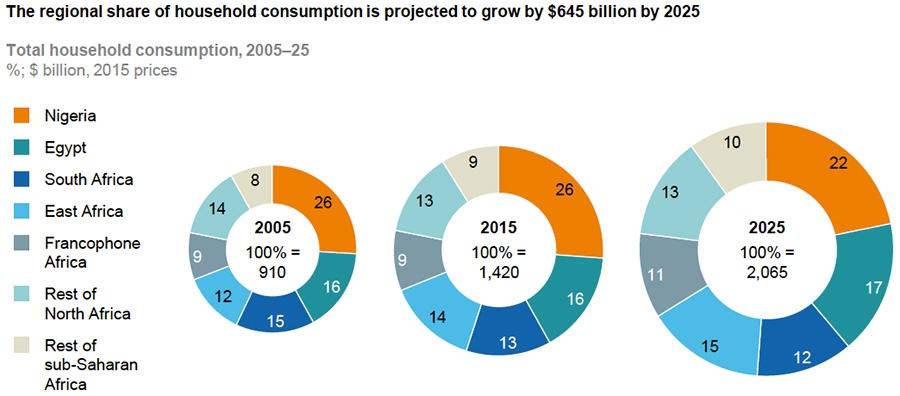

Africa’s real GDP growth rate for the period 2010-2015 is higher than the global average and outpaces other economies, such as the EU, North America and Latin America, at 3.3% compound annual growth, according to McKinsey Global Insights. Private and business spending are projected to show growth in the upcoming years growing from $1.4 trillion and $2.56 trillion in 2015, to reach over $2 trillion and $3.5 trillion in 2025 (in real 2015 prices).

Africa enjoys 81% penetration rate of mobile phones, and as of mid-2015, 200 million of Sub-Saharans enjoyed internet connectivity. The Sub-Saharan market is also categorized by a huge potential workforce, with over 60% aged 30 and below.

With a growing population, and an increasing workforce and middle class, it is important to understand where Africa’s largest markets can be found, in order to focus marketing or collaboration efforts in the regions with the highest potential.

International Companies are Investing in Africa

Various international companies, such as Walmart and Carrefour have opened branches in Africa. ShopRite, another leading retailer, invests in African cities with emerging middle classes, boasting over 2,000 African locations, making it the largest retailer on the continent.

Additional international players are looking to invest in Africa as well, taking advantage of the projected increase in local retail spending. Strategically, international investors will want to focus their preliminary efforts in Africa on fast-growing markets.

Analyzing African Urban Clusters

Much of the available data on Africa is nationally based, such as the GDP and estimated growth trends for different countries. There is also geographic data, such as the population in specific cities. However, due to the vastly differing economic states of different regions within each country, the national GDP and population distribution is not enough to learn about the economic welfare of specific markets. In fact, a specific city’s GDP per capita may be significantly higher than the national average, dependent on the concentration of wealth in specific urban areas.

Fraym, a geospatial data company focused on Africa, has developed the Fraym Urban Markets Index, which ranks the largest urban clusters in Africa based on data on:

- Economic activity – an estimate of the metropolitan GDP for the geospatial cluster

- Consumer size –the number of people living in households belonging to the emerging middle-class (those who own either a car, motorcycle, television or refrigerator) within the geospatial cluster

- Trade/Connectivity – based on the number of international destination for regularly scheduled flights within the city, and trade relationships between different clusters

Focusing on African cities with populations of over 300,000, this index identifies the strongest African urban clusters, as well as those with high growth potential.

Which African Cities are the Largest Markets?

