Tanzania’s commercial banking landscape is highly regulated, however, recent years have seen improvements in efficiencies and the implementation of internationally accepted protocols.

While it has only been 15 years since the automation of the Bank of Tanzania’s Electronic Clearing House, additional technologies have since been implemented which have increased processing times and changed the payments landscape in Tanzania.

Tanzania’s real time gross settlement system is known as TISS (Tanzania Interbank Settlement System). TISS uses SWIFT messaging standards and complies with modern payment principles. Through TISS, payments are processed within 2 hours of receipt, creating a convenient and low risk payment method for the government and for corporations, particularly with regard to cross border payments.

The move towards digital banking

While the above described clearinghouses process checks, this is not a viable payment method for private consumers, due to identification and authentication difficulties for their customer base. In recent years, banks have begun incorporating credit and debit cards, and have increased their ATM base, adding approximately 150 new points annually.

Payment via electronic card is increasingly available at points of sale as well, with value of transactions via POS devices up 75% between 2012 and 2013. Internet banking transactions are also increasing, up by 28% in 2012. However Tanzania still ranks in the bottom quartile of countries in terms of access to traditional financial services, with only 2.5 bank branches and 6.4 ATMs per 100,000 adults. As such, Tanzania is still largely a cash-based economy.

Mobile banking brings financial inclusion

Tanzania remains largely unbanked, with only 15% of the population managing traditional bank accounts. However, The Citizen reports, that thanks to mobile money accounts and wallets, financial inclusion is currently at 86%, leading the Sub-Saharan region. KPMG reports that Tanzanians are increasingly adopting mobile money alternatives, with 43% of the adult population as active users. This is a staggering adoption rate for less than a decade since Vodacom first launched their M-Pesa platform.

Year over year growth is impressive as well, such as the increase of close to 66% in mobile money transaction values from $11.3 billion in 2013 to $17.93 billion in 2014. And, the more recent growth of close to 14% between July 2016 and April 2017. This 10 month period saw 1,444.6 million mobile money transactions.

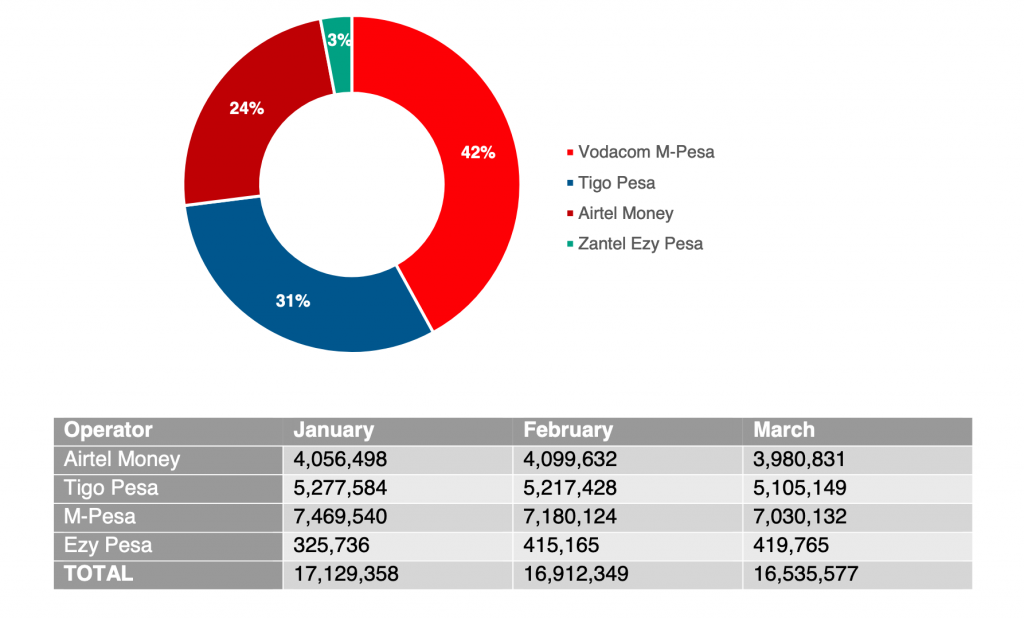

Continued growth and the jump portrayed during 2016 can be attributed to the interoperability agreements between the different mobile money service providers. The market players are Vodacom (42%), Tigo, (31%), Airtel (24%) and Zantel (3%) and most recently, Halotel became the fifth mobile money provider in Tanzania.

Between 2015 and 2016 these players reached commercial agreements in which they collaborated with each other, enabling person-to-person mobile money transfers between accounts operated by the different providers. With this, Tanzania became the first country to achieve complete interoperability in the world.

Projected ecommerce growth in Tanzania

As internet access, mobile device penetration, and mobile money adoption continue to increase, it is likely that ecommerce, currently still in its infancy in Tanzania, will do so as well. Industry expert and active manager of the online shopping portal kupatana.com, Makusaro Tesha, was quoted proclaiming that the Tanzanian ecommerce market was enjoying 50% growth in 2016.

Taking advantage of the projected growth rates, Jumia, one of the leading ecommerce companies in Africa, launched its services in Tanzania in 2014. Additional leading ecommerce players include Kaymu, Kivuko, Inauzwa and Shopping TZ.

Payment service providers in Tanzania

There are a number of payment service providers (PSPs) serving the growing Tanzanian market. These players offer secure ecommerce payment methods, mobile money wallets and even mobile point of sale applications enabling both online commerce players, and brick and mortar businesses to take advantage of the mobile money revolution in Tanzania.

Direct Pay Online for instance, supports interoperability with M-Pesa (vodacom), Tigo Pesa and Airtel money. Their solutions also accepts credit and debit cards as well as bank and electronic transfers. Direct Pay Online is the first African PSP to receive the Payment Card Industry Data Security Standard (PCI DSS) Level 1 certification in 12 African countries, including Tanzania, ensuring highly secure payment methods for Tanzanian consumers and retailers.

Key takeaways

While highly regulated, Tanzania’s banking system has been continuously evolving in the past decade. Despite increases in traditional banking services, much of the Tanzanian population is unbanked, with cash still the leading payment method for consumers. However, the horizon is bright, with mobile money achieving huge adoption rates, causing Tanzania to become the leading Sub-Saharan country for financial inclusion. It is also the first country in the world to achieve complete mobile money interoperability between providers. In addition to mobile money’s success, ecommerce in Tanzania is enjoying high growth rates, and a host of PSPs offer online payment services, along with mobile wallets and mPOS to both ecommerce and traditional retailers across the country.