Increasing revenues is a fundamental goal of every business, be it a hotel, restaurant, or tour operator. When it comes to your online activities, an excellent website, targeted marketing campaigns, and content personalization can all help you achieve that goal. But while these efforts play an important role in your success, there’s another highly effective key technique that is often overlooked…

Using the right payment solution.

An advanced payment solution can help increase your revenues in the following ways:

Improving customer experience and convenience

A streamlined, quick and easy payment process helps to improve the overall customer experience. And when customers enjoy their experience with your business, they are much more likely to become return customers in the future and refer their peers to you, as well (which translates into more revenues for your business).

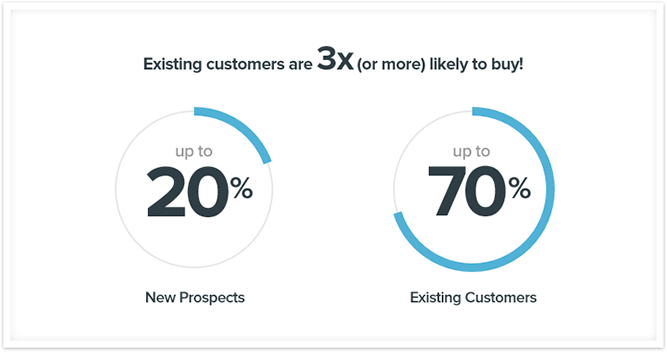

According to Marketing Metrics, the probability of selling to an existing customer is up to 70%, compared to up to just 20% for new customers. This shows just how valuable it is to build customer loyalty through satisfaction, and an enjoyable payment experience is one of the best ways to achieve this.

Source: Shopify

But to make your customer experience “excellent”, and not just “good”, you need to cater to the payment preferences of your customers, too.

Working with the right online payment solution can help you enable your customers to choose from a range of payment types and currencies, increasing the likelihood that they will be able to pay according to their preferences.

Offering customers their preferred payment type not only improves the customer experience, but it allows you to expand your reach and target more people, as well. Accepting a variety of payment methods also helps you appeal to global customers by allowing cross-border payments to be made conveniently in the customer’s local currency and payment types.

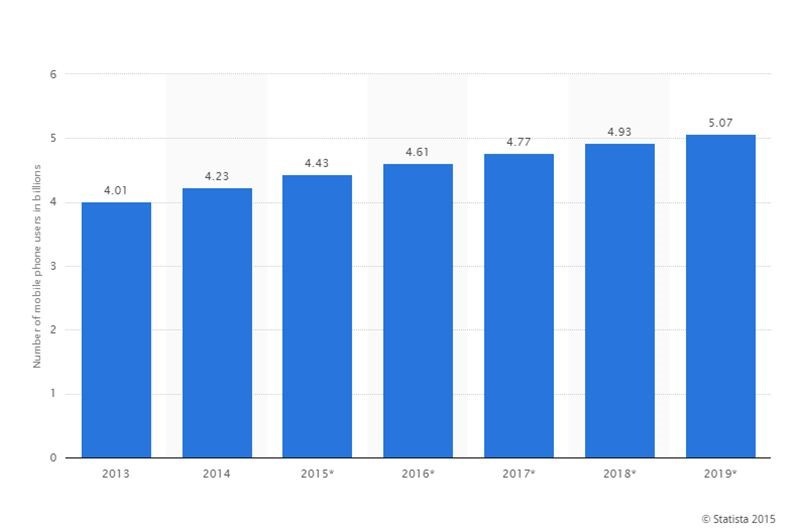

Aside from enabling the use of typical payment methods, such as credit cards and bank transfers, a good payment solution will also offer mobile payment solutions. These are another way of increasing customer convenience and making the payment process simpler and quicker. And with the number of mobile phone users expected to reach 4.77 billion this year, mobile payments are a must-have in your payment arsenal.

Common mobile payment methods include mobile wallets and mobile money. Mobile wallets allow customers to store credit cards, bank details, and other payment information in a single ‘virtual wallet’ app on their phone. Mobile money uses a mobile device to transfer money without the need for a bank account – like virtual cash.

