DPO Case Studies

Airline case study – Growth Of Mobile Money

How incorporating additional payment methods facilitate huge business growth

With the ever changing travel trends, the airline realized that they can improve sales by giving their customers the freedom to pay with credit card, mobile money or paypal.

In Q4 2014, the airline took their user experience to the next level by allowing their customers to log into their website, book a flight, pay online from wherever they are and get a real time confirmation with their PNR… Powered by Direct Pay Online (formerly 3G Direct Pay)

2014

With only a few months remaining for that year, they managed to get a total of 220 transactions which 156 were card payments, 40 paypal and 24 mobile money payments.

2015

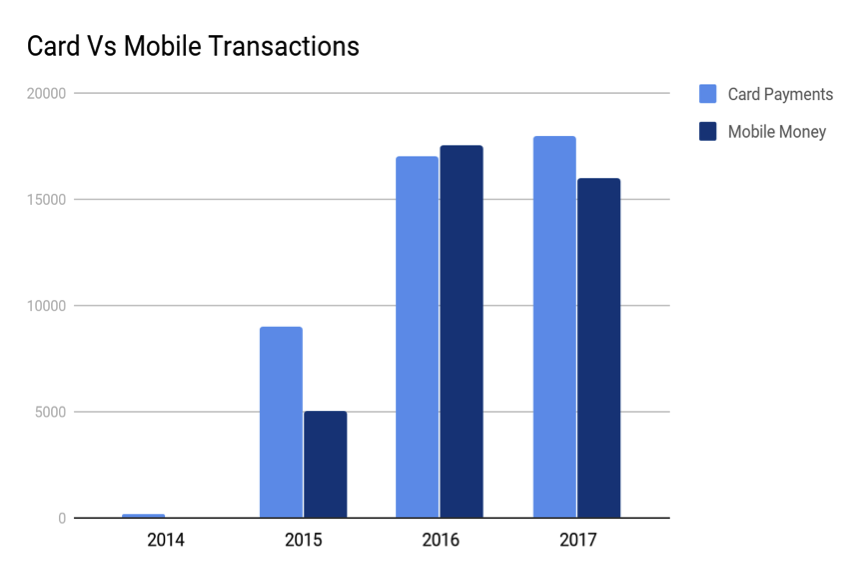

Their customers got used to the new way of doing business and fully embraced it to garner over 17,000 transactions where over 9,000 were card payments, over 500 paypal and over 5000 mobile money payments.

2016

With the rise of mobile money wallet usage, from sending money to paying for goods and services, the airline was in the right place. 50% of their 35,000 transactions came from mobile money wallets.

2017

Credit card companies made strong efforts to penetrate the region. This is reflected by a percentage of customers shifting from mobile payments to credit and debit card payments.

Conclusion

The airline’s growth thanks to adopting all payment modes with Direct Pay Online’s platform is the perfect example to show the growth of mobile money wallets across the region. With Direct Pay Online single connection, the airline gave their passengers the freedom to pay with:

All Cards

Visa, Mastercard, American Express

Mobile Money

mPesa, tigo pesa, airtel money, MTN *Available in Kenya, Tanzania, Uganda, Zambia and Rwanda

This is a classic case of an airline which has adequately responded to the market needs to better serve their customers. The western world has been using cards to pay for goods and services while Africa remained as a cash economy. Since the inception of mPesa in Kenya by Safaricom, other Mobile network operators have come up with their own mobile money wallets all across east Africa.