Mozambique, which is approximately 3 times as large as Great Britain, is divided into 154 districts. As of 2016, only 72 of these districts had bank branches in them. The Mozambique government and commercial banks in the country have undertaken to open at least one branch per district, by 2019.

Sub-Saharan Africa suffers from a high rate of unbanked, with only 34% of the region’s adults holding either a formal or mobile money account, according to the World Bank. With limited access to commercial banks, it is not surprising that Mozambique, suffers from an even higher rate of unbanked citizens, at 87%. In rural areas, access to formal financial services is even more restricted. A recent government decision supported by the World Bank however, aims to reach 60% financial inclusion by 2022.

Introduction of Mobile Banking and eCommerce

In 2011, the digital payments landscape in Mozambique was transformed when state-owned mobile operator mCel launched mKesh, Mozambique’s first mobile money service, followed by M-Pesa from Vodacom in 2013. By the end of 2014, there were 500,000 clients at the two networks combined. Subscriptions grew to over 2 million mKesh users and an additional 1 million m-Pesa users by March 2016.

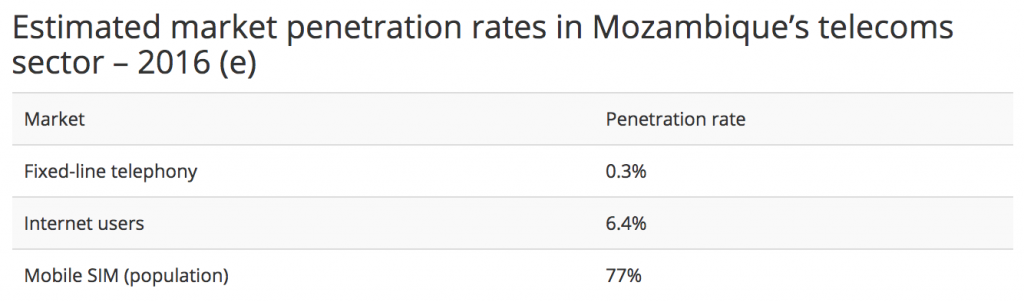

According to BuddeComm, an independent research and consultancy company which focuses on the telecommunications market, mobile phone (sim) penetration in Mozambique reached 77% in 20 16.

16.

Combined with the growing awareness of mobile money alternatives, it is likely that the number of mobile money subscribers will grow in the coming years, together with usage rates.

While ecommerce is still in its infancy, as most of the population is still unbanked, and without credit or debit cards, this purchasing alternative holds much promise. Mature internet users in Mozambique are overcoming privacy concerns, and are ready to embrace online shopping. As Mozambicans increase their familiarity with mobile banking and its advantages, particularly in rural regions, ecommerce will likely grow. This trend will also be supported by the emerging middle class of the country.

Payment Service Providers

Various Payment Service Providers have recognized the potential for online payment growth in Mozambique, and have offered their services to the emerging eCommerce industry. For instance, Direct Pay Online, supports all modes of payments for point of sale and online commerce, accepting a wide range of local and international credit cards, all currencies (including digital currencies), as well as mobile money and mobile wallet payments. Serving over 20,000 merchants across Africa, Direct Pay Online has offered its secure and comprehensive services to this continent since 2006.

Leading Ecommerce Sites

Recognizing the potential for growth and bolstered by the success of ecommerce sites in nearby regions across the continent, a number of ecommerce sites are already active in Mozambique. Here are a few of the leading ecommerce sites in the country:

Izy Shop

Izy Shop is an online supermarket which provides a convenient shopping experience to consumers.

The site also connects local producers to consumer markets, giving producers access to a broader market which increases their revenues.

Compras

Compras is an online shopping portal and trading platform for IT and other products.

The site has over 20 suppliers who either sell directly, or supply their products to the site which acts as a reseller. The site sells both to business and consumers.

Xava

Xava offers electronic products via its online shop.

Additionally, as ecommerce has opened the global economy to them, some Mozambicans shop on international ecommerce sites, such as Amazon.

Mobile Transaction Acceptance

The Bank of Mozambique recorded 21.3 million mobile financial transactions in 2015, which grew to 149.8 million in 2016. The number of active mobile money clients has been calculated at slightly above 10% of the total population, which is less than 20% of the adult population.

Acceptance and growth is hampered by the lack of interoperability between providers, although agreements between digital providers and banks are emerging. Interoperability is crucial in order to encourage additional market players.

The World Bank supports efforts to increase banking coverage in Mozambique. The Bank of Mozambique is working towards modernizing the national payment system, and creating a regulatory policy which will support these efforts. As the market matures, it is projected that the government will institute policies to encourage, or even require interoperability, which will foster an increase in the usage rates of mobile money transaction, and ultimately financial inclusion for the Mozambican population.