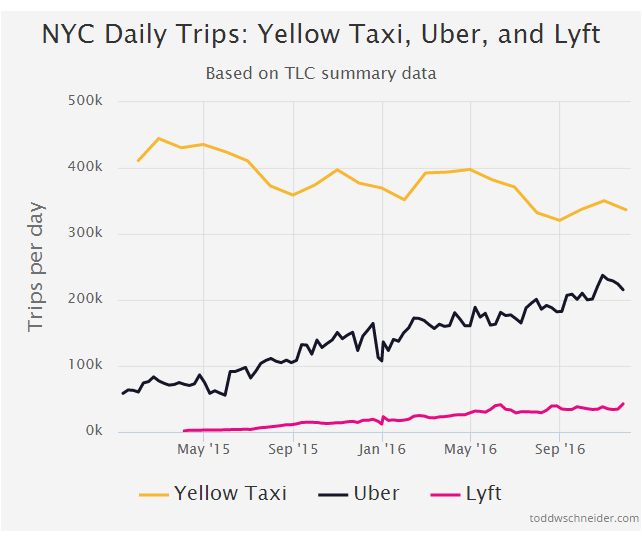

Uber, the popular ride sharing company, continues to gain market share, boasting 62 million trips in July 2016, up from 54 million the previous month. Deployed in 450 cities worldwide, Uber has revolutionized the transportation industry, but its rise in popularity has also lead to the rise of a few questions:

- What does this change mean for taxi companies?

- How can taxi companies compete with Uber and gain back market share?

- Will Uber continue to dominate the transportation industry in the future?

Uber Disrupts the Market with the Ease of an App

How was Uber able to so completely disrupt the taxi industry? This was accomplished by combining modern technology with flexible payment and pricing strategies, while simultaneously offering a beneficial platform for prospective drivers.

In retrospect, it is alarmingly clear that the car hire industry fits a geolocation mobile app like a glove on a hand. Uber recognized this symbiosis, and created its mobile app, which enables users to order a ride, (an “Uber”), with the ease of a tap or swipe. The app recognizes the user’s location, or allows the user to define where he/she would like to be picked up, and when. The user can then follow the driver’s progression towards the pickup location, in real time. The app also includes a rating system, in which the drivers are evaluated at the end of a ride. Uber removes subpar drivers from its system, thereby maintaining a high customer service standard.

To add to the convenience of its users, Uber has done away with cash payments. Users define their payment details in the app, so the ride is paid for digitally, saving time and hassle. Users are also provided the estimated charge in advance, increasing the transparency of the service.

Uber’s Platform Supports Competitive Pricing

As Uber is not a taxi service, but rather, a ride sharing service, it is not subject to various taxes and license fees. Uber has chosen to do away with expensive transaction costs, such as reservation costs, and enjoys the benefits of contracting its drivers as agents — not as employees. The drivers are also not subject to municipal costs, higher insurance rates or expensive permits, and are in essence turning their existing cars, into an income-generating mechanism. These combined advantages allow Uber to offer competitive pricing to their customer base, while creating revenues to its network of drivers.

Potential drivers have the flexibility and opportunity to turn the existing resources (a car and their free time) into revenues. As the number of drivers increases, the customer satisfaction improves, creating increased customer demand.

Taking on the Taxi Industry

Uber users are growing steadily as a result of their satisfaction from the short pick up time, the increased convenience and the lower rates, so there is a resulting increase in demand for drivers.

