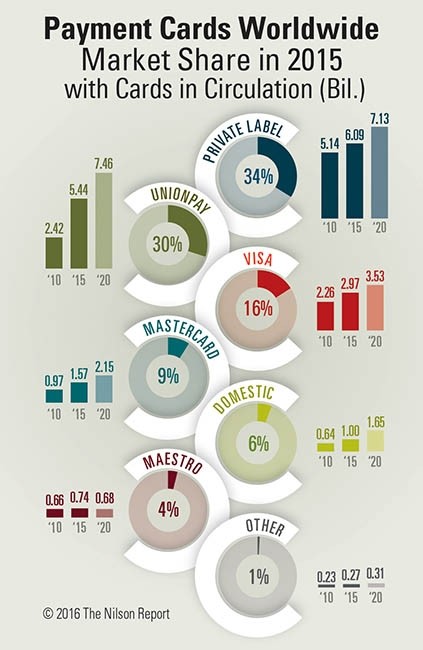

With major credit card companies investing in Africa, more Africans are using payment cards now than ever before. And on a global level, credit and debit cards have been a highly popular alternative to cash payments, so much so that, at the end of 2015, there were an impressive 18.08 billion payment cards in circulation worldwide, according to The Nilson Report. This figure is expected to grow to 22.90 billion by 2020.

If you want your business to keep up with the demands of these cashless customers, you must have a merchant account.

Payment Cards Worldwide (The Nilson Report)

A merchant account is a bank account that enables you to accept multiple payment types, including credit card payments. Merchant accounts also offer other benefits such as increased security, the ability to accept multiple currencies, and better money management.

The best and least expensive way to open a merchant account is to work with a payment service provider (PSP). PSPs offer a simple, integrated solution for multiple payment methods and currencies. They also receive bulk discounts from banks and credit cards companies, and pass these savings onto you through competitive pricing. Another benefit is that the PSP will employ risk management strategies to ensure you are protected from fraud.

Here are the main benefits of having a merchant account, in more detail:

The ability to accept debit and credit card payments

When you open a merchant account, you will be able to accept credit and debit card payments. This is becoming a necessity as more customers expect to be able to make payments using cards, both online and in-store. However, the payment processing is not limited to cards. Your payment service provider will be able to process mobile payments and eWallet payments as well, allowing you to cater to a larger audience.

According to a paper by Professors at M.I.T, customers tend to spend more money and make more impulse purchases when using a credit card, compared to when paying in cash. In addition, a study by Intuit Inc. found that 83% of small businesses who began accepting credit and debit card payments saw an increase in sales. If you want to increase your profits, opening a merchant account and accepting card payments is the way to do it.

Increased security

By working with a PCI DSS certified PSP to open your merchant account, you can be sure that customer cardholder data is protected. To get certification, the PSP must comply with the strict security standards set forth by the PCI DSS and use advanced technology to check for fraud and keep credit card information safe.

A recent survey by ACI Worldwide revealed that more than half of consumers fear credit card data theft. So, if your customers know that you are meeting high security standards, they’ll know their data is safe, and will feel confident to make purchases through your online store.

The ability to accept payments in a wide variety of currencies

One of the major benefits of merchant accounts is that you can accept multiple currencies. This ensures that you can reach customers across borders, enabling them to make payments in their local currency. This significantly improves payment process experience for these international customers, and it’s no secret that the easier it is for customers to make payments, the more likely they are to return again and again.

To set up your business for receiving cross-border payments, you’ll need your PSP to help you open an instant merchant account for each currency. Some PSPs such as DPO even have merchant accounts for different currencies already set up in their name in order to streamline the process for merchants and facilitate the acceptance of multiple currencies with minimal effort required. Once set up, your merchant account credit card processing is easily done with every currency and your account is credited with the currency of your choice.

Better money management

By using a merchant account to accept digital payments, you can more easily stay organized and manage your cash flow. Your PSP can send you detailed monthly statements of all transactions that have been made, with which currencies, and with which payment methods, among other information. This makes it easier to deal with taxes and keep an eye on your profits. If you use merchant account services provided by a PSP, you will also be able to view and manage all payments through an online interface where you can login to track your payment activity.

If you’re interested in reaching more customers, offering a variety of secure payment options, and managing your money with ease, it’s time for you instantly open a merchant account for your business. Contact DPO to start accepting payments online.