We have all seen barcodes in our day-to-day lives: at the supermarket, clothing store, parking garage – you name it. But in recent years, a different type of barcode has become increasingly popular thanks to the mobile revolution:

QR, or quick-response, codes.

The difference between a QR code and a regular barcode is that QR codes store information in two dimensions, so they appear as pixelated black and white squares, each containing a unique pattern. Also, they are designed to be read by a mobile phone camera, whereas a regular barcode uses a scanner.

Source: Scanova

QR codes have many different uses, but one of the most popular uses is to make payments using a mobile device.

How can QR codes be used to make payments?

Mobile shopping is on the rise, and many retailers are looking for new ways to let people pay in-store using their mobile phones. In fact, the number of people in the US making in-store mobile payments is expected to reach 150 million by the end of 2020!

One way of making mobile payments in-store is by using QR codes. All you need is a mobile phone with a camera, and a mobile app that can scan, store, and share QR codes.

Here are the three main payment types you can make using QR codes, and how they work:

1. Paying retailers with QR scanners.

At the check-out, the cashier will enter the amount to pay. You will then open your QR scanning app and display your unique QR code to the retailer. The retailer will scan the QR code to identify you and deduct the money from your mobile wallet, using a compatible mobile payment app.

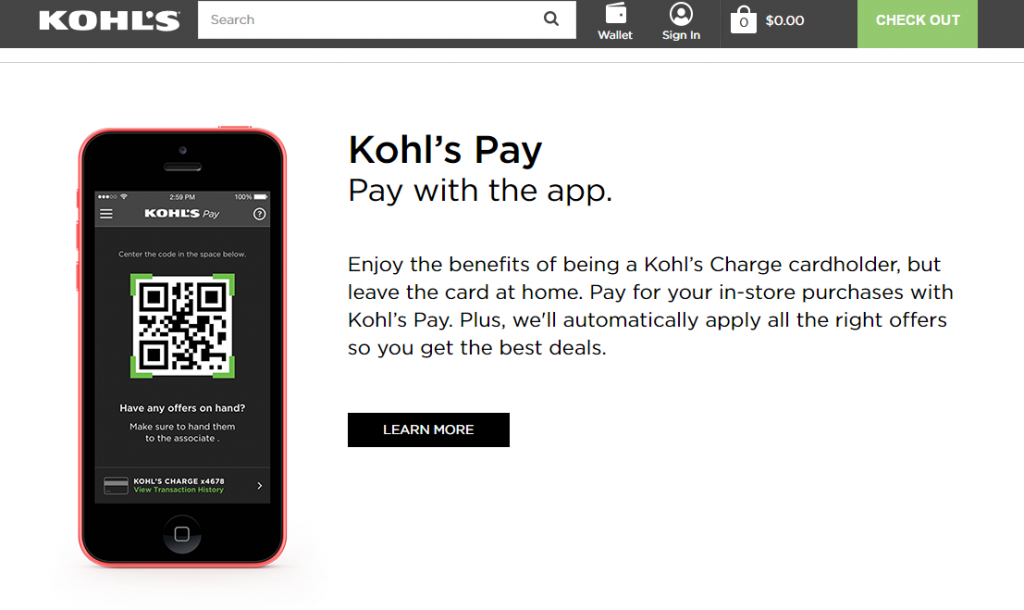

2. Paying retailers without QR scanners.

In this scenario, the retailer will display a QR code and you will scan it using the QR scanning app on your mobile device. The app will identify the retailer. Then you can enter the payable amount and complete the payment. One example of this in action is the system used by US department store, Kohl’s. Kohl’s Charge cardholders can now make payments via their mobile app by scanning a QR code at the check-out.

Using QR codes to pay with the Kohl’s app

3. Paying individuals (such as self-employed professionals).

Maybe you will need to pay your taxi fare upon drop-off, rent to your landlord, or even pay back a friend you borrowed cash from in the past. In this case, both you and the recipient open the QR scanning payment app. You will scan the recipient’s unique QR code, add the amount to pay and complete the transaction.

A great example of this is from the South African company, Zapper. They have developed a mobile phone app that lets customers use QR codes to pay for taxi rides. When a taxi driver signs up, Zapper installs a QR code in their taxi cabin. At the end of a journey, passengers can make a payment at the touch of a button, by taking a picture of the QR code.

What are the benefits of using QR codes?

There are many benefits of using QR codes to make payments:

1. No special equipment needed.

One of the challenges of mobile payments is finding a solution that works with different devices. QR codes help overcome this challenge, as all you need to scan a QR code is a camera on your mobile phone.

2. Quick and easy to use.

You don’t need to enter the details of the person you are paying, just scanning the QR code will identify them instantly.

3. More convenience.

You can make payments using QR codes from any location with only a few taps on the mobile device.

4. Increased safety.

Storing your payment details in your mobile phone and carrying it around is much safer than bringing your entire wallet full of cash and credit cards everywhere you go. The chances of theft and fraudulent purchases using your payment details are much less with QR codes.

QR codes are a promising trend for the future of mobile payments, and are an exciting, easy and convenient way to pay using just your mobile phone.