Like every major credit card company, Visa takes fraud prevention very seriously. Using a selection of sophisticated card security features and an array of fraud prevention strategies, they enable merchants to accept card payments with a minimized risk of fraud.

Physical features of Visa credit and debit cards

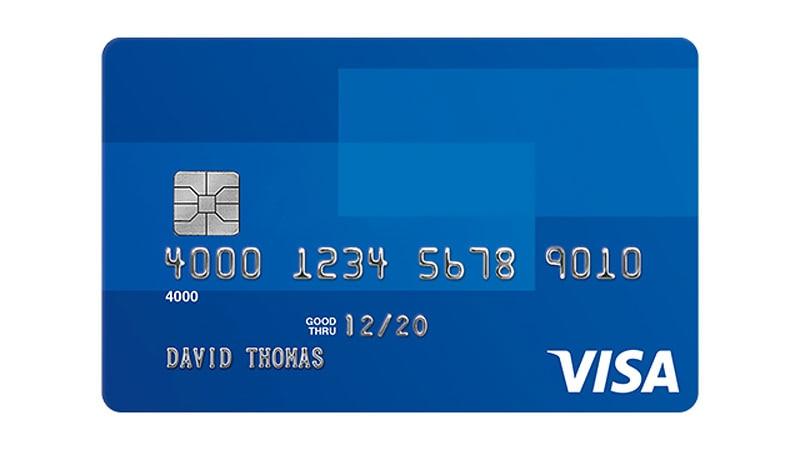

Visa security features has a first line of defense against fraud which comes in the form of unique physical design features on the card – proving that it is genuine. Knowing about the following features will help you identify fake credit cards. If anything appears absent or altered, this should raise your suspicion.

- All Visa accounts begin with the number ‘4’. The account number should be embossed on the front of the card in straight, even lettering.

- The cardholder name should be embossed in even lettering below the account number.

- A Visa brand mark should appear on the front of the card. It is blue and gold, with a white background.

- There should be a valid expiration date on the front of the card.

- A dove hologram should appear on the back of a Visa card, to the side of the signature panel, or above the Visa logo on the front of the card.

- The signature panel on the back of the card will say VOID if tampered with. It should be signed, and the signature should match the signature collected from the customer, when applicable. Above the signature panel, it should say “Authorized Signature” and “Not Valid Unless Signed”

- Some Visa cards have embedded EMV chips on the front of the card, used for secure card-present transactions.

- Below the account number, the first four digits of the number should be repeated, this is called the Bank Identification Number (BIN)

- On the back of the card, next to the signature panel, there should be a white box with three numbers – the CVV2 – card verification value.

- Some Visa cards are not embossed – these will feel smooth and will have laser printed details.

A typical Visa card (Source: visa.com)

Possible signs of a fraudulent customer

Visa advises that merchants be on the lookout for suspicious behaviors. Understanding fraudulent transactions, and learning how to spot unusual behaviors can help you detect fraud before it happens.

These are the red flags Visa advises you look for:

- Customers making many high value purchases, without caring about the size or color of the items.

- Any customers who exhibit rude or distracting behaviors may be using a fraudulent card, as well as customers who try and rush you, especially if they arrive right at the end of the day, when you are trying to close your store, or just as you are trying to open your store first thing in the morning.

- A customer who buys a high value item without asking any questions or seeming to care about the value of the purchase they are about to make.

- Someone who doesn’t want their item delivered for a negligible cost – this signals that they may not be the true owner of the card in their hands.

- For online orders, a customer might choose an anonymous email or one with a name that doesn’t match the name on the card in any way.

- Multiple online transactions shipping to the same address, or from the same IP address, using different cards.

The process of accepting a Visa card

Visa has identified a number of steps you should take when accepting one of their cards:

For Card Present transactions

- Swipe the card or insert the card into the chip-reading device to begin requesting transaction authorization.

- While the transaction is in the middle of processing, check the features on the card carefully for signs of tampering, ensure all design features and security elements are present.

- Once authorization has been received, in situations where a signature is needed, get the cardholder to sign their signature on the sales receipt.

- Check the name, account number and signature on the card and transaction receipt to ensure all details are a match.

- If you suspect fraud, follow your merchant store procedures. Always remain safe.

For CNP (Card-Not-Present) transactions

- Make an authorization request, always including the expiration date. If the expiration date is invalid or missing, it may mean the customer is not in possession of the physical card.

- If you have any questions, contact the cardholder to confirm

- If the billing and shipping address is different, consider sending an order confirmation note to the billing address when the merchandise is sent out.

Visa’s Fraud Mitigation Tools

Visa offers tools that help merchant protect their businesses and their customers from fraud. These tools include:

Chip activated terminals

Visa chip activated terminals can be used for in-store credit card processing, to protect payments. A one-time code is generated each time a transaction is made, and this code is needed for the transaction to proceed. This code cannot be generated if the card is counterfeit.

Verified by Visa for online transactions

When making ecommerce transactions, “Verified by Visa” confirms a cardholder’s identity using the 3-D protocol for cardholder authentication. Using “Verified by Visa” creates trust and keeps customer information safe, thus protecting your business even before authorization occurs.

AVS – Address Verification Service

This service allows merchants accepting card-not-present transactions to check the customer’s billing address with the card issuer. Merchants using this service can perform an AVS request during an authorization request, or by itself. A code is returned, indicating whether or not the addresses were a match.

CVV2 – Card Verification Value

The CVV2 is the three digit number on the signature panel of all Visa cards – it helps validate that a customer is in possession of the physical card when an online transaction is made. Always ask for it.

As a merchant accepting Visa cards, you have little to worry about if you follow the above guidelines – checking that cards are not fraudulent, and looking out for suspicious behavior. Add an extra layer of protection using DPO’s platform with its array of fraud mitigation tools, and you can relax in the knowledge that your fraud risk is greatly reduced.