Hotels and OTAs (Online Travel Agencies) have enjoyed a love-hate relationship for some time, now. They both benefit from the immense marketing budgets and efforts the OTAs invest, but most hotels would prefer to be free of the limitations the OTAs impose on them and the high commissions they pay for bookings done via their platforms.

OTAs invest 35-40% of their revenues on marketing, enabling them to dominate Google Adwords and other SEO-based marketing channels. Priceline, for instance, spent an impressive $2.8 billion on online advertising in 2015.

Hotels, on the other hand invest approximately 6% of their revenue on marketing, as they have additional non-virtual assets, which require constant maintenance and support, as well as a portion of their working capital. A hotel’s online marketing costs should make up a recommended 75% of the entire marketing budget, as digital marketing is usually the highest traffic generator to hotel websites.

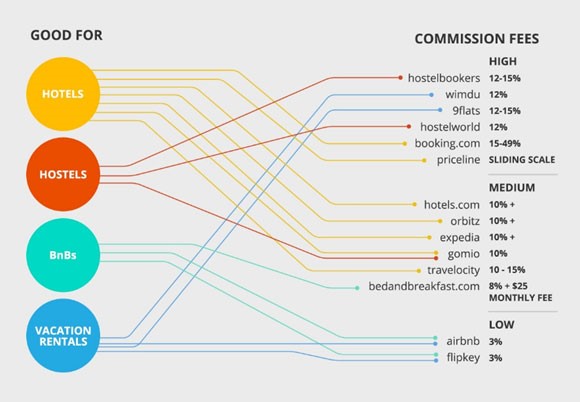

In exchange for acting as a distribution arm, the OTAs receive commissions on bookings from their partnering hotels. This commission is lower for large hotel brands, as they have bargaining power, at approximately 10-15%. The commission is higher for smaller, independent hotels at up to 25%.

Source: Cloudbeds.com

The last years have seen a push, especially within the larger hotel chains, to pull visitors to their direct booking pages. Efforts to increase direct hotel bookings should theoretically create increased profits per guest due to the savings on commissions. But will these efforts negatively impact OTAs revenues as a result? Not necessarily, according to an analysis conducted by Skift, a global travel industry analyst.

Hotels and OTAs could benefit from a shift in bookings

The Skift analysis describes a scenario where all players could theoretically enjoy a win-win situation from the shift of direct bookings to large hotel brands. In this scenario, the hotels will experience increased profit margins due to, as described above, fewer commissions paid to the OTAs. If, for instance, a hotel increases its direct bookings from 60% to 75% of all online reservations, and the hotel was paying its OTAs a 10% commission, then the hotel will have increased revenues of 2.5%.

However, the increased profits to the hotel will likely be lower, as this shift will probably be the result of increased marketing expenses, which cut into profits, or promotional campaigns such as preferred pricing for customer club members (like in rewards programs), which decrease the revenue per night booked. Therefore, the hotel will come away with some level of increased profit from the shift in direct booking, but not the full amount in commissions saved.

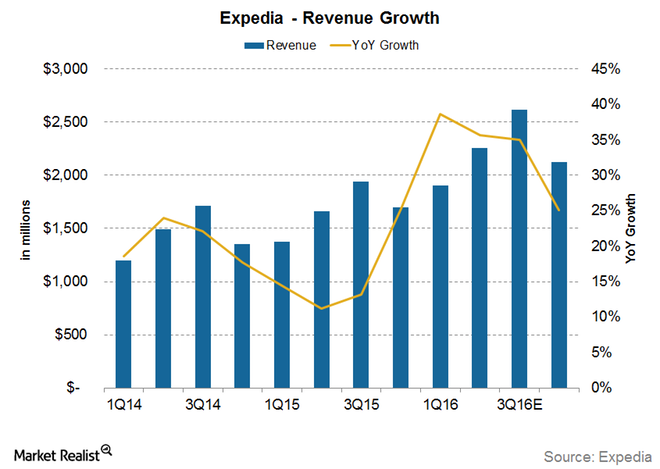

What about the OTAs? Will they lose profits from decreased commissions? As large hotel chains have likely negotiated comparatively low commissions from the OTAs, these agencies are losing sales volumes from their lowest paying customers. OTAs realize much higher commission rates from the smaller independent hotels. These smaller hotels, who rely on the OTAs as their most effective online marketing channel, pay closer to 15-25% commissions on bookings. The shift in bookings volume from the larger hotels to the smaller partners would theoretically increase the OTAs’ revenues due to the higher commissions realized on the new bookings source, if they do not suffer a drop in bookings volume. Indeed, despite large hotel chain efforts, and success in increasing direct bookings, OTAs such as Expedia and Priceline have continually seen growth quarter after quarter.

Source: Market Realist

A win-win-win scenario for the online booking ecosystem

We have managed to create a win-win result for OTAs and hotel chains. What about the smaller, independent hotels? How will they fare as a result of the shift? In the model presented thus far, they are poised to achieve increased sales as well, resulting in a three-way win-win-win result.

There is no doubt that investing in effective SEO for hotels is an important factor in its online marketing budget. However, the limited resources available to smaller, independent hotels limit the level of exposure they receive using traditional online marketing tools.

In the above model, larger hotel chains will decrease their inventory of rooms marketed on the OTAs in response to their increased direct bookings. As such, smaller hotels will receive more exposure over the OTA platforms, to a large potential customer base, whom they would likely not reach using their independent, limited SEO efforts. The increased exposure should ultimately lead to increased volume of sales to their businesses, both via the OTAs and direct bookings, due to the billboard effect.

Responsibility will dictate the extent of success

So, increased direct bookings is good all around – right? Only potentially. If the shift to direct booking becomes an industry wide trend, OTAs stand to lose, as this shift will eat away at its current market share. Additionally, if the larger hotels begin lowering their prices in order to facilitate the shift to direct bookings, then the smaller hotels would have no choice but to match these rates in order to compete. Doing so would result in lower commissions to the OTAs and decreased revenues to the hotels. On the other hand, if all parties act responsibly, and see the big picture, these main players in the online hospitality ecosystem stand to gain from this shift.