Online merchants and consumers alike expect online buying and selling to be easy, efficient, and safe. eCommerce transactions trigger complex automated processes that involve downstream players: banks and payment processors to name just two. In addition, technological advances in smartphones and e-wallets, shifting purchase patterns, and demand for cross-border, multi-currency electronic payments have fueled PSP competition to maintain and increase market share.

New technologies have already simplified and smoothed business-to-business and business-to-customer experiences with mobile payments, e-wallets, and contactless cards. As the online payment processing market grows, user demands for additional payment features and options lead growth in multiple directions.

Providers are under pressure to provide peer-to-peer payments beyond traditional banking models, and to facilitate a cashless society that can enable any purchase, even mechanical transactions such as parking meters or vending machines. These demands create technical challenges for merchants, processors, and users up and down the transaction path.

Below is a list of the 5 main challenges in online payments and how to overcome them.

1. Fraud and chargebacks

Online transactions are “card-not-present” transactions. As e-commerce expands, opportunities for fraudulent misuse of payment networks and data theft grow right alongside. In addition to more obvious fraud-monitoring tools such as the customer account, validation services, and purchase tracking, a certified Level 1 PCI DSS payment processor’s risk management staff can sniff out fraud before it occurs.

Chargebacks, in addition to being costly, can damage business reputations; an excessive number of chargebacks can lead to closed merchant accounts, effectively killing the business. While chargebacks do sometimes happen for legitimate reasons, use of customer service practices based on know-your-customer principles, and merchant accessibility, can substantially reduce or eliminate chargebacks.

New technologies such as EMV and fingerprint recognition are also being used by PSPs to reduce fraud and chargebacks.

Advanced EMV technology is used to validate that a payment card is genuine and facilitate the authorization of the transaction. When a payment is made in-store, the card is inserted into a compatible card reader, the EMV chip is read, and data is exchanged in a highly secure manner, using encryption.

Of course, when making an online payment, the buyer manually enters card information, so the chip appears to have no benefit. However, EMV still provides an indirect security benefit for online payment processing. In the event that card information is stolen online, it’s much harder for fraudsters to clone and use a card with an embedded EMV chip.

Consumers are becoming increasingly familiar with biometric identification, such as fingerprint recognition, which is often used to unlock phones. It is now being introduced to increase mobile payment security and prevent fraud. During the mobile payment process, the buyer simply scans their fingerprint using a compatible mobile device, to prove their identity. This is a powerful tool for fraud prevention, as it ensures the person performing the transaction is truly authorized to do so.

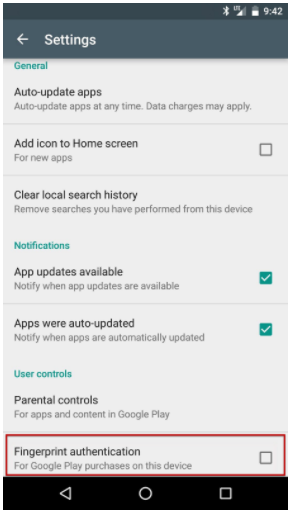

While a password or PIN code can be stolen or guessed, fingerprint data requires the buyer’s physical presence.. This technology is already being implemented by Google Play, allowing users of Android smartphones with built-in fingerprint scanners to authenticate Google Play purchases using their fingerprints.

Enabling fingerprint authentication for Google Play purchases

2. Cross-border transactions

Cross-border payments can be slow, inefficient, and expensive, but they play an important role in global trade. Typically, national banking infrastructures can’t handle cross-border payments, resulting in independent and non-uniform development in technologies and software platforms that complicate or stall cross-border transactions. New developments are beginning to shape cross-border payment requirements:

- Emerging transnational systems will decrease reliance on correspondent networks

- Government-led initiatives and mandates will begin to regulate payments and fees

- Payment systems will manage credit risk, liquidity, and costs more effectively

- Multinationals will achieve economies of scale, with a side benefit of consolidating credit risk

- Outsourcing will increase processing efficiency and drive down costs

3. Card data security

Payment Card Industry Data Security Standards (PCI DSS) certification is required for every merchant or business accepting credit or debit cards, online or off. PCI DSS standards require merchants and processors to meet 12 criteria across six security arenas:

- Build and maintain a secure network and systems

- Protect cardholder data

- Maintain a vulnerability management program

- Implement strong access control measures

- Regularly monitor and test networks

- Maintain an information security policy

Recent retail, government, and healthcare security breaches underscore what every merchant knows: customer and card data security is top priority. Preventing online payment security issues is a must for anyone doing business online. This can be done by either acquiring PCI DSS Level 1 certification, or using a PSP-hosted payment page.

4. Multi-currency and payment methods

Global ecommerce means accepting a variety of payment methods and currencies. eWallet payment processing, mobile payment processing, and of course acceptance of international credit/debit cards help online merchants compete in global markets by allowing their customers to pay in their native currencies and method of choice. For merchants, multi-currency, cross-border transactions can require new bank accounts, new business entities, and new regulatory hurdles in each national market.

Selecting a payment service provider with the necessary infrastructure already in place can provide effective, and immediate, solutions to those problems. A merchant can easily collect payment in one currency and credit the merchant account in its home currency. A good PSP is able to securely process eWallet payments, credit and debit card payments and integrate natively mobile payment processing systems (for example mPesa). In the next section we’ll discuss integrations.

5. Technical integration

Online payment systems run the proprietary gamut across hardware and software platforms. Credit card-affiliated payment processors, while more secure, can be expensive for online retailers. Added to the expense is the lack of interface between processing systems—it may be difficult or impossible for a PSP to link with other systems, resulting in processing and payment delays, lost transactions, and expensive fees.

In true real-time processing, a combination of features, including integrated systems and gateways, addresses liquidity issues and minimizes delays, while preserving online transaction integrity. A payment processor that provides for immediate and individually processed transactions can open client accounts in more than one acquiring bank, thus avoiding the delays often inherent in automated clearinghouse processes.

For online merchants and consumers alike, the bottom line is an easy, seamless and secure transaction process, most often provided by a PCC DSS Level 1 payment processor.