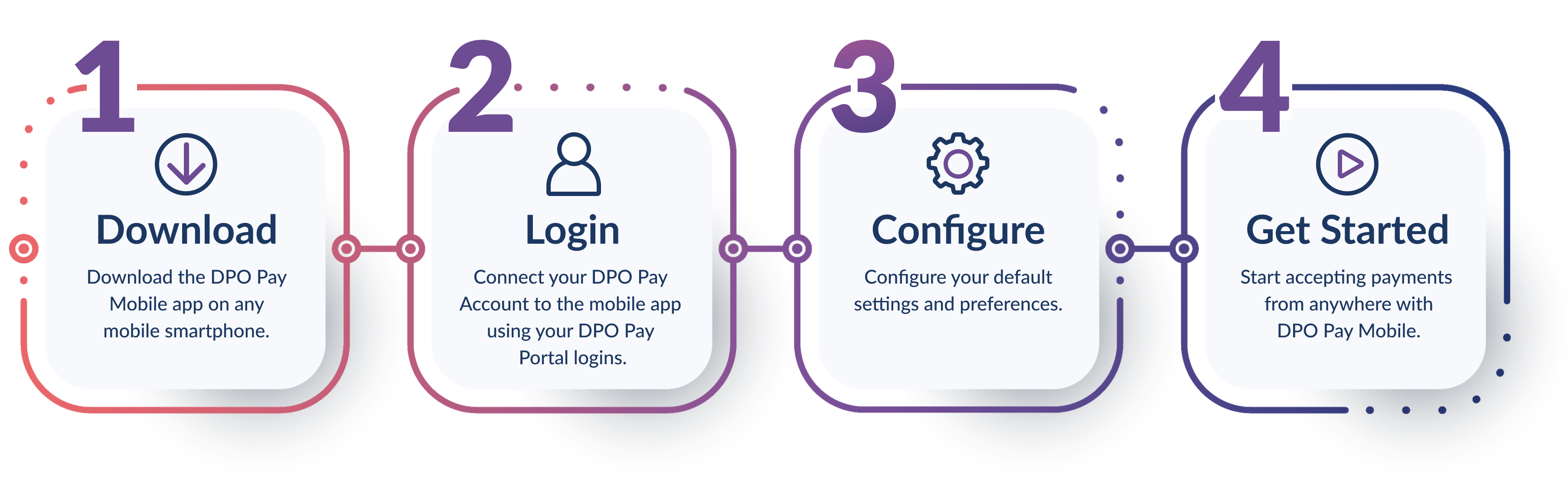

Get Paid Anywhere with our

On-the-go Mobile Payments App

Our mobile payments app helps businesses of all sizes accept payments from their mobile device across Africa. Request a payment in person or by link allowing your customers to pay with leading mobile money wallets, credit and debit cards, and more.

All the things you love in one place

Features of DPO Pay Mobile

Card Scanner

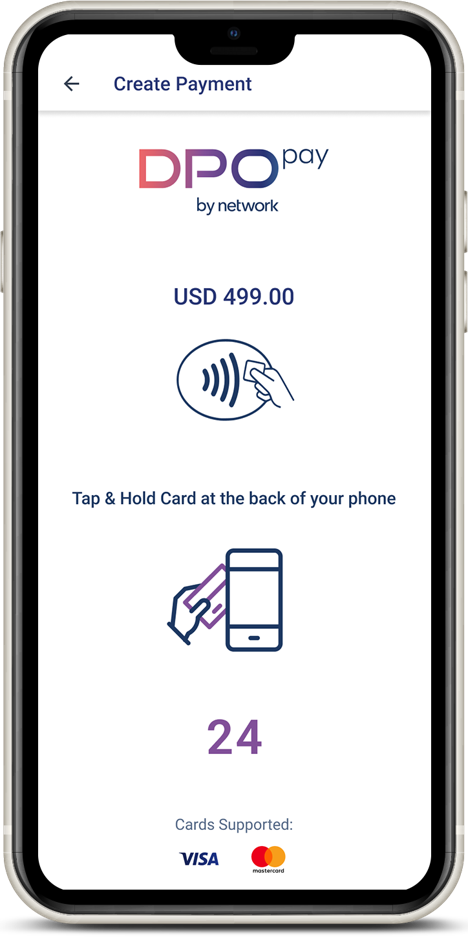

Tap & Pay

Tap & Pay is a more secure, convenient and faster option for customers to make seamless payments. It allows customers to pay using their debit/credit cards by tapping on an NFC-enabled device.

