Most companies and employees who travel know the drill. Unless you are a high-powered exec, who holds a company credit card, you will receive a budget and general instructions on your travel-related expenses. Certain expenses may be charged to a general company account during the booking stage, while others may be paid out of pocket, and reimbursed upon return.

Reimbursement requires filling out detailed expense reports and handing in receipts. The travel managers will then reconcile the expense report with budgets and check for compliance. Certain payments will be checked to confirm booking rate against payment (room service or pay per view anyone?). Finally, the approved expenses are reimbursed to the employee. Simple, right?

Considering that travel managers spend 40 hours per month dealing with reconciling these payments, the answer is most likely “no”. To make matters worse, it is difficult to isolate data on a specific trip, as multiple trips are all paid from the same account, or via a credit card which passes from traveler to traveler. So, managers are not always sure which payments are related to which trips. Allowing multiple employees access to a company card which could help isolate specific trip costs is a huge security breach, exposing the company to card not present fraud down the line.

With 72% of travel managers stating that they have not achieved their desired travel policy compliance level, according to a 2015 survey by the Association of Corporate Travel Executives (ACTE), there is definitely room to improve efficiencies both in the reconciliation process as it exists today, and in employee travel expense compliancy management.

A Millennial Workforce Signals Change

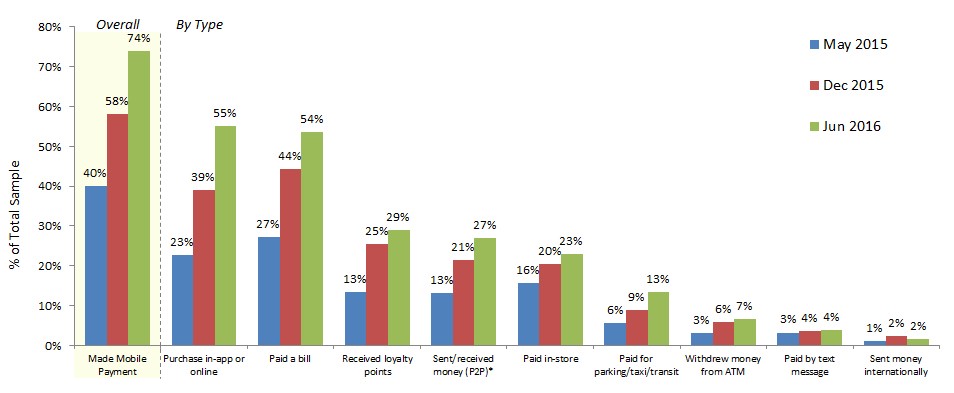

Consumers are adopting alternative payment methods, such as mobile and virtual payments. According to First Annapolis’ semi-annual Study of Mobile Banking & Payments Global from 2016, 74% of respondents made a mobile payment within the 12-month period prior to the study, up from 40% merely 13 months beforehand.

Global mobile payment revenue is expected to reach $780 billion in 2017, up from $450 billion in 2015, according to Statista. In store mobile payments alone are projected to increase at an 80% compound annual growth rate between 2015 and 2020 to reach over $500 billion, according to Business Intelligence.

Leading the adoption of mobile payments are the Millennials. 45% of Millennials have made an NFC payment compared to 26% of those from the previous generation, according to a recent Square survey. This is the same market segment which is poised to make up 75% of the workforce, according to Forbes, and which currently takes the most work-related trips, with 7.7 annual business trips, compared to an average of 7.4 in the general workforce population. In 2017, Millennial business trips are projected to increase to 8.6 business related trips per year.

Business travel managers should learn from their travelers, and adopt corporate digital payments, which are not only more convenient than traditional methods, but also serve to streamline travel expense reconciliation, follow-up and analysis.

Corporate Digital Payment Revolution

Three payment methods, namely mobile payments, virtual payments and invisible payments, are merging to create a corporate digital payment solution. With a large portion of the workforce already embracing mobile payment methods, the advantages of digital payments, combined with the projected ease of implementation could be the solution corporations need to increase travel-related efficiencies.

Here is a brief description of these 3 components of digital payments:

1. Mobile payments

This includes both mobile wallets and mobile money. Mobile wallets store users credit card data on the phones, and are used to pay at specialized NFC-enabled terminals in a simple tap or wave of the phone at the terminal.

Mobile money, a non-bank based payment method, allows users to upload cash on their phones, with which peer-to-peer money transfers can be made. There are many mobile payment platforms that support these payment options, offering a secure and flexible payment method for today’s super connected consumer.

2. Virtual payments

Virtual credit cards work similarly to traditional credit cards. The virtual credit card is essentially a unique number which is used in place of a credit card, complete with CVV number and pin. The card is issued for a specific time frame or for one-time use.

The card can also be customized to accept or reject specific payments. For example, if a transaction is over the budget or not recognized as an approved category of payment, as set by the travel manager, then it will not be approved. These payments are all automatically defined as part of a single trip, allowing efficient follow-up and lowering the time needed for reconciling refunds, as any approved cost was made via the company funded virtual card.

3. Invisible payments

These types of payments are made when the customer is automatically recognized when receiving goods or services, and he is charged automatically by a preloaded payment method – usually from a mobile device. Invisible payments generally use location-based Bluetooth beacons on the customer’s cell phone for identification purposes.

This payment type is already hugely popular with Uber, where the passenger orders a ride via the app, and the payment for the ride is taken care via the app as well. Another example of invisible payments can be seen in car parking lots or toll highways which recognize the car and charge the owner automatically, per use.

Consolidation of the above payment methods, while connecting these methods to a company’s central booking account for travel management, enables effective data collection and trip monitoring while cutting back on the time required to approve and refund travel expenses. As alternative payment methods gain popularity, it is expected that travel managers will embrace digital payments for corporate trips.