Whether you’re swiping, scanning or receiving payments via a link, each transaction shares a piece of your customers’ private data. Data that you must guard with your life, literally. A single data breach can cost your business millions in fines, not to mention the irreversible damage to the trust your customers have in you.

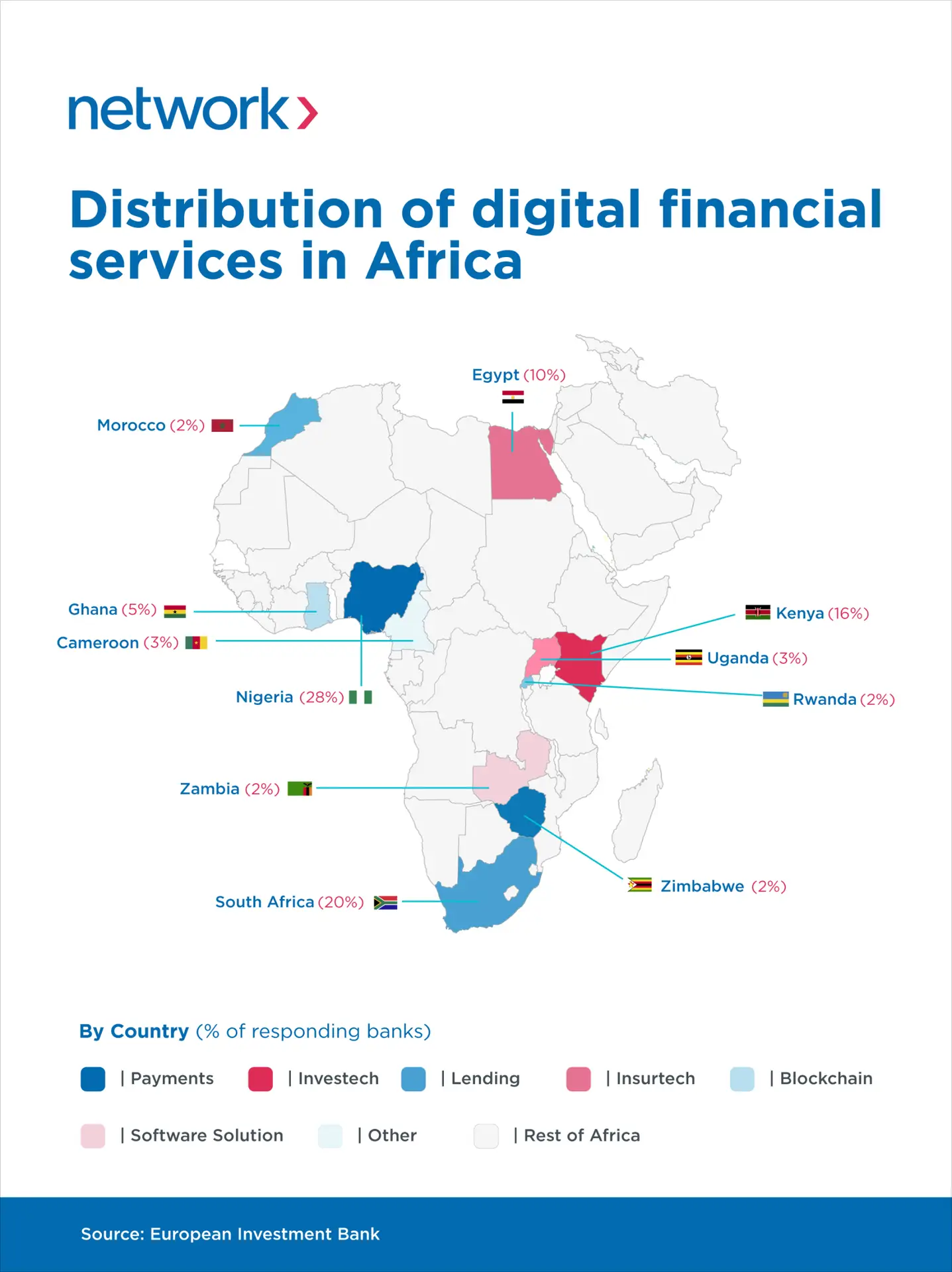

How many fintech companies have you seen launched over the last couple of years? Quite a few, right? It doesn’t come as a surprise, Africa’s fintech sector is booming. According to the European Investment Bank, the number of African companies offering innovative financial services jumped from 450 in 2020 to 1,263 by the start of 2024. This growth reflects the rapid expansion of digital finance, payments and e-commerce.

