As mentioned in part 1 of this series, consumers are shifting their payments away from physical cards and cash to their mobile phones. Here are 6 more apps that have revolutionized the mobile payments industry and are leading the way towards a cashless society.

Google Wallet

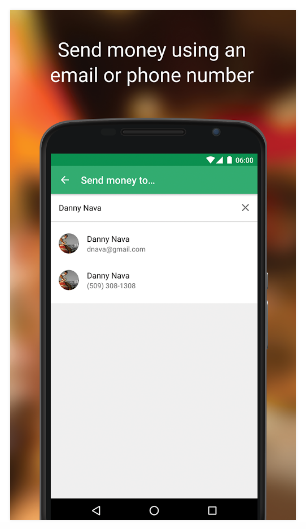

Google Wallet is a free, peer-to-peer money transfer app that allows anyone in the US to send payments to a US phone number or email address. Funds can be withdrawn immediately to a US debit card or bank account. The app also works in the UK, though only through Gmail, and funds cannot be sent between the US and UK.

The app is PIN-protected and enables the user to disable the account on a stolen phone. Another fact that makes users feel more secure is that Google Wallet payments are FDIC-insured, which lays them on equal ground with banks.

Google Wallet was a trailblazer in contactless payments, being the first to utilize NFC technology, allowing users to simply wave or tap their phones on the mPOS device in order to make payments. Google Wallet also enables in-store credit (at relevant merchants) as well as gift cards, which allows merchants to run loyalty programs through the app.

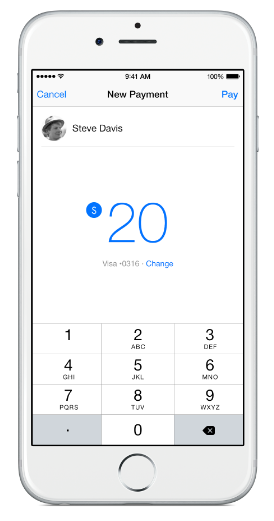

Apple Pay

Apple Pay also uses NFC technology, allowing its users to pay at physical stores by waving their phones over an mPOS device. Additionally, payments can be sent directly through the Apple Watch.

Apple Pay single-handedly transformed the mobile payments industry by enabling payments to be protected by using the Touch ID fingerprint sensors for approval, providing consumers with an additional layer or protection that most payment apps do not currently have. Apple Pay also allows users to disable their accounts on stolen or lost devices.

On top of all that, Apple Pay enables users to scan 2D barcodes to access various tickets, such as airline and concert tickets, and also allows customers to use their loyalty cards with select merchants and earn points and rewards. Additionally, the app accepts store credit cards, such as the Kohl’s charge card.

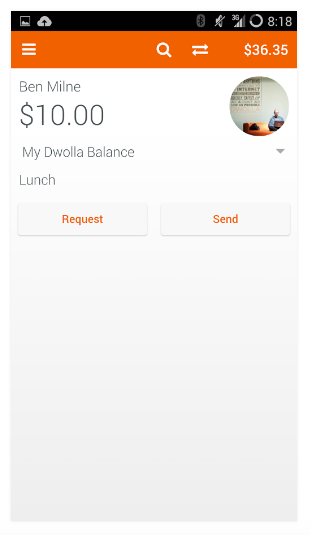

Dwolla

Dwolla is a peer-to-peer mobile payment app that enables its users to send payments through social networks such as Facebook, LinkedIn and Twitter by connecting directly to a US bank account. The app also has built-in app that informs consumers of nearby merchants that accept Dwolla payments. Dwolla is free for payment under $10, and only $0.25 per transaction if above $10.

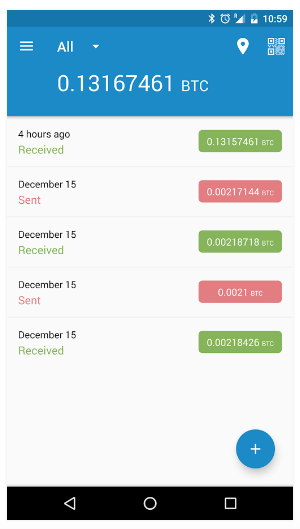

Blockchain

Blockchain is a very popular bitcoin app that enables users to pay in bitcoin at local businesses that accept the cryptocurrency. As the largest provider of the most popular bitcoin wallet, it is the most trusted brand in Bitcoin, with over 7 million users worldwide.

As opposed to the majority of payment apps, Blockchain is available internationally and boasts over 20 currency conversion rates. The app gives users a snapshot of recent transactions, mined blocks in the Blockchain, and other various statistics.

Its two-factor authentication and PIN protection maximizes the safety of its users’ funds.

Blockchain is the first Bitcoin payments app that has, undoubtedly, contributed to the explosive growth of Bitcoin by making payments even more accessible than ever before.

Read more about Bitcoin and digital currencies in our blog post, here.

Facebook Messenger

Facebook Messenger enables free peer-to-peer transfers directly through Facebook by connecting to the sender’s debit card.

The app has an option for PIN creation to add an additional layer of security, as well as Touch ID on iOS.

Transactions are free and are inherently social, keeping excellent records for future reference. Payments via Facebook Messenger are meant to be peer-to-peer only and not payments to businesses.

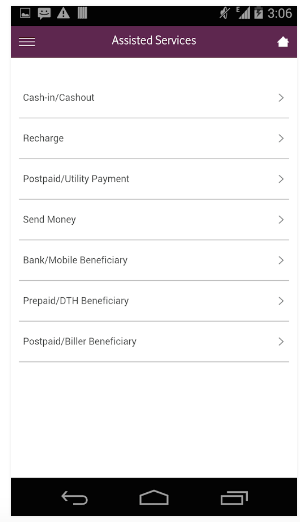

M-Pesa

As the leading mobile-based banking service in the developing world, mainly Africa, M-Pesa has been credited for enabling financial independence and growth to people who previously had no access to official financial services.

M-Pesa is a peer-to-peer payment system that enables users to store funds on their mobile phones and send them to their peers and pay for goods and services. Balances can be sent through PIN-secured text messages and can be withdrawn in local currencies. Both the sender and the recipient are charged a small fee for using the service.

M-Pesa is unique in that it is a branchless banking service – funds can be deposited and withdrawn via a network of agents. M-Pesa can be used to to pay bills, purchase airtime and, in some countries, send payments to bank accounts. Only the sender must have M-Pesa; the recipient does not have to be a member of the network.

mSwipe+

mSwipe+ is one of the most advanced mobile payments apps in Africa. It was developed by 3G Direct Pay for their merchants. The app enables the merchants to accept payments from their end customers while on the move or while on-site, at their business premises.

It is one of the first apps in Africa to support multiple payments options within a single app platform. The app can be connected to a pin and chip card reader to accept card payments via Bluetooth

The app supports all debit, prepaid and credit cards, as well as all mobile money networks in Kenya, Uganda, Tanzania and Zambia.

In terms of safety and security, the app supports EMV transactions using a pin and chip card reader, and it is PCI DSS Level 1 secured.

The influx of payment apps is indicative of the growth of consumers’ dependence on their mobile phones. Shopping online and sending payments to each other, consumers are shifting their money away from their physical wallets and cards and into their secured phones.

Encrypted technology and multiple authentication methods guarantee that payment information is stored securely, virtually eliminating the chances of credit card theft. Also, in most cases, merchants and peers do not even have access to credit or debit-card information.

As reliance on mobile phones continues to grow, mobile payment apps will continue to evolve and position themselves as the best and safest payment option for consumers.