Brand loyalty seems to be a thing of the past. Even the leading brand consumer packaged goods are reporting declines, due to an overall decrease in brand loyalty. In fact, according to market strategist company Accenture, customers are constantly evaluating new products and providers, becoming what they coin “non-stop customers”. These non-stop customers switch brands easily, creating a $6.2 billion global revenue opportunity across providers.

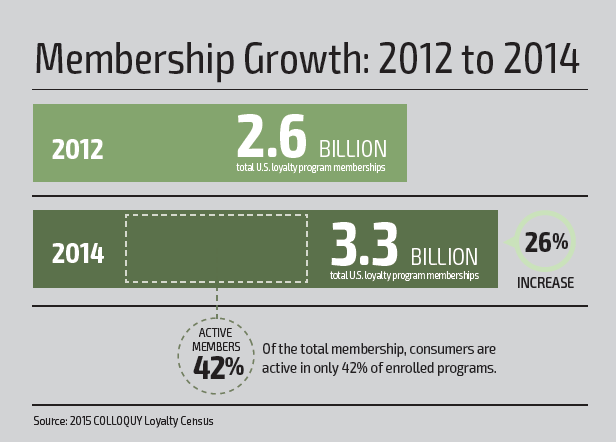

Improving customer loyalty via effective marketing strategies was rated a top priority amongst 80% of large corporation executives for the year 2016, according to Forrester research. The 2015 Colloquy Customer Loyalty Report found that there were 3.3 billion total US memberships to loyalty programs, with average families subscribing to 29 such programs, but that only 42% of the members are in fact active.

This is not surprising. Customers happily accept the opportunity to subscribe to loyalty programs, for the benefits and advantages they provide at the time of purchase, but that does not ensure they will come back. For instance, a traveler may subscribe to Holiday Inn’s rewards program and receive better room rates and amenities while earning points for one visit, and then opt for Best Western on the next trip, subscribing to their program as well. With OTAs (Online Travel Agencies) offering so many options to travelers, a preexisting subscription to a loyalty program is no longer enough to create brand loyalty.

Enhance your loyalty program with mobile payments

According to Colloquy, 62% of the US adults are always digitally connected. They own multiple devices and access the Internet from different locations, throughout the day. These always-on consumers view their mobile devices as an extension of themselves, and are likely to perform research on their devices before making a purchase or use their devices to complete a transaction.

These consumers are generally not committed to specific brands. According to Google, 90% of smartphone users are not sure which brand they wish to purchase from when they conduct a search. Smart marketers need to take heed of this and interact effectively with their customers on mobile to give them a reason to stay. By offering mobile-centric loyalty programs and convenient mobile payment options, companies can offer their non-stop consumers a shopping experience that meets their ‘always-on’ expectations.

Companies can use mobile payments to improve their customer-vendor relationship and help build brand loyalty in the following 4 ways:

1. Security

Mobile payments offer a safe and secure method for completing transactions. SSL encryption and PCI DSS Level 1 standards encourage brand loyalty by giving customers confidence to make purchases without fear of having their personal details stolen or compromised in any way. Personal security is a minimum requirement of all m-commerce consumers, so offering secure mobile payments is the first step towards building loyalty.

2. Increasing user convenience and flexibility

Most shoppers are increasingly online via a mobile device. These shoppers are perfectly comfortable using their mobile devices for everything, from researching a product, through reserving a hotel room, to paying for goods/services. Offering them a mobile payment solution with a choice of different methods allows them to complete their transactions quickly, via their preferred payment method, with the ease of a few taps. Offering this high level of comfort and convenience to today’s on-the-go consumer will encourage customer loyalty and purchase completion.

3. Personalizing the customer experience

Mobile-based loyalty programs together with mobile payments facilitate customer experience personalization. They enable vendors to offer location-based offers and time-relevant coupons directly to their customers’ mobile devices, partially based on previous purchase history. This helps vendors provide added value to their customers, which is key to increasing brand loyalty, both overall and at the time of purchase. Furthermore, 67% of US consumers and 58% of UK consumers claim that they are likely to visit a store if they receive a coupon expiration reminder when they are in proximity of a shop, which is a clear indication that mobile loyalty reminders serve to drive in store traffic, as well.

4. Improving their customer experience

The customer experience strongly affects consumer brand loyalty. Since the payment page is where the final conversion happens, it is crucial that it enhances the overall customer experience and doesn’t leave the customer with any negative feelings. The above benefits of mobile payments and mobile loyalty programs play a significant part in achieving a positive customer experience. Along with security, convenience, and personalization, mobile payments impact the customer experience, and thus brand loyalty, thanks to the following characteristics:

- Familiarity – seeing payment company logos and payment methods they recognize makes customers feel more comfortable and more likely to purchase from you.

- Trust – having well-known payment methods and security icons on your mobile payment page makes consumers trust your company, which increases the chances that they will be repeat customers.

- Ease – when payments are easy to navigate and complete, the seamless shopping experience makes customers more content and more likely to return in the future.

Smart businesses that harness the power of mobile payments can succeed in creating and increasing customer loyalty in this era in which customers can be fickle and their loyalty fleeting. By using mobile payments, businesses can make customers feel secure, offer them convenience, and give them an all-around enjoyable user experience, leading to modern-day brand loyalty.