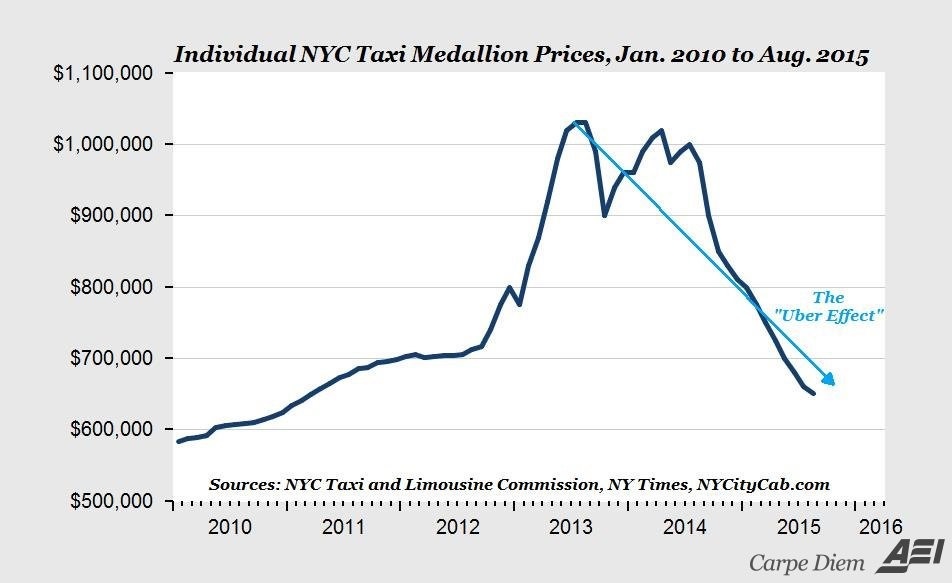

Thus, there has been a decrease in the prices of taxi licenses and taxi medallions (permits) in some major cities. In order to not overinflate the market with drivers, taxis were required to own a medallion, the number of which is controlled, thereby ensuring consistent demand for drivers.

Until Uber, that is.

Due to the “Uber Effect” there is a decrease in the number of rides a cab gives, leading to a decrease in the profitability of the medallions. Whereas the price of a medallion in in NYC was at $1 million in 2014, as of last November the prices have plummeted to $500,000. Similar trends can be seen in Chicago and Boston.

The heightened competition has also led to the closure of some taxi businesses that were steadily losing customers to Uber. In San Francisco, the largest taxi company filed for bankruptcy in 2016.

Drivers are feeling the effect as well. In LA, for instance, taxi cab rides fell close to 30% between 2012 and 2015. The biggest declines are in tourist rides, with these customers opting for ride sharing alternatives. As a result, the take home pay for drivers in LA has declined from $800 per week to approximately $450 per week.

How can the Taxi Industry Compete?

All things considered, the taxi industry is not dead, nor should it roll over and play so. Customers recognize that there are advantages to riding in a regulated and safer environment. Furthermore, Uber has price surges at peak hours, in which their prices fluctuate and are less competitive. Taxi companies should take advantage of their inherent competitive edge of safer reputation and set prices, while improving their level of service, to win back market share. In order to effectively compete with Uber and similar ride sharing companies, taxi companies should do the following 4 things:

1. Offer alternative payment methods

One of Uber’s key advantages is that it automatically charges the customer using his payment details stored in the app, doing away with the need to have cash on hand to pay for a ride. Taxi companies could achieve this same advantage by incorporating mobile payment solutions, such as mobile money, e-wallets or mobile points of service (mPOS).

These payment methods allow customers to pay for their rides by simply tapping their phones, via mobile money transfer, or even via credit card at an mPOS console within the cab.

The benefits of mobile payments to taxi companies include:

- Increased convenience to the customers

- A high level of payment security for both the passenger and the taxi company

- Increased flexibility due to a variety of alternative payment methods available to the passenger

2. Incorporate apps for hiring a taxi

Much of Uber’s success is due to its keeping up with the times, and offering an app for hiring a ride. Taxi companies must offer this convenient method for ordering a taxi as well in order to attract customers. Taxi companies can create their own app or join forces to create an e-hail app, similar to Arro in the United States.

3. Invest in training programs to improve driver service levels

Uber drivers are held accountable for their level of service, and they are ousted from the network if they are not up to par. Taxi companies must strive to ensure that their drivers provide the same level of service, if not better than the competition. Taxi companies should invest in mandated service seminars to train their drivers how to interact with customers. A similar rating system can be employed, and drivers who consistently receive poor reviews should be reprimanded in order to improve customer satisfaction.

4. Keep up car maintenance

One of Uber’s advantages is that it offers newer and more comfortable cars. Taxi companies must strive to keep their cabs well-maintained, thereby putting their customers’ comfort first. Make sure the back of the cab has comfortable seats, and that the air-conditioning reaches the passengers adequately. Keep door handles and surfaces clean, and make sure the exterior and interior of the cabs are inviting. You could even offer bottled water to customers as part of the service.

What the Future Holds

Will Uber prevail?

Possibly, but not necessarily.

Uber’s current business model has them subsidizing fares, thereby enabling the lower rates to passengers, yet worthwhile payments to the drivers. These subsidies are largely the reason why Uber is losing money today, despite the uptake in ride volume. Uber finished 2015 with a loss of $2 billion, and a cumulative $4 billion in loss since inception. At some point, something is going to have to give, and Uber will need to make changes and move towards a profit-generating business model.

In order to compete, taxi companies need to take a lesson from the Uber playbook and improve their service levels, institute app-backed hiring options, and offer alternatives to cash payments such as mobile payments methods. By improving efficiencies and catering to what today’s market demands, taxi cabs will be positioned to win back market share.