We’ve added a new form of payment that will allow merchants to be paid by their customers via a USSD code (or Unstructured Supplementary Service Data). This new feature allows merchants to receive payments from customers who don’t have access to mobile banking or a payment card.

USSD payments enable merchants to grow their customer base by accommodating as many payment methods as possible, getting paid from different shoppers across Africa. As part of DPO’s commitment to supporting businesses of all sizes, this new payment method will enable merchants to reach a new customer base that they may not have had before. USSD-based mobile banking can be used to make transfers, check account balances, and generate bank/account balances, among other uses.

The Benefits of USSD payments

This is an easy-to-use payment method that helps merchants get paid faster, and without any hassles. USSD payments work with any mobile device, from the latest smartphones to previous generation feature phones allowing merchants to reach customers that they may not have attracted before.

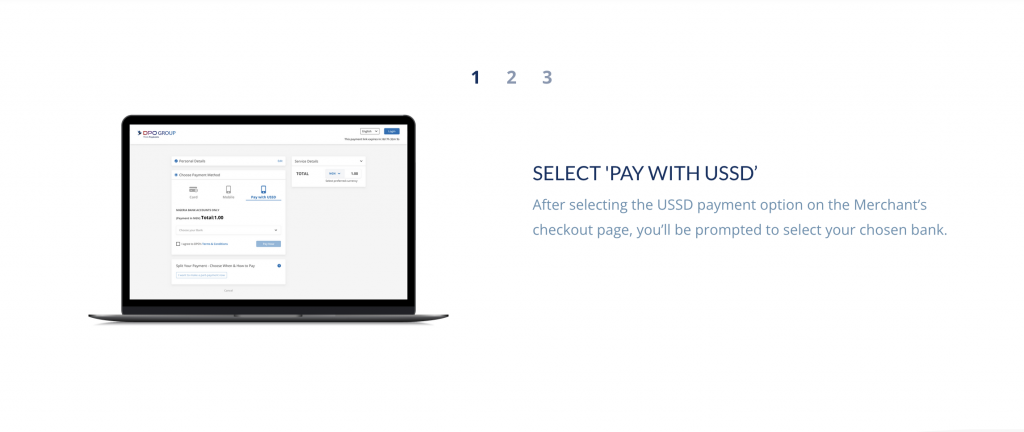

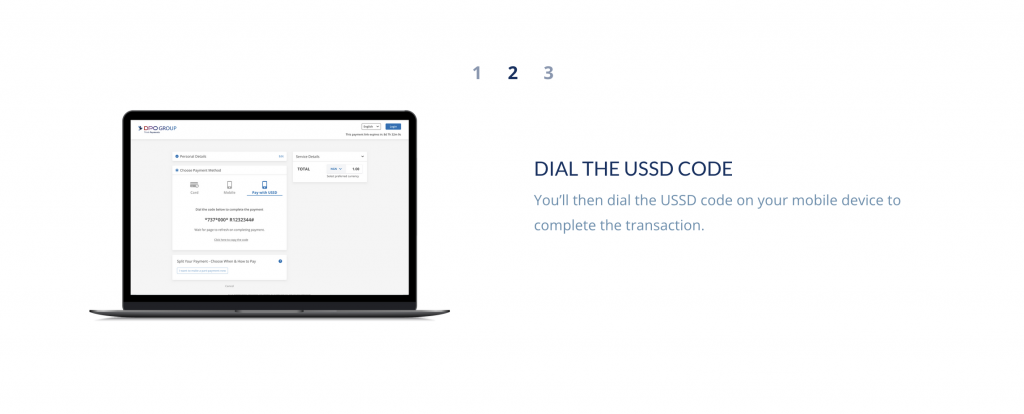

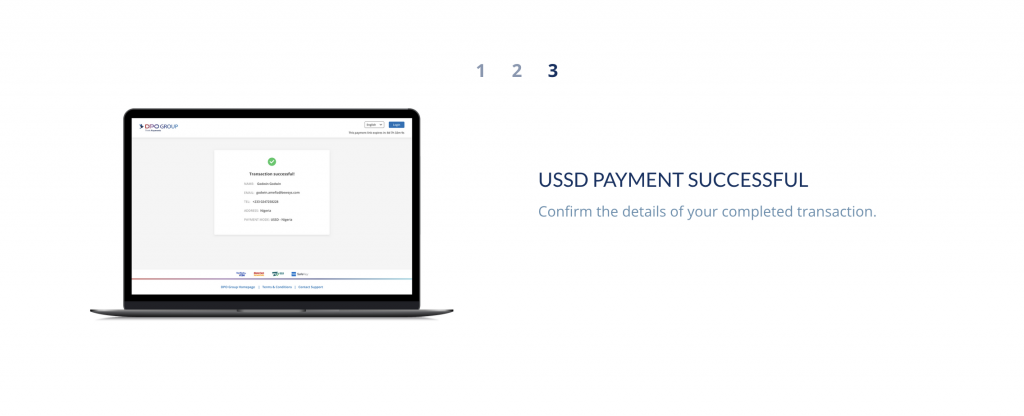

How USSD works

Already in its first nine months of operation in Nigeria, a total of 336.5 million transactions were recorded across a number of industries; such as eCommerce, travel and hospitality.

DPO’s country manager in Nigeria, Chidinma Aroyewun, said: “As the shift to a cashless, digital economy becomes a reality, we want to make it easier for both the customer and merchant to carry out transactions. We are passionate about empowering our merchants with the tools they need to grow.”

We love to see your business grow, and USSD payments are just another way we’re helping businesses succeed.