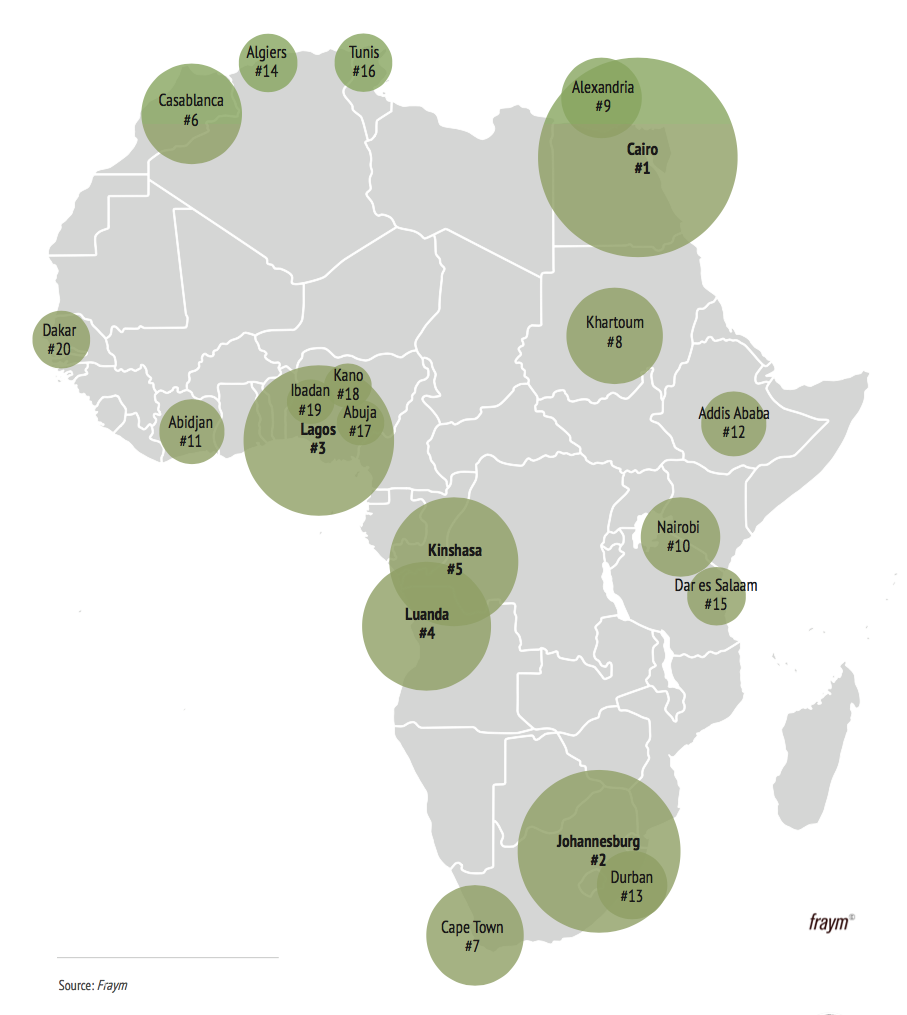

The cities with the largest markets are not surprising, with Cairo, Egypt taking first place, followed by Johannesburg, South Africa, and Lagos, Nigeria coming in third. The top five cities however, included Luanda, Angola as the fourth strongest market and Kinshasa, Congo, as number five.

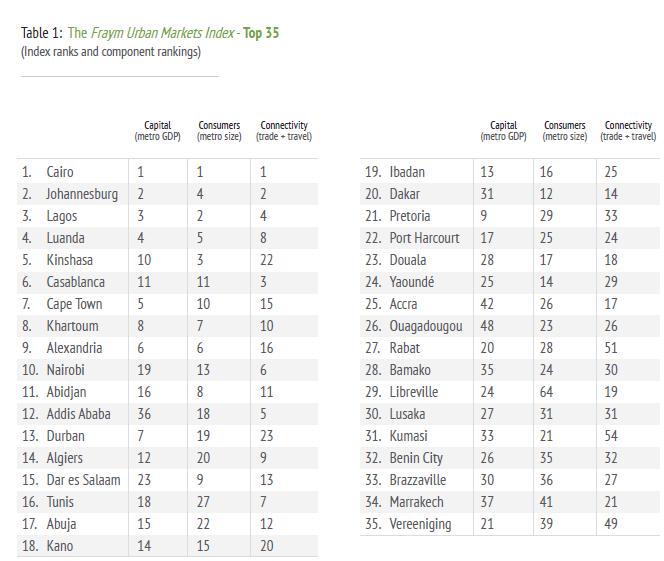

The following presents the top 20 cities according to Fraym’s Urban Markets Index:

Fraym’s analysis found that there are 200 million Africans currently considered to be middle class (owning one of the above mentioned vehicles or devices). These consumers however, can be found in a few clusters, with 25% of them living in Cairo, Lagos, Kinshasa and Johannesburg, while 50% live in the top 18 cities.

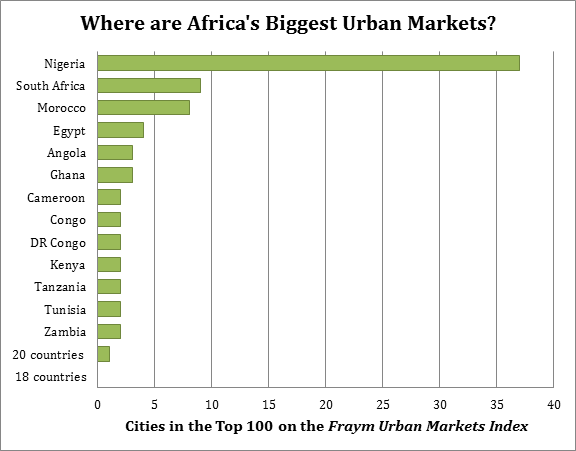

Countries with the most leading cities include Nigeria, which leads the chart with 5 cities in the 25 and 37 cities in the top 100. These 37 cities have a joint consumer class of 41.6 million people. South Africa comes in second place with 9 cities in the top 100. Apart from these countries, most leading markets are found within capital cities.

Africa’s biggest markets differ from each other with cities such as Khartoum and Alexandria boasting a large emerging consumer base, while cities such as Tunis, Nairobi and Addis Ababa have been identified as well-connected cities, and therefore hubs of commerce and transportation.

Key Takeaways:

The following are the key takeaways regarding Africa’s biggest markets, and projected retail trends:

- Consumer spending is projected to reach over $2 trillion in Africa in 2025.

- Africa’s GDP is currently growing at higher rates than the global average.

- Africa’s young population, create an emerging middle class stimulating growth.

- The above indicators signify an economic opportunity for investors and companies interested in gaining a foothold in this growing market.

- Due to the vast differences in populations across Africa, even within countries, it is essential to identify the specific cities for preliminary investment.

- Different cities boast different strengths, with some stronger in consumer market size, while others offer higher connectivity to additional markets.

- The top 35 African urban markets, as presented by Fraym are:

If you are planning on starting or expanding your business in one of Africa’s biggest markets, it is important to partner with a local payment service provider that has the expertise to help you succeed. Make sure the PSP you choose understands the ins and outs of the market, offers local and international payment methods, and uses sophisticated risk management technology.

For more information, contact us at Direct Pay Online, today.