Send payment links

Transaction reports

DPO Pay Card Scanner

Avoid Input Errors;

Scan Card Details

Avoid human error by scanning the customer’s card to capture card details for payment without saving the customer’s card details, adding to privacy and security.

Tap & Pay is a more secure, convenient and faster option for customers to make seamless payments. It allows customers to pay using their debit/credit cards by tapping on the NFC enabled device.

You will need an NFC-enabled device to accept payments using the Tap & Pay option.

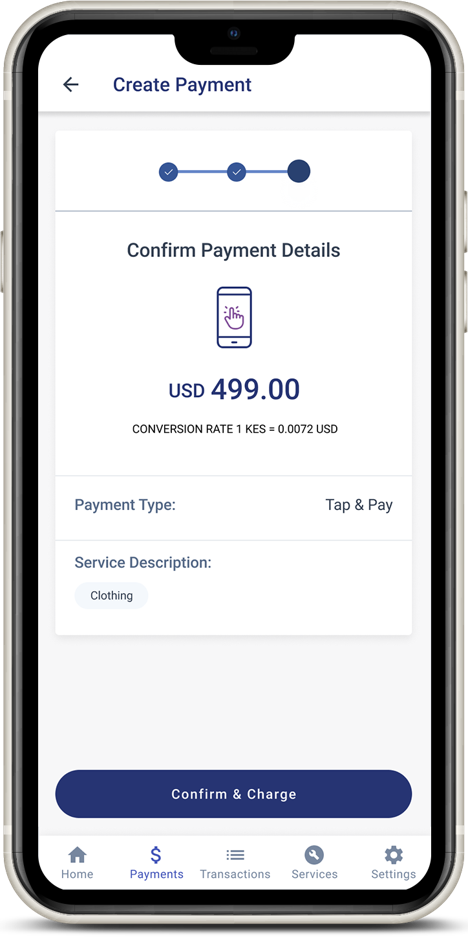

How Tap & Pay works

payment details.

What is Tap & Pay?

Tap & Pay is the ability for your DPO Pay Mobile app to read a customer’s card with just a tap on the back of the device using NFC technology.

What is NFC?

Near Field Communication (NFC) is how devices communicate upon touch or close proximity. This can include communicating with each other or authenticating credit cards, access control, file transfer, and initiating wireless connections.

How can customers to start making payments using Tap & Pay?

The Tap & Pay option will be available via the DPO Pay mobile app as an additional payment option. Merchants will simply need to select Tap & Pay as the payment option and follow the payment screens as guided on the app to process payments.

Can Tap & Pay be used for online payments?

Tap & Pay is a face-to-face payment option as it needs the customer to physically pay at the merchant’s device via NFC technology, therefore this cannot be utilised for online payments.

Is there a limit to how much a customer can Tap & Pay using their card without inputting a PIN?

The customer’s bank sets the limit for transactions that can be carried out without inputting a PIN. Once this limit has been surpassed, the customer will be required to input their PIN on the merchant’s device to complete the payment.

How secure is Tap & Pay?

Because this is a face-to-face payment transaction, it is a much safe transaction option than online payments, and the chances of fraud are significantly reduced. If a customers’ card has been stolen, customers are advised to immediately report the same to their bank to block their card and reduce the chances of having someone use their card for a Tap & Pay transaction.

How do I access Tap & Pay?

Login to your DPO Pay Mobile App. Use the same credentials created for your DPO Pay system. This is available on all Smartphones.

Which card schemes are supported by Tap & Pay?

Visa, Mastercard and Amex cards. This is depended on the access given during onboarding.

Are there extra charges for using the app?

No, normal rates apply.

Are there any transaction limits?

Same limits applicable as per the account setup.