And there’s more, IMARC’s report indicated that Africa’s e-commerce market reached a valuation of $277.1 billion in 2023 and is expected reach $939.8 billion by 2032, that’s a compound annual rate of 14.4% between 2024 and 2032.

But as exciting as this digital revolution is, it comes with its challenges we must prepare for. More online transactions mean more cyberattacks. This calls on business owners to be more alert and intentional about safeguarding sensitive customer data.

That said, let’s look at data privacy trends shaping payments in 2025 and how they are protecting both businesses and consumers.

The Payment Card Industry Data Security Standard (PCI DSS) is also evolving, and the recent version 4.0 sets a new benchmark for securing payment data. But what does PCI DSS mean? It’s a framework that ensures businesses handling cardholder information meet stringent security standards to protect against data breaches.

Achieving PCI DSS compliance isn’t just about avoiding fines, it’s about showing commitment to data privacy. Network takes pride in being the first Payments Service Provider in Africa to receive the prestigious PCI DSS certification across 12 countries. As a PCI DSS Level 1 certified provider, we uphold the highest security standards, ensuring every transaction is secure.

Fraudsters are getting smarter, but so are the tools designed to stop them. In 2025, artificial intelligence (AI) will drive real-time fraud detection systems capable of identifying suspicious behaviours faster. Predictive analytics will play a critical role in proactively blocking fraudulent transactions before they occur.

AI’s ability to adapt to emerging threats ensures businesses stay one step ahead of cybercriminals. For example, machine learning algorithms can analyse large sets of transaction data and detect anomalies that might go unnoticed by human analysts. This protects customers’ data and ensures smoother payment experiences.

This data privacy trend will continue to gain traction as it compliments traditional methods like passwords. We are talking about technologies like fingerprint scanning, facial recognition and voice-activated payments.

Take voice authentication as an example. It adds a layer of security that’s nearly impossible to bypass. By pairing biometric authentication with multi-factor authentication (MFA), businesses can significantly reduce the risk of fraud and enhance the customer experience.

This is the cornerstone of secure payments; it ensures sensitive data is protected throughout the entire transaction journey. As a payment service provider, Network leverages E2EE to support secure commerce across multiple channels. From the moment a customer enters their payment details to the final processing stage, all data transmitted through our payment platform is fully encrypted. This safeguards sensitive information from being accessed by unauthorized third parties during transmission.

When combined with Multi-Factor Authentication (MFA), E2EE creates an additional layer of security, making it nearly impossible to compromise customers ‘data. In 2025, expect to see more businesses adopting this technology as a standard practice.

Besides data privacy trends, cybersecurity regulations also keep evolving, so it’s important as a business owner to keep up with the changes and align with both local and global data privacy standards.

Laws like the Data Protection Act (DPA) and the General Data Protection Regulation (GDPR) set the stage for how organizations handle sensitive data. Notable cases, such as Sephora and DoorDash, highlight the importance of adhering to regulations to avoid penalties and maintain customer confidence.

It’s safe to argue no. Consumers are no longer limited to point-of-sale terminals or online checkout pages. They expect secure and seamless payment options wherever they interact with your brand – whether it’s over the phone, live chat, IVR, chatbots, WhatsApp or SMS.

Each channel comes with unique vulnerabilities, but businesses can mitigate these risks by investing in omnichannel payment solutions. Tools like secure payment capture and tokenization are essential for protecting customers’ data across different touchpoints.

Trust is everything in business, and prioritizing data privacy is one way to build trust and secure your business’s future.