As consumers become increasingly reliant on their mobile phones for all aspects of their daily lives, the progression into mobile payment adoption is a natural next step. Retailers already geo-target their customers when they are in the vicinity of their stores: they send targeted text messages with special offers that entice customers into making a purchase at a store that they may not have even been planning on visiting. Consumers have already shifted a large part of their shopping to their mobile phones, purchasing vacations, shopping online and sending payments through various applications, and are now faced with the decision of selecting a payment app that suits their needs. While the offerings of each company are varied and the number of payment apps are on the rise, there are several mobile payment apps that lead the way for consumers.

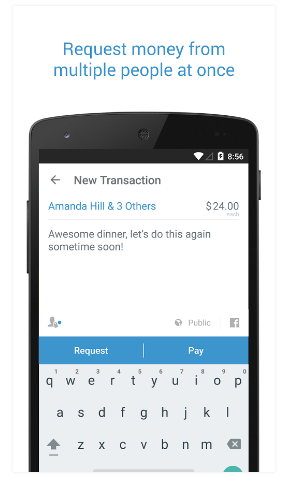

Venmo

Venmo is a peer-to-peer payment app that enables users to send payments to each other. Both the sender and the recipient must have Venmo accounts, and payments can be sent either from the wallet’s balance or by connecting a bank account or debit card. Senders can write notes on the payment for future reference, and recipients can transfer funds directly to their bank account, usually within 24 hours. Many of the payments are free to send and to receive, though it depends on the method of payment – credit cards have a 3% fee. The free app currently works only in the USA and is the most social of the mobile payment apps, enabling users to hold conversations within the app and even send emojis. Venmo was recently purchased by Braintree, a subsidiary of PayPal, and is very popular among the millennial crowd.

Square Cash

Square’s payments are divided into two account types: personal and business. Personal accounts are mainly used to send and receive payments between friends, much like Venmo. Sending and receiving payments is generally free through personal accounts, though there is a 3% fee when using a credit card to send payments. Business accounts hold a 2.75% fee for payments received. Square recommends holding separate accounts for business and personal use, and enables users to hold multiple accounts of each type as well, though each account must be registered under a unique email address. Square Cash works only within the continental US and is unavailable in the US territories and internationally. Recipients can withdraw their funds directly to their bank accounts. Square Cash is quickly developing into a social app as well, enabling users to set up profiles and even locate other users in their vicinity.

You can read more about Square in our blog post, here.

Starbucks

As opposed to aforementioned apps, the Starbucks app is unique to a single retailer: Starbucks. The app enables customers to both pay for their purchases and earn rewards through the Starbucks app. Customers can also tip the barista directly from the app and place orders before they arrive at the physical location. It is widely accepted as the most successful wallet app in the US, with over 21% of translations credited to the app alone in 2015, a percentage that is expected to rise up to 50%. While the app is mainly used in the US, in 2016 it will be expanding into Asia and Latin America.

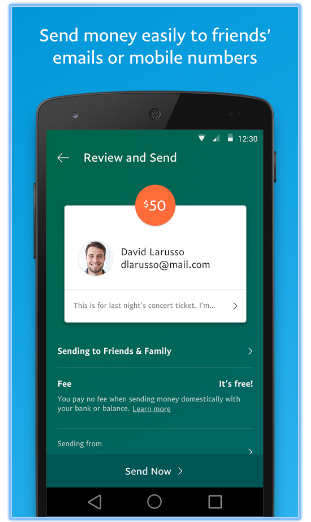

PayPal

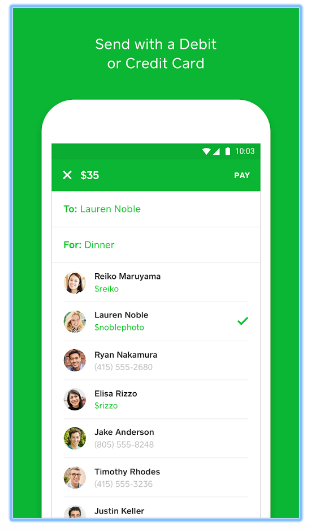

Founded by eBay to be a solution for online payments on the well-known bidding site, PayPal is now independent and one of the first and most famous payment companies. The app enables peer-to-peer transfers, as well as sending and receiving payments for services rendered and goods delivered. Free to send, PayPal charges a percentage to some of the recipients, dependant upon location of the recipient. While open to everyone in the US, only US bank accounts can be linked to PayPal accounts at this time. PayPal works worldwide, however its usage is limited in some countries and not available at all in a select few. The PayPal app not only enables customers to check their balance and transactions and to send and receive payments, but also gives them the ability to check in and order in advance at select restaurants.

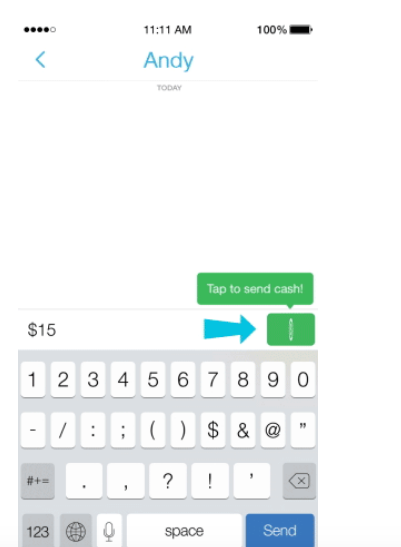

Snapcash

Popular social network Snapchat has enabled peer-to-peer payments via their app that are powered by Square Cash. Credit card information entered by users is stored by Square and not by SnapChat, and payments can be sent directly through chats with other users. Much like photos that are published for a set amount of time, payments must be accepted by the recipient within 24 hours or the funds are returned to the sender. Snapcash payments are free to send and to receive, and, like Square Cash payments, are sent directly to the recipient’s bank account. Snapcash can only be used in the continental US, connected to a US debit card, and cannot be used in conjunction with credit cards, PayPal, or prepaid cards.

The aforementioned mobile payment apps are a clear indication that payments are moving away from physical cards and wallets to mobile phones. Social media can be credited for significant growth in the payment industry, with networks, such as Snapchat, developing their own methods of receiving mobile payments. As consumers continue to shift their shopping to a more virtual experience, their expectations will lead them to select retailers that share their vision of moneyless and walletless transactions.

Part 2 of this post will showcase additional mobile payment apps that are revolutionizing online and offline commerce, including mSWIPE+, an app developed in Africa, powered by 3G Direct Pay, that is a game changer in the travel industry.