at the physical location, their food and coffee is ready and waiting for them.

The Starbucks App (Google Play)

A big benefit of mobile ordering is that it makes it easy for people to order items – all they need to do is press a few buttons at their convenience. This increases sales and spontaneous purchases, and it improves the customer experience (and thus, customer loyalty).

3. Bluetooth-enabled mobile payments will gain popularity

Bluetooth use will surge this year, thanks in part to Apple’s decision to ditch the headphone jack on their products. Bluetooth Low Energy (BLE) allows Bluetooth data to stream without consuming much power. Like NFC, BLE enables wireless data transfer, but it operates at a slightly longer range. This means customers can connect to a POS from anywhere in a store – not necessarily at a POS terminal.

4. Cloud POS systems will start to be used more instead of traditional POS systems

Instead of storing information on a physical hard drive in a traditional POS system, businesses are now able to store their data using a cloud-based POS system. Then, it can be accessed from anywhere, as long as there is an Internet connection. The system is compatible with a wide range of computers, mobile devices, and other hardware making it easier for businesses to accept online payments. Cloud POS systems can also provide reporting capabilities for tracking sales and employee performance.

The cloud also brings increased security. If a traditional POS system is stolen, all the data is available to the thief. In a cloud system, data is protected by passwords and encryption. Cloud POS systems are inexpensive to set up and can be updated easily, whereas traditional POS systems are rarely updated and even then, it is often at great cost.

As cloud POS systems become more popular, we will see more all-in-one POS and mPOS devices used in stores, using a comprehensive software system for processing payments and other customer-related functions.

5. Machine-learning for fraud protection will improve significantly

Machines will be used to fight payment fraud this year. With advances in machine learning, complex programs can provide computers with the ability to respond accurately to different scenarios and detect fraudulent activity. At the moment, fraud management systems use a set of rules and often require additional manual checks. Machine-learning avoids this by using advanced techniques that detect patterns in consumer behavior and make profiles based on the data. Each payment is evaluated by sophisticated algorithms using both historical and streaming information to evaluate the fraud risk in real-time. This can help prevent chargebacks, a major expense for businesses. Global Risk Technologies found that 86% of chargebacks are fraudulently placed.

The results of this automatic fraud protection will become highly accurate as time goes on and the machine learns more about consumer behavior. It is ideal for larger e-commerce retailers who don’t have the time to perform extensive manual checks and want to process payments as quickly as possible while keeping risk at a bare minimum.

6. Chatbots will have an impact on payments

These automatic chat partners with artificial intelligence are the new must-have technology for every business. In 2017, we can look forward to seeing them used for payments.

Chatbots use messenger platforms to interact with customers in a natural, conversational tone. When designed and programmed well, they can be used to respond to customer enquiries, take orders, and process payments. This reduces the cost of customer service and enables the integration of mobile payment options such as digital wallets.

In 2016, Facebook opened its Messenger app to chatbots, and over 30,000 different bots have been developed. Some of these bots can accept payments directly.

Building Facebook bots for the Messenger platform (Source)

As people are already using messaging apps to speak to their friends, using a chatbot is the obvious next step to providing customers with convenient customer service and payment options.

In 2017, embrace the exciting future of the payment industry. Keep up with these trends, and provide your customers with the secure and streamlined payment process they crave, so you can improve the customer experience, boost customer loyalty, and ultimately benefit from more sales.