Africa has lagged behind other continents in airline travel. Different factors can be to blame for this isolation, such as tedious government agreements necessary to create direct routes, illogical routing causing long flights, and costly airfare. The main contributing factor to the low volume of air travel adoption in Africa though, was the fact that many Africans are unbanked.

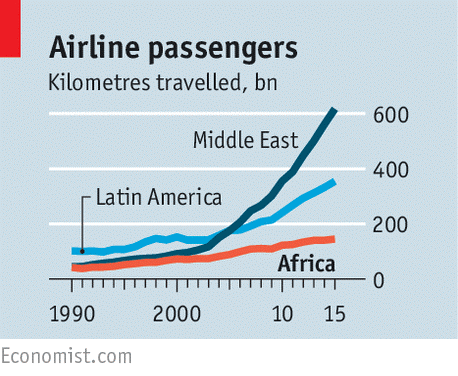

However, recent years have seen an increase in African airline passengers, growing at 5% per year, according to The Economist. African airlines experienced an over 8% rise in demand between Q4 2015 to Q4 2016, according to International Air Transport Association (IATA).

Mobile Payments Open the Airways to Africa’s Unbanked

While Africa is a highly unbanked region, with the majority of the population without a formal bank account, mobile alternatives are thriving in this region. In fact, Africa accounts for over 50% of the worldwide live mobile money services and for 64% of all active mobile money accounts, with over 260 million mobile money users in the region, according to a 2016 GSMA report.

E-wallets and mobile money technologies enable Africa’s unbanked to purchase products and services via websites offering online payment solutions. Users can “deposit” cash to their mobile accounts, and use their balance to make online payments or cross border money transfers. The flexibility of using mobile money as a payment method, has opened the airways to unbanked Africans, contributing to the increase in travel presented above.

Low-cost Carriers in Africa Integrate Mobile and Online Payments

With the millions already using mobile money payments in Africa, and the projected increase in the African mobile money market from $2.73 billion in 2015 to $14.27 billion in 2020, retailers and service providers are tapping into this growing market.

Airlines, such as FastJet and JamboJet, who offer low cost air travel, have rightly implemented turnkey payment solutions which provide online payment options via traditional credit cards as well as via mobile money options. Unbanked Africans, who could not previously reserve flights online, as they did not have the required credit card, can now utilize mobile money alternatives. With their low-cost focus, this market segment is a key target market for these domestic and intracontinental carriers.

Serving regions such as Tanzania, Zambia and Zimbabwe, with plans to expand, Fastjet offers eight routes, via their fleet of four aircrafts. With flights selling for as low as even $36, including taxes, and connections to seven international airports, Fastjet is helping many Africans fly and cross borders, for the very first time. According to the company, as of the end of 2016, it had served over 2.5 million travels, in the four years from its inception.

Similarly, Jambojet, currently a domestic carrier in Kenya, provides affordable reservations and flights to any of a number of Kenyan destinations, with plans to expand internationally. With its mobile payment solution, passengers can easily reserve and pay for their flights, starting as low as $31. Unbanked, and unflown Africans, can utilize their e-wallets and mobile money accounts to book these affordable flights online, and enjoy air travel for the first time.

What’s more, with the growing international interest in the beautiful Kenyan beaches, Jambojet offers an affordable carrier for the many tourists flocking to Africa. Its online payment system, with its ability to accept international credit cards and handle cross-border mobile money payments, not only opens the door for unbanked Africans, but opens Africa to a host of international tourists, as well.

Low-cost airline carriers are growing their customer base and helping more people fly by accepting a variety of currencies and payment methods.