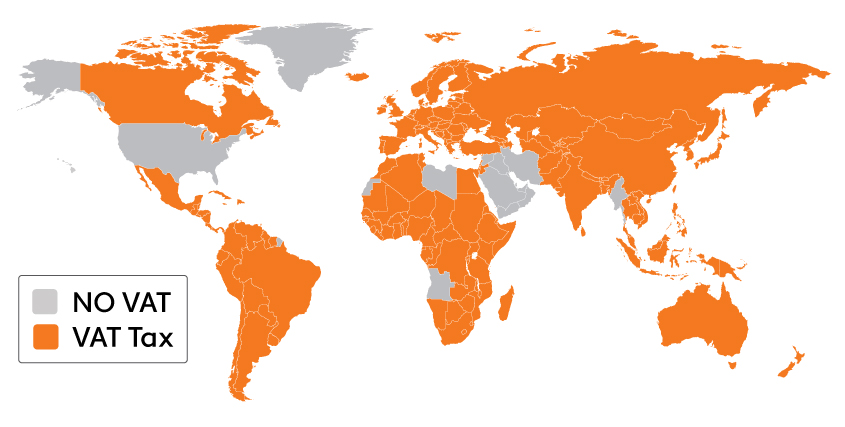

Value-Added Tax (VAT) is a tax that is levied on the sales of goods or services. How much the tax is worth is dependent upon the value of the goods or services being provided. In the case of products, the VAT is placed on a product at any point in the supply chain that value is added to the product. In this way, VAT differs from sales tax in that it is applied throughout the supply/production chain, rather than at the point of sale. The tax is based upon the cost of the produced item, less any cost of materials which have already been taxed. More than 160 countries around the world use VAT and it is most commonly found throughout the EU.

Source: https://woocommerce.com/posts/vat-selling-internationally/

The intricacies of VAT compliance will vary by country or region, but some basic factors will help you to determine whether you need to collect VAT:

- Where your business is based

- Where your customers are based

- What you are selling

- Whether you are selling to businesses, or consumers

- How your goods or services are being delivered

- The total amount of your sales per annum

In the case of business-to-business sales, there is a good chance you may be able to recover some of your VAT via tax refunds. It is important to remember that if you are to recover funds, you must be in compliance including remittance of all VAT to the government – meaning you must either collect the VAT from your end customers, or pay it yourself. This is an important thing to consider if you plan to do business internationally.

As with any tax regulations, VAT compliance is crucial. The penalties for noncompliance vary from country to country, based on where you and your customers are located. While VAT may feel like a complex layer to add to the back end of your business dealings, the benefits to getting (and staying) on top of it far outweigh any effort it takes to manage the process. Make sure you consider VAT when establishing presence or opening sales overseas, and don’t save it as an afterthought.

To assist you in staying compliant (and avoiding any unforeseen fees or other penalties), it is important to work with compliant partners and payment processors. Having a professional contact in countries where you are selling goods and services to work with on tax matters will eliminate many headaches. A compliant payment processor will ensure you are collecting VAT at the point of sale in relevant countries (and at relevant rates/percentages) and will keep necessary records to assist when tax time rolls around.

To help you take more of the guesswork out of VAT, here is a list of frequently asked questions:

VAT Regulations

Q: Why is there VAT on DPO transactions?

A: According to the regulations, any company processing payments is required to charge VAT on the transaction fees. DPO will add VAT to transaction fees for payments processed in the relevant market.

Q: What Percentage Applies ?

A: All countries have different percentages:

- Tanzania – 18%

- Kenya – 16%

- Namibia – 15%

- Botswana – 12%

- Ghana – 5% (12.5% VAT plus 2.5% NHIL)

- Rwanda – 18%

- Nigeria – 5%

- Uganda – 18%

Q: Will DPO Group Issue us with invoices to claim back this VAT?

A: Yes, we will give you a monthly TAX invoice for transactions where VAT has been applied.

Q: Are you charging us more money?

A: We are not charging you more, and the VAT does not affect your DPO transaction fee. It is a tax compliance regulation.

- DPO will remit the full VAT amount to the Revenue Authority.

- Please note that you can reclaim the VAT from the local revenue authority by applying for a rebate

Q: When will we be charged?

A: The payment of VAT will be charged per transaction on successfully paid transactions processed in the relevant market.

Supplementary Questions

Q: What happens when in a case of a refund? And an Instant Refund?

A: DPO works with banks and they charge us a transaction processing fee which includes VAT. Incase of a refund the fee is not refunded neither is the VAT as it counted as a charge.