Mobile payments increase customer loyalty by making the payment process quick, easy, and convenient. All the customer has to do is press a few buttons on their phone and the transaction is complete, almost instantaneously.

Increasing security

Customers are more likely to use your services if they are confident that their payment data is in safe hands. Use a well-known PCI DSS Level 1 certified payment solution, like Direct Pay Online, to show your customers that you value security – this will encourage them to trust you with their information. PCI DSS certification is awarded when a payment provider meets strict security standards and uses advanced fraud detection technology. The more people feel they can trust your site, the more likely they are to do business with you.

Fraudulent transactions can also be a significant expense for online businesses. An increased level of security will protect your business from fraudulent transactions and thereby help you prevent financial losses.

Allowing upselling and cross selling of products and services through mPOS devices

An advanced payment solution will offer mPOS (mobile point of sale) functionality. This allows you to use a mobile device in place of a traditional cash register by installing a simple add-on and an app. The portability of mPOS devices opens up unique opportunities for upselling and cross-selling in off-site locations. For example, a tour guide could use an mPOS device to sell additional excursions to current tour participants while out in “the field”.

Research performed by PhoCusWright found that 59% of hotel users are at least sometimes interested in additional services. To capitalize on this interest, mPOS devices could also be used in hotels, so that guests can order extra services from the comfort of their own hotel rooms or by the pool, for example. This is the ultimate in luxury and convenience — a surefire way to keep your customers happy.

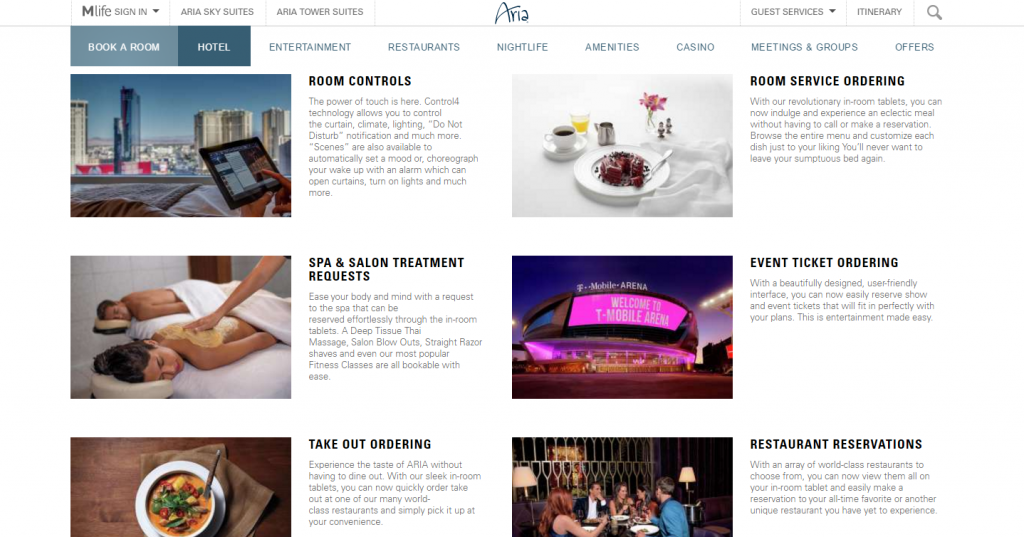

One hotel that has taken up this idea is the luxury Aria Hotel and Casino Resort in Las Vegas. They have 10” bedside touchscreen tablets in every hotel room, allowing guests to order room service, book spa treatments, and much more.

The Aria’s room technology (Source)

Security and convenience are prime customer concerns that are easily handled by using a comprehensive online payments solution. This will lead to increased loyalty and satisfaction, both of which translate directly into more revenue for you. Furthermore, you can profit greatly from the new upselling and cross-selling opportunities provided by mPOS devices. In a nutshell, it pays to invest in the right payment solution for your business.

Get more tips on how to increase your revenues and thrive in the 21st century. Download our free ebook “The Travel Agent’s Guide to Surviving in the OTA Era“, today!