According to a study carried out in 2014, only 30% of the Zimbabwean population had accounts in formal banks. The remaining 70% have traditionally shied away from Zimbabwe’s banking industry. While many Sub-Saharan countries have a large portion of unbanked citizens, Zimbabwe’s percentage of unbanked is higher than the regional average of 65%.

In 2008-2009, Zimbabwe suffered from hyperinflation which lead to the collapse of its economy. The Zimbabwean dollar decreased in value and was replaced with a number of international currencies such as the US dollar, the Euro, the South African Rand, the Indian Rupee and the Japanese Yen. Since this occurred less than 20 years ago, Zimbabwean’s are still wary of being left penniless, as their cash and banked money was eliminated when the leading banks liquidated following the collapse.

While the move to international currencies, predominantly the US dollar, has stabilized the economy, Zimbabwe still suffers from an ongoing cash crisis. According to the Daily News Ashok Chakravarti, economic advisor to President Mugabe, is quoted stating that Zimbabwe has $6.5 billion in deposits, yet only $300 million in circulation. Most of these deposits are to civil servant employees. These in turn try to withdraw their salaries, so as not to leave cash in the banks.

To combat the cash shortages, banks limit withdrawals. Some banks limit single withdrawals at $40. Account holders wait hours in line to withdraw cash. Bank charges per withdrawal are high, reaching even $4. Banks do not pay interest on deposits, and charge high interest rates on loans. In fact, 55% of Zimbabwean bank income comes from a host of fees on accounts. With the current cash shortage, the high fees charged at banks, and the history of Zimbabwe’s financial crisis, it is not surprising that the majority of Zimbabweans prefer to remain unbanked.

Zimbabwe’s Financial Landscape has Promoted Mobile Money Adoption

Mobile money is a non-bank based payment method. This cash-based payment alternative allows users to deposit their cash into their mobile money account, whether directly, or via designated agents, who also enable users to “cash-out”. Available even over simple mobile phones, mobile money can be transferred from one account to another mobile account via SMS, creating a highly secure method for electronic payment and cash remittance. Real-time confirmation of the transaction is received by each party.

In regions with a high proportion of unbanked citizens, such as Sub-Saharan Africa, mobile money accounts provide a viable alternative to traditional banking and promotes financial inclusion. Mobile money allows users to make and receive cross border transfers, to make electronic payments and to safely deposit their money. Many mobile money service providers have begun to offer additional services, such as small loans. The data created via mobile money accounts can serve as a basis for credit scores, further improving the economic alternatives available to mobile money account holders.

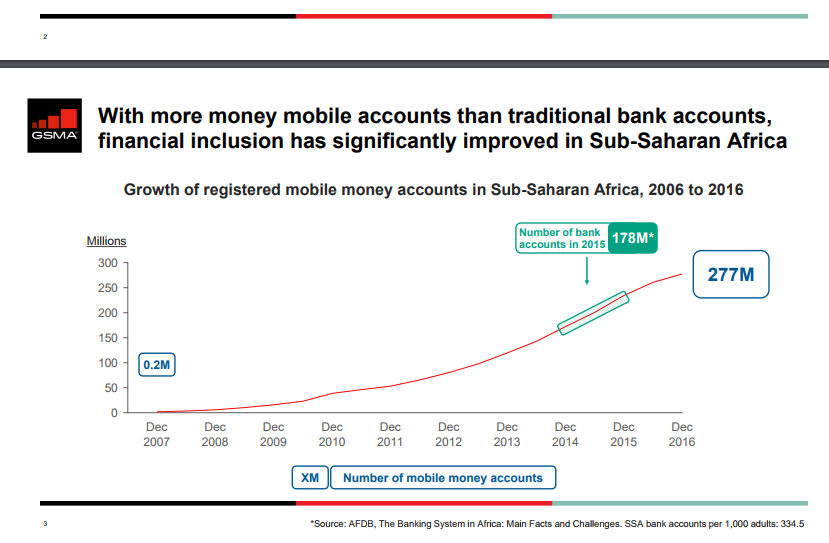

Sub-Saharan Africa, with its lack of infrastructure and concentration of population in rural areas, has seen massive adoption of mobile money accounts and mobile payment methods, with the number of accounts growing from 200 thousand in 2007 to 277 million in 2016, according to GSMA. In fact, this region, which enjoys high mobile phone penetration rates, contributes over half of the mobile money services available globally. More than 40% of the adults in this region are active users of mobile money accounts.

Zimbabwe, with its lack of trust in conventional bank accounts, and its mobile phone penetration rate of 95.4% as of January 2016, was the perfect candidate for mobile money services. Introduced in 2009, mobile money was quickly adopted by Zimbabweans, reaching 45% penetration in 2014, with 3.25 million Zimbabweans holding mobile money accounts. The government actively supports electronic payment methods as a means to combat the cash shortages. In 2016, mobile money payments accounted for 81.2% of all digital payments in Zimbabwe, with a total of 298.59 million transactions in that year, up from 228.2 million in 2015.

Benefits of Mobile Payments

While Zimbabweans enjoy the benefits of a non-bank based financial alternative, mobile money and payments have a number of additional benefits as well, including:

Convenience

Mobile payments includes a number of alternative payment methods, such as SMS money transfers, online payments or transfers, and mPOS payments. Whereas in the past Africans generally made all payments in cash, mobile payments offers a significantly more convenient method for making payments.

Utility payments or similar types of expenses can be paid remotely, instead of making a lengthy and often expensive trip to the collection agency. Consumers have access to the global economy and can make online purchases via their mobile wallet. When available, consumers can simply tap their phones at POS terminals, or perform real-time transfers when purchasing groceries, fuel and other retail products.

Inexpensive Payment Method

Mobile payments typically have low transaction fees, creating a beneficial alternative for payments. Merchants enjoy low overhead as they do not have to invest in payment terminals, but can rather accept mobile payments directly into their mobile money accounts, and receive real time authentication of the transfer. Mobile money providers also typically charge lower fees than on credit card payments.

Increased Security

Mobile payment providers are aware of the security concerns. As such, mobile payment platforms utilize a host of authentication technologies in order to ensure highly secure payments. From two-factor authentication via virtual tokens and biometric authentication systems, mobile payments offer one of the most secure platforms for electronic payments.

Collaboration and Interoperability with Banks

Due to the popularity and high penetration rates of mobile money and payments, leading banks in Africa have begun collaborating with leading telco’s and Payment Service Providers (PSPs) who offer mobile money solutions, such as Direct Pay Online’s DumaPay.

DumaPay is an advanced mobile application which allows merchants to charge their customers via mobile payments or credit cards.

DumaPay offers a variety of payment options, such as EMV-protected credit card payment, mobile wallet payments and QR codes. Merchants can send payment links via email to their customers for direct payments, as well.

As banks increase their interoperability and partner with mobile payment providers, the penetration of this highly secure and convenient payment alternative is poised to continue to grow the world of digital payments in Zimbabwe.