Mobile money was first introduced in Ghana in 2009. By 2012, the Bank of Ghana began compiling data and observed that the value of mobile money transactions reached GH¢ 19.6 million. Mobile money penetration has grown significantly since then, with GH¢155.8 billion ($35 B) in mobile transactions in 2017, up from GH¢78.5 billion in 2016.

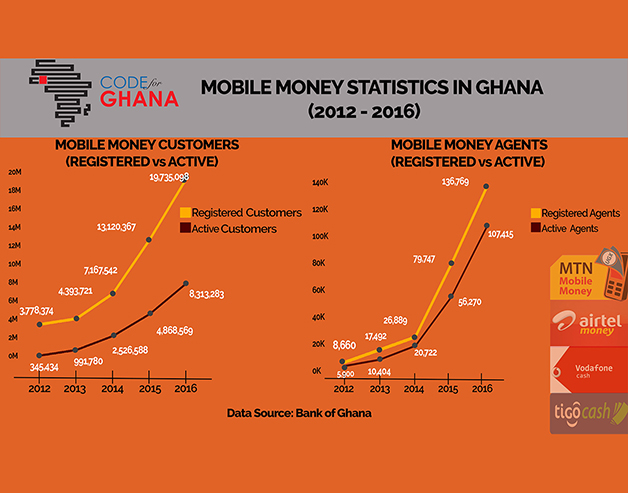

In an economy in which only 36% had a bank account in 2015, up only 2% since 2010, mobile money holds much promise for financial inclusion. Mobile device penetration is over 100% in Ghana, creating an optimal infrastructure for mobile financial service adoption. In fact, the total number of mobile accounts in Ghana in 2016 reached 19.7 million, with 8.3 million active accounts, for an adoption rate of 48%. These accounts are served by over 100 thousand mobile money agents.

Image: Code for Ghana

According to the 2016 Ghana Banking Survey by PriceWaterhouseCooper, mobile money usage in Ghana has been focused on remittance and fund transfer, while service for payments was still lagging as of 2015. Survey respondents, which included CEOs, CFOs and Heads of E-banking of banks in Ghana, felt that mobile money was still in the growth stage and had not yet reached its peak.

As of September 2016, Bank of Ghana (BOG) has approved the payment of interest at rates of between 1.5% and 7% to be paid by partner banks on mobile money floats they hold. The telecom service providers are required to pay 80% of this interest to their customers. In this win-win-win manner, the banks enjoy sizeable deposits, the telecoms receive 20% of interest payments, and the mobile account holders receive interest on their deposits, encouraging the adoption of this inclusive financial service.

Credit and Debit Card Usage in Ghana

The credit card boom has not yet reached Ghana. This is because credit card fraud is prevalent in Ghana, leading to what has until recently been a cash-based economy.

Ghanaians who are afraid that their card number will be reused fraudulently, or that they might be charged more than once by the same vendor, are apprehensive to adopt this common payment method, despite the switch to EMV cards in recent years.

These payment methods witnessed GH¢70 million in credit card transactions and GH¢ 13.58 million in debit card transactions in 2016. Compared to the billions in mobile money transactions, it is clear that adoption of credit and debit card based financial services is lagging.

Will Ghana Become a Cashless Society?

Mobile money offers a highly secure alternative to credit and debit card based transactions for Ghanaians interested in a cashless future. As mentioned above, this payment method is still in its growth stage. Is it therefore feasible that Ghana can become a cashless society?

Close to half of the respondents to the PwC 2016 survey felt that Ghana could become a “cash lite” society within 5 to 15 years. According to research by Bankable Frontier Associates, a global strategy consulting firm, cash lite relates to a society in which cash is no longer the most prevalent form of payment. In a cash lite society, cash and electronic payments co-exist.

Mobile money is projected to be the catalyst to becoming a cash lite economy, together with additional electronic payment methods such as bank cards as well as e-payments. Cashlessness, according to PwC, is not considered to be a likely scenario for Ghana in the upcoming period.

Mobile Money presents Opportunities and Threats to Ghanaian Banks

As mobile money adoption rates continue to climb, the banks in Ghana are aware that the playing field is rapidly changing. The PwC survey found that most bank executives view the mobile money revolution as both a threat to traditional banking products and an opportunity to expand their reach.

Ghanaian banks are responding to the changing industry proactively. In addition to improvements in customer experience and convenience of service, banks are investing in the following offerings which will allow them to compete and even expand their services:

1. Regulation

Banks consider regulation a crucial method for ensuring a level playing field for all stakeholders. They are not pushing to over-regulate mobile money transactions, but they do believe that regulation seeks to foster shared success for all industry participants. The banks are working together to define this optimal framework.

2. Technology

The telcos that offer mobile money have a strong technological infrastructure and development teams. Their product offerings are therefore, superior compared to traditional bank products. Banks who are able to invest in technology which enables integration with telcos will be better positioned for success. Improved technology will also enhance the customer experience. As such, banks are focused on developing platforms which allow them to receive mobile money deposits and provide mobile money related services. Furthermore, they are investing in competing platforms such as internet banking and smartphone applications.

3. Partnerships

Both bank-to-bank partnerships and bank-to-telco partnerships are viewed as important for continued growth. Bank-to-bank partnerships, such as cross platform ATM use, direct debit and direct deposits, and faster check clearing improve the customer experience and overall satisfaction of account holders.

Bank-to-telco partnerships enable banks to provide banking services which the telcos do not yet offer. Banks are actively looking to partner with the mobile money service providers and additional banks, and those which have already done so are focusing on strengthening these relationships

Key Takeaways

Mobile money is growing at an impressive rate, and the volume of transactions has dwarfed those done on credit and debit cards in this previously cash-based society. Mobile money offers a chance at financial inclusion to Ghanaians who until now, have been highly unbanked, with only 36% holding traditional bank accounts and extremely wary of credit and debit cards. Since its adoption in 2009, mobile money has already achieved a 48% adoption rate with 8.3 million active accounts.

Despite the extensive adoption rates, industry experts do not believe the state of cashless payments in Ghana will be overwhelming. They do however believe that mobile money is a catalyst for becoming a cash lite society, in which both cash and electronic payment methods co-exist. Until recently, Ghana was a completely cash-based society, so this holds much promise for all stakeholders.

Banks are actively investing in technology and partnerships as well as collaborating towards creating an optimal regulatory framework so that the adoption of mobile money in Ghana is a win-win opportunity for themselves, telcos, and the economy in Ghana.