A chargeback occurs when a cardholder disputes a transaction, prompting their bank to reverse the charge. Originally designed to protect consumers from fraud, chargebacks are now frequently used for various reasons, including customer dissatisfaction and processing errors. Understanding how chargebacks work and key strategies to prevent them is crucial for business owners.

Rahab Wanja, Network’s AFU Supervisor Operations, explains: “Chargebacks can be disruptive and costly to businesses, but with the right measures and customer engagement strategies, merchants can significantly reduce their occurrence and protect their revenue.”

Now that we understand what a chargeback is, let’s see how it compares a refund.

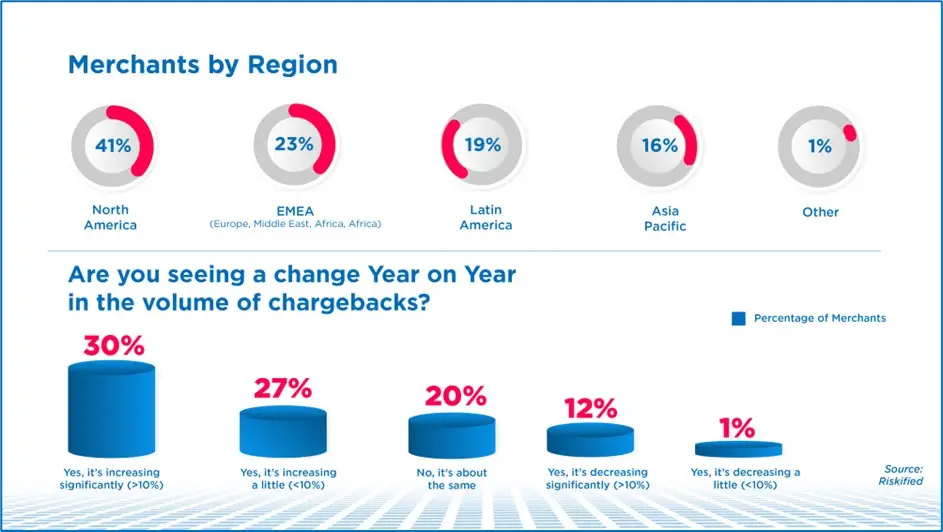

If you’re facing chargeback challenges, you’re not alone. A study by Riskified and Paladin Fraud surveyed over 300 chargeback managers worldwide to assess the scale of chargebacks and their impact on merchants. Key findings include:

These types of chargebacks may be initiated if:

When a customer initiates a chargeback – potentially up to 120 days after the transaction, the disputed funds are immediately withheld. The process then unfolds.

The customer’s bank withholds the transaction amount and notifies the merchant.

Arbitration: Still unresolved? The card network (for example, Visa or Mastercard) makes a final, binding decision. This stage comes with significant fees, e.g. for a Mastercard chargeback, expect a $150 filing fee, $250 admin fee, $150 withdrawal fee and $100 in technical fees. Acting quickly helps businesses avoid unnecessary losses.

Quick responses help businesses avoid unnecessary losses

As a payment service provider, Network plays a critical role in assisting merchants throughout the chargeback process. By partnering with Network, businesses in accross Africa can leverage real-time fraud monitoring, transaction reviews and expert support to effectively manage and reduce chargebacks. Implementing these strategies can significantly minimize the risk of chargebacks and safeguard your business’s financial health.

To win disputes, gather the right documents for card transactions. Here’s what Network recommends for different business types:

E-commerce & retail

To win disputes, gather the right documents for card transactions. Here’s what Network recommends for different business types:

Scenario: A boutique ships a dress paid via Visa card but faces a “not delivered” dispute. DHL tracking saves the day.

Hospitality

Mandatory documents:

Scenario: A hotel guest disputes a Mastercard payment for a stay. The signed Network Authorization Form and ID card copy prove the cardholder checked in, reversing the chargeback.

Transportation:

Scenario: A taxi service faces a “no-show” claim on a card payment. The manifest and ticket ID via Network’s system win it back.

Educational services

Scenario: A online tutor proves a student accessed lessons paid by card, countering a “non-delivered” dispute.

Digital services:

Scenario: A streaming service shows login proof via Network’s logs, shutting down a friendly fraud claim on a card charge.

Logistics & courier services

Scenario: A courier’s photo proof via DPO Pay’s portal overturns a “lost package” chargeback on a card transaction.

Travel agencies & tour operators:

Scenario: An agency uses a signed itinerary and boarding pass to beat a “cancelled tour” dispute on a Visa card.

One of the most effective ways to reduce chargebacks is by working with a PCI DSS Level 1 certified payment service provider like Network. PCI DSS (Payment Card Industry Data Security Standard) ensures that payment gateways in Ghana and globally meet the highest security standards to protect sensitive cardholder data.

Network offers robust fraud prevention tools, including:

By integrating secure payment solutions, merchants can significantly reduce fraudulent transactions and lower chargeback rates.

Chargebacks are a significant challenge for businesses, but they can be managed effectively. By implementing secure payment solutions, maintaining transaction transparency, and enhancing customer service, merchants can minimize chargebacks and protect their business.

Partnering with a trusted payment service provider like Network further strengthens your security, ensuring a safer and more seamless payment experience for merchants and customers alike.

Got questions about chargebacks and refunds. Read our FAQs.