As Nelson sits gazing at his computer screen, the luscious scent of rich Arabic coffee wafts from his mug, lulling him into thoughts of a laughter-filled morning over breakfast with his fiancé; glancing at the clock, he thinks about getting home early because they have dinner plans with friends for his birthday.

Yanking him out of his reverie, a sudden, ominous beeping sounds an alarm from his computer, warning him of a long evening ahead.

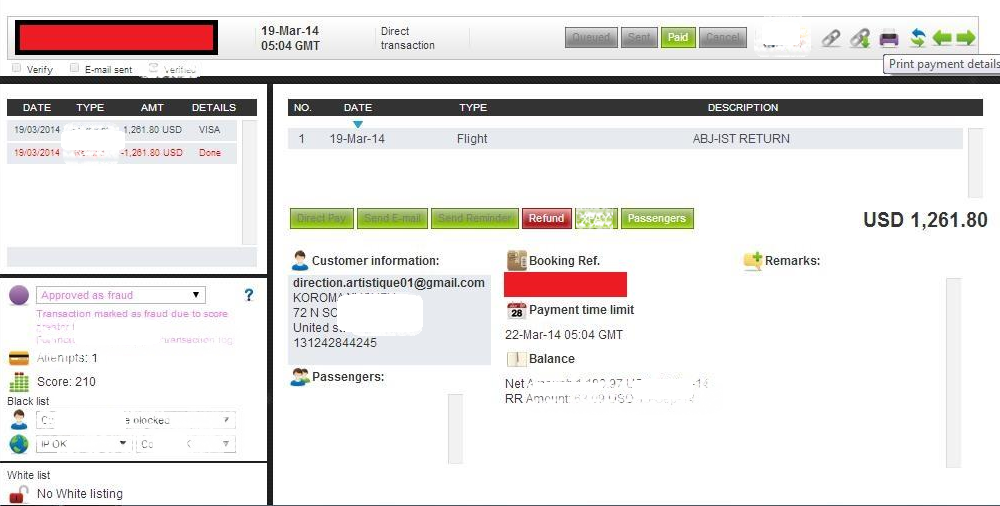

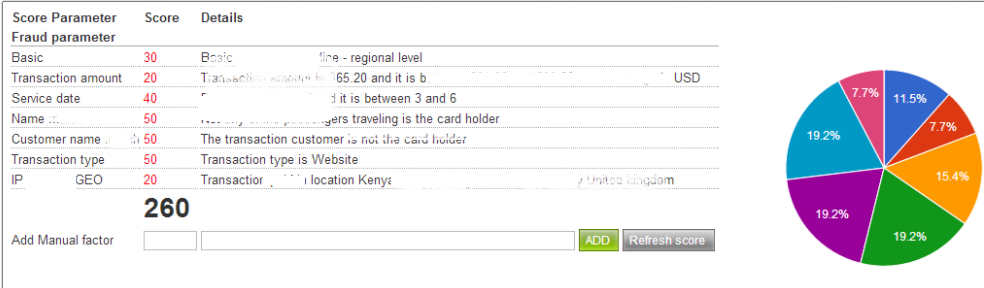

An example of a transaction risk assessment made by the fraud prevention system, based on an elaborate algorithm.

“Damn”, he says, “there goes any chance of getting out of here early tonight”.

Quickly turning to his dashboard, coffee and birthday plans forgotten, Nelson brings up the transaction log to see what’s going on.

There it is. Three failed payment attempts at processing a hefty sum of $6079 to a regional airline for flight reservations. Looking more closely, he notices that the credit card holder name looks familiar. Digging deeper into the system logs, Nelson also finds a transaction from the same credit card, and “client”, but in the much smaller amount of $179, to a tour operator for airport transfer fees on the same date of the flight reservations, but in a completely different country! Checking the system’s algorithm score, he is certain he is on to a fraudster.

“Got him”, he mutters. Pushing back his glasses, he leans in and rolls up his sleeves for a deep investigation.

Let’s see what else this guy has got going on, he thinks, and “approves” the final attempt for $6079. Sending out an auto-responder email, he thanks the “customer” for his business and asks him to provide some documents and a copy of his ID, in order to “finalize the transaction”

An example of a fraudulent transaction attempt

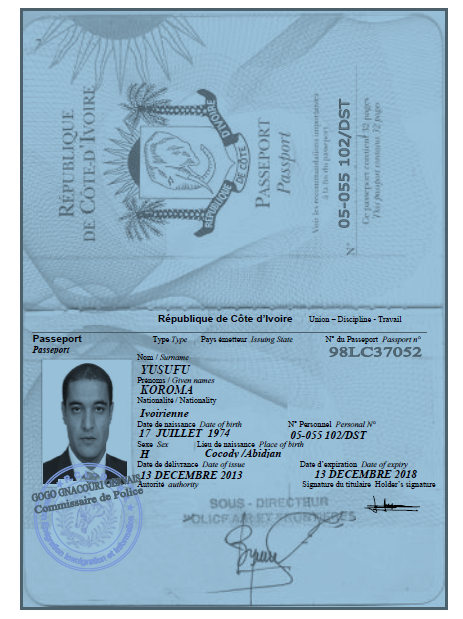

Within minutes he gets an email back with a copy of a credit card – both front and back- along with a black and white copy of a passport.

Going over the document carefully, it is clear to his well-trained eye that the passport is a fake. He sends a thank you email to the fraudster advising him that his transaction has been approved; sure enough, shortly thereafter he receives an email requesting that the agency “fees” be wired to the “travel agent” in Luxemburg via Western Union.

In order to be extra thorough, Nelson also does some research on the name and information given by the “customer” via social media and online search engines. In under an hour his suspicions are confirmed. He definitely has a fraudulent transaction on his hands.

Nelson immediately blacklists the name and advises the bank to freeze the card. Digging deeper, over the next few hours Nelson uncovers 3 other credit card charges, all for small amounts to the same service provider, and all in different names, but all purchases being processed by the same individual. Clearly this fraudster thought he was doing a pretty good job of testing the waters before he went for the big payoff.

Forged passport used in online payment attempts (the poor stamp on the image gives it away)

Not on my watch, thinks Nelson. Not on my watch.

The scenario above is not an unusual one in the world of digital payment processing. As online purchasing becomes more the norm than old-school brick and mortar shopping, fraudsters all over the world are getting smarter and smarter about how to steal credit cards and put the chargeback risks in the hands of the service providers, thus collecting exorbitant rewards for their thieving efforts as they go along.

Nonetheless, despite the shocking statistics, there is one industry, at least in East Africa, where the number of successful fraud attempt preventions is roughly 0.3%, as compared to only 1% worldwide

Enter the Direct Pay Online Risk Management and Fraud Prevention Center, where expertly trained fraud protection administrators, like our man Nelson, diligently watch out for suspicious activity.

With state of the art equipment in place that measures payment transaction algorithms, a niche focus on the travel industry, and a comprehensive checklist for measuring the legitimacy of each payment, Direct Pay Online is way ahead of the game when it comes to preventing the loss of millions of dollars in fraudulent activity that takes place on a daily basis around the globe.