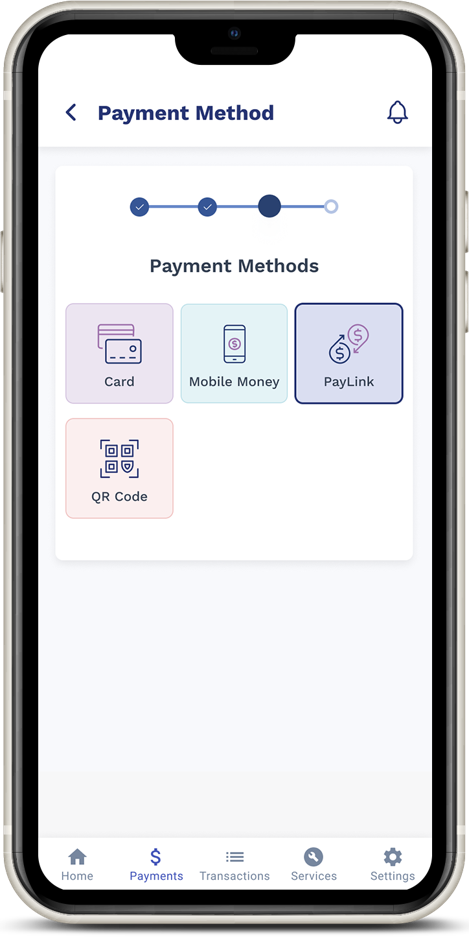

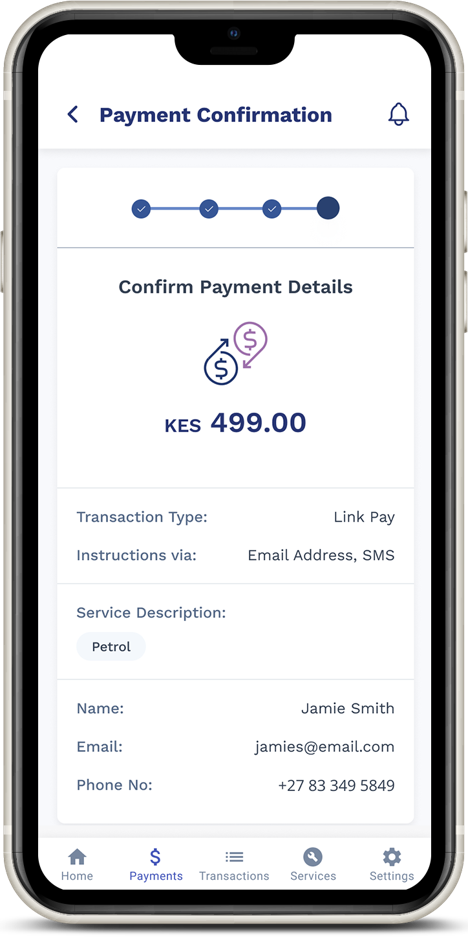

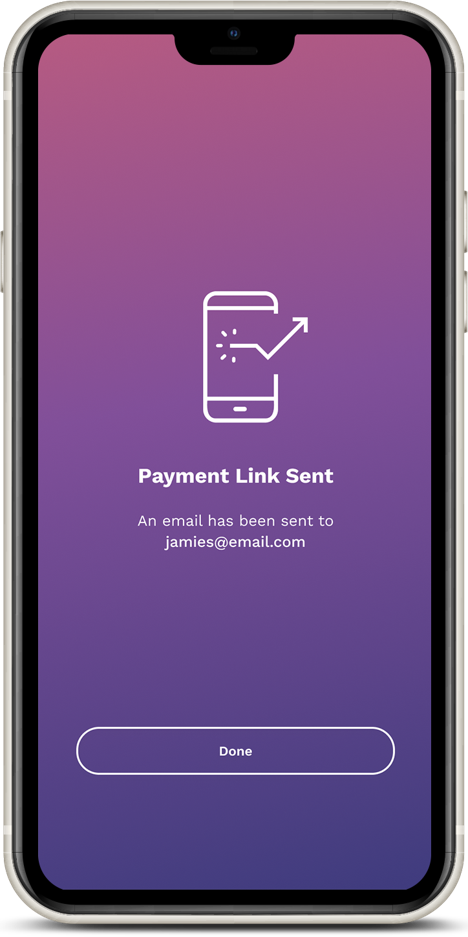

DPO Pay Payment links

Send payment links

Generate payment links to send to your customers via email, SMS, or WhatsApp for easy payment collection.

PayLink option.

Choose how you want to send the payment link.

Review and confirm the payment details.

Confirm and send payment link to the customer.

Many Ways to Get Paid

How it Works