mVisa is an exciting digital payment method which offers simple implementation, security and interoperability between banks and mobile networks. It was first introduced in a pilot with Indian banks in October of 2015, followed by expansion in that market and introduction in Kenya in 2016.

The mVisa payment option utilizes QR codes, which are scanned by the customer and linked to the merchant’s account. The QR code can be unique per transaction, dynamically displayed on a merchant’s mobile device, or even a static code printed on a placard and displayed for payment purposes.

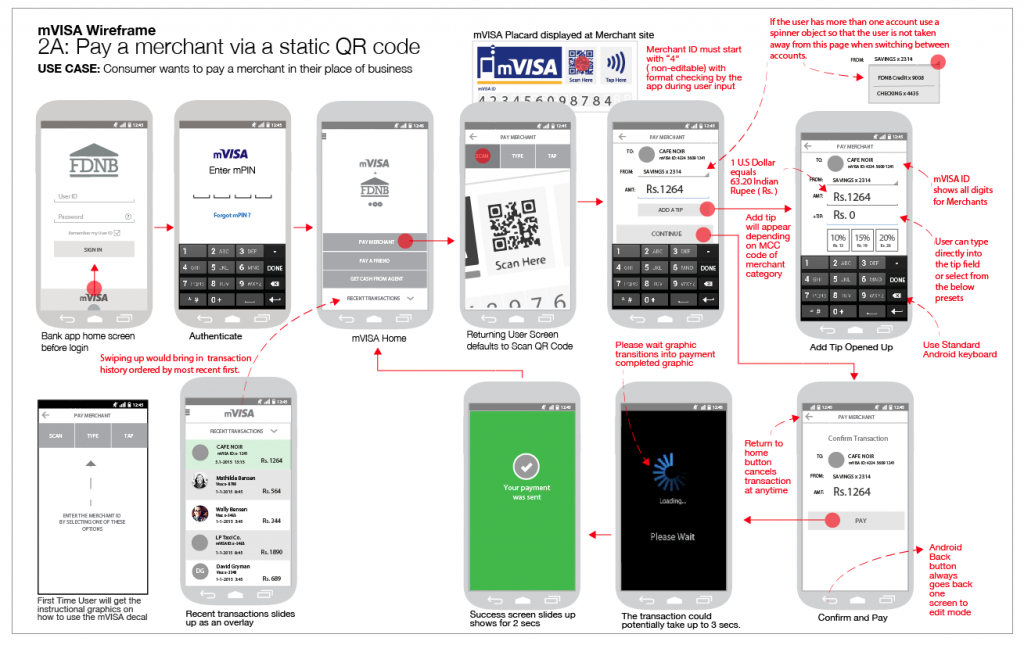

Payment with mVisa is a simple scan-and-confirm process. When relevant, a tip can be added to the bill, or the customer will be offered the option to choose which of their mobile payment methods they prefer to use. Payment is automatically transferred from the customer’s preferred mobile payments account, such as mobile wallet, or via mobile money transfer. And, both parties receive real-time confirmation of the payment.

Below is an example of this process with a static QR code, taken from Visa’s website:

mVisa to Expand to Additional Regions

According to Visa, 33 banks, and close to 330,000 merchants across India, Kenya and Nigeria have adopted their interoperable standards and QR payment method. The service is also available in Egypt and Rwanda.

According to the ICICI Bank in India, 5,000 merchants in Bengaluru offer mVisa payment options. In Kenya, mVisa is accepted at thousands of merchants, such as at IMAX theaters, Kenya Airways, and more.

In the coming period, mVisa will add additional regions which are considered prime locations for cashless payments. They will target Cambodia, Ghana, Indonesia, Kazakhstan, Malaysia, Pakistan, Tanzania, Thailand, Uganda and Vietnam, at the outset.

A Revolutionary Mobile Payment Method

mVisa is a revolutionary payment method as it enables infrastructure-free mobile money acceptance and offers interoperability. Here are the additional advantages mVisa brings to both the merchants and consumers:

Affordable solution for small businesses

The QR codes can be used in place of expensive POS registers, enabling even small players to integrate electronic payments in their businesses with no requirement for capital equipment investment.

Anytime, anyplace

Static QR codes enable merchants and service providers to offer their goods and services even in remote locations, and receive direct payment via the customer’s smartphone scanning option.

Interoperability

Unlike the leading mobile money company in Africa, mPesa, mVisa offer interoperability between a host of account providers and mobile networks. This means that a customer can send payment via his account, or via money he has deposited into his mVisa account, to a merchant who has an account with a different provider. Interoperability has been found to be a crucial requirement in successfully moving towards a cashless economy.

Ease of use

With its simple scan approach, mVisa is easy to use from the consumer side, but even more importantly, simple to implement from the merchant side. It enables them to safely and simply receive mobile payments. Consumers also enjoy the option of paying bills remotely, via scanning codes on the bills.

Security and global acceptance

The QR codes represent a digitization of the recipient’s account. As such, mVisa offers a highly secure method for mobile payment and cross border payments. Additionally, as it is backed by Visa, mVisa enjoys global acceptance. Furthermore, by using this payment method, consumers and merchants enjoy the benefits of creating a digital payment record for themselves, crucial for participation in the global economy.

The Future of QR based Payments

QR code payments have seen much success in many regions, such as China. In areas that are mainly cash based, this technology enables leapfrogging over point of sale technologies to a completely cashless society. Africa, which has readily accepted mobile payment alternatives, is clearly a prime market for this form of cashless payment at the point of sale. As such, it is no wonder that Visa plans to continue to expand its global coverage, focusing on regions where mobile payments have already enjoyed successful penetration.

In addition to regional expansion, mVisa continues to add phone networks and financial banks as collaborators, further expanding their interoperability capabilities.

For instance, mVisa partnered with Direct Pay Online bringing this revolutionary payment method to their large client base of merchants, enabling them to receive both in-store payments, as well as to implement this payment method in their ecommerce sites. Online customers who choose to pay via mVisa receive a unique QR code generated by the system which they scan via their mobile or online banking application. This secure and simple electronic and mobile payment method, which can be integrated via Direct Pay Online’s suite of online tools will enable merchants of all sizes, to easily enter